Diamond tokenization has reached a new milestone as the UAE’s Billiton Diamond and digitization firm Ctrl Alt successfully tokenized over AED 1 billion ($280 million) worth of certified polished diamonds on the XRP Ledger (XRPL). The initiative is supported by Ripple, which provides enterprise-grade custody technology to secure these high-value physical assets.

Source: Official Press Release

Dubai’s DMCC played a key role in supporting the initiative, reinforcing the city’s position as a global hub where commodities and digital tokens intersect. The project shows growing confidence in blockchain-based infrastructure for real-world assets.

Under the collaboration, Billiton Diamond and Ctrl Alt completed end-to-end digitization of the precious stone, including inventory, certification, custody, and on-chain representation. Each token represents ownership of a real, certified diamond stored securely off-chain. Important details such as origin, grading, certification, and ownership history are embedded on-chain, making them easy to verify.

Source: Senior Executive Officer, Ripple

The assets are minted on the XRPL due to its fast settlement speed, low transaction fees, and scalable design. Here, Ripple’s custody solution ensures that the real diamonds backing the tokens remain securely stored and auditable.

Traditionally, diamonds are illiquid and difficult to verify. Tokenization helps reduce these barriers by enabling better transparency, easier access, faster settlement and clearer ownership records.

Billiton plans to expand this model further by launching a tokenized diamond platform, enabling real-time inventory management and preparing the asset for future primary and secondary market listings. These operations will move forward after approval from Dubai’s Virtual Assets Regulatory Authority (VARA).

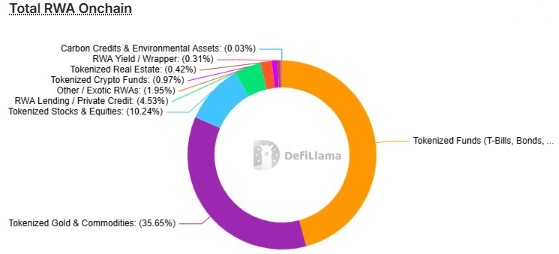

Diamond tokenization is part of a much larger trend known as real-world asset (RWA) tokenization. This market includes real estate, private credit, commodities, precious metals and physical products like diamonds.

Currently the sector holds around $14.885 billion in onchain value as per DefiLlama, while industry estimates suggest the global RWA market could grow beyond trillion by 2030, as institutions look for more efficient ways to manage and trade physical asset. XRPL has already supported earlier diamond tokenization efforts worth $109 million, showing steady growth in this sector.

As physical asset tokenization continues to grow, a common question is emerging across the crypto industry: could tokenized real-world assets like gold, silver, diamonds, and other commodities reduce demand for purely digital tokens?

Adding on, crypto exchanges like Binance, Coinbase, Bitget, themselves are now actively entering this space, offering tokenized versions of precious metals and commodities alongside traditional cryptocurrencies.

This shows rising interest from investors who prefer resources backed by real-world value, especially during periods of market uncertainty.

However, tokenized physical assets are not replacing digital tokens. Instead, they are expanding the crypto ecosystem. Physical asset tokens attract users looking for stability and real-world backing, while digital tokens continue to drive innovation, network activity, and decentralized finance.

Rather than posing a threat, the rise of tokenized metals and commodities suggests a shift toward a more diversified crypto market, where real-world asset and native digital token coexist and strengthen overall adoption.

Disclaimer: This article is for informational purposes only and does not provide financial or investment advice.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.