The Rainbow token airdrop is becoming one of the most closely watched crypto events of February. With the $RNBW listing set for February 5, users now have a rare chance to see price discovery happen in a fully transparent and fair way.

Between the Uniswap CCA auction, MEXC premarket trading, and the confirmed snapshot, the project is building strong momentum around its long-term price prediction 2026.

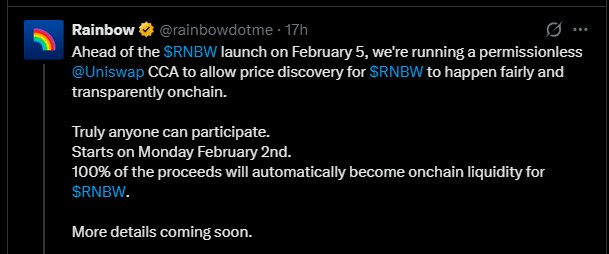

Source: Official X Account

The Rainbow $RNBW token airdrop snapshot will be taken on Monday, January 26 at 4:20 PM EST. Users can still earn points through trading, swaps, Perps, and prediction market activities. Even if points are not visible in the app’s ‘Points tab’, they are safely tracked on the project's backend and will convert into rewards at TGE.

Before the official MEXC RNBW listing on February 5, it is running a permissionless Uniswap CCA (Continuous Clearing Auction Protocol) starting Monday, February 2. This system allows anyone to participate and ensures transparent on-chain price discovery.

100% of the funds raised in the auction will automatically become on-chain liquidity for the asset. That means early trading will not depend on artificial market making. Liquidity will be real, visible, and community-backed. Uniswap founder Hayden Adams also confirmed support by stating that “Rainbows and Unicorns work well together,” showing confidence in the CCA model for token launches.

This setup reduces fake price action and builds trust from the start.

Rainbow MEXC premarket listing confirmed on January 22, 2026. Since then, the asset has started showing real price behavior. The MEXC pre-market chart shows the token is trading in a tight range between $0.11 and $0.12, with the current price near $0.1140.

The 24-hour trading volume is still very low at around 79 USDT, which shows liquidity is thin and that large movements are unlikely before the main Rainbow token airdrop listing.

Being a crypto analyst’s point of view, this trading chart shows how traders value new coin debuts before open market liquidity. Because both MEXC order books and Uniswap CCA will be active, $RNBW token price discovery will be guided by real demand and supply.

Total Supply: 1 Billion tokens

Treasury: 47%

Community (Future): 15%

Airdrop at TGE: 15%

Team: 12.2%

Investors: 7.8%

Pre-Sale: 3%

Presale Price: $0.10

FDV at sale: $100 million

The Treasury and community together control 62% of supply. This limits early dumping pressure and supports long-term growth.

Thanks to MEXC premarket and Uniswap CCA, the asset already has real price discovery. On listing day, the price could open 20–50% above current levels due to retail demand. A realistic opening range is $0.15 to $0.30.

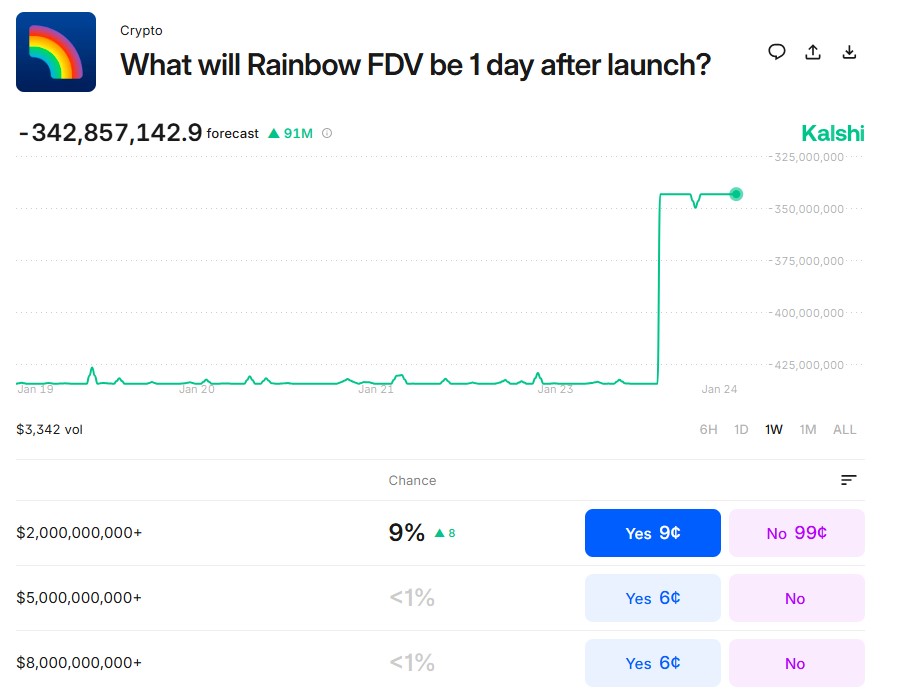

Kalshi predictions show FDV around $340M to $360M after one day. That means:

$340M FDV → $0.34

$350M FDV → $0.35

$360M FDV → $0.36

This aligns with post-listing stability around the $0.25 to $0.35 range. If volume stays strong and selling pressure remains controlled, Rainbow crypto price prediction may land between $0.60 to $1.20.

This price forecast is based on the current demand, pre-market data, and Uniswap CCA initiative. Traders should consider this with caution as they are not guaranteed.

The Rainbow token airdrop connects directly with real usage, real trading, and real liquidity. With Uniswap CCA, $RNBW MEXC premarket pricing, and balanced tokenomics, the project enters the market with strong transparency.

YMYL Disclaimer: This article is for informational purposes only. It does not provide financial advice. Cryptocurrency investments carry market risk. Always verify data from official sources and do your own research before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.