The hype around the $RAVE listing has exploded this week. Binance confirmed on its official X account that it will be the first platform to list RaveDAO airdrop on December 12, making it one of the most talked-about new crypto listings of the month.

With strong exchange support, and artist partnerships, people across Web3 are now watching this project very closely.

Before trading starts, here is everything you need to know about the $RAVE listing date and price prediction, along with upcoming airdrop rewards and tokenomics

Binance wallet account announced that eligible users can claim their $RAVE rewards using Alpha Points once trading opens. More details will be posted soon on the Alpha Events page.

This news has created major interest because Binance backed listings often see strong early demand. The official RaveDAO X account also confirmed the airdrop, stating that community builders from 2024–2025 will be rewarded.

This includes Genesis members, verified global event supporters, and Web3 contributors. The team will release the full claim guide soon.

The network aims to merge music, culture, technology, and community ownership through blockchain. The project includes:

Global large-scale music events

DAO-based community chapters

NFT membership systems

The $RAVE token for governance and rewards

THe asset is getting global attention because of its strong partnership and backing from well-known artists including Vintage Culture, Don Diablo, Lilly Palmer, Chris Avantgarde, GENESI, Bassjackers, and MORTEN.

It is also supported by leading platforms like Binance, OKX, Bitget, Bybit, WLFI, Polygon, AMF, Warner Music, and 1001Tracklists.

Because of these collaborations, many analysts now refer to it as one of the most promising new crypto listings in the music and Web3 sector.

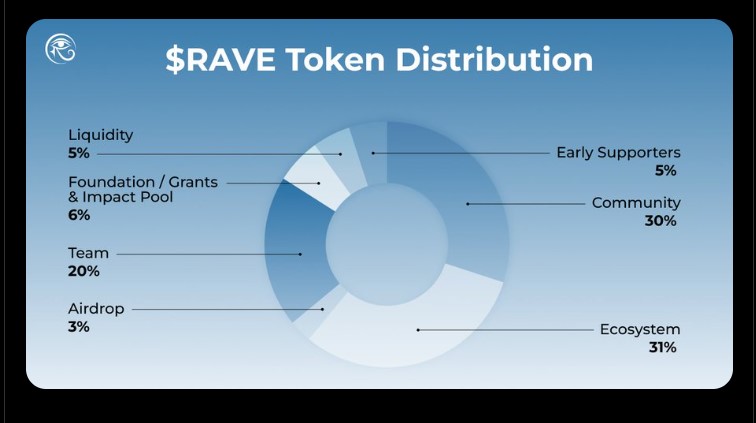

The total supply of the coin is 1 billion tokens, matching the structure seen in several successful Web3 projects. Here is the full token allocation:

Community – 30% (12-month cliff, 36-month vesting)

Ecosystem – 31% (15.03% unlocked at TGE; rest vested later)

Initial $RAVE Airdrop – 3% (100% unlocked at TGE)

Foundation / Impact Pool – 6% (12-month cliff)

Team & Co-Builders – 20% (12-month cliff)

Early Supporters – 5% (12-month cliff)

Liquidity – 5% (fully unlocked at TGE)

This tokenomics model structure reduces early selling pressure and supports long-term network growth.

Analysts compare the asset token supply to Celestia (TIA), which also launched with around 1B supply. Celestia listed at $2.10, but corrected 70% over time and still holds strong potential.

Using this comparison and early market signals, the expected $RAVE token listing price can land between $0.40 – $0.90. However as per my analyzing benign a cryptocurrency expert, the asset may drop towards $0.25, as news coins often correct after debut due to airdrop sell-off pressure.

But if global DAO chapters grow and NFT membership adoption expands in 2026, the asset may see steady upward movement towards $1.80 – $3.50.

The coming days will decide whether RaveDAO airdrop listing becomes a breakout Web3 project or not. With global partners, artist backing, Bitget listing, Binance launch momentum, and the highly anticipated token is entering the market with strong energy. Keep a close eye on the upcoming update, and check your eligibility before trading begins.

Disclaimer: This article is for informational purposes only. Crypto markets are risky. Always research before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.