Highlights:

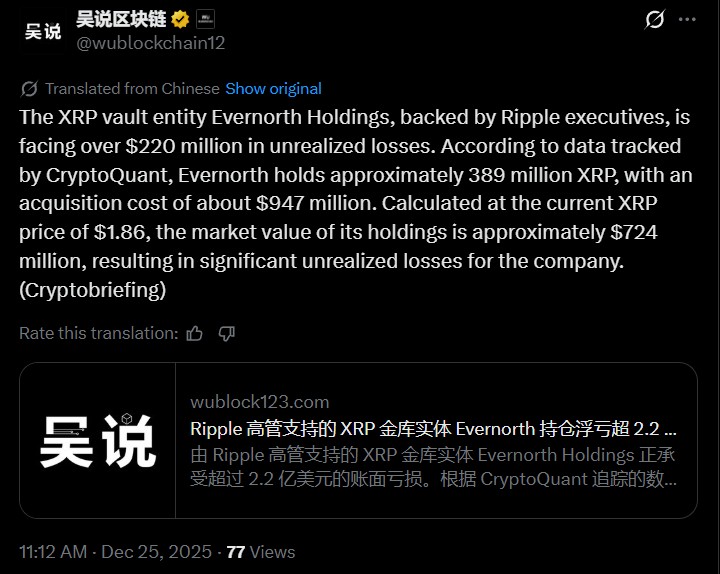

Evernorth Holdings, which is backed by Ripple, is carrying a balance of more than $220 million in unrealized losses in its treasury.

The company has 389 million tokens, which it acquired at a cost of about $947M, and is currently worth about $724M.

Although the price has declined in the recent past, U.S.-based XRP ETFs have received more than $1 billion in inflows, indicating that institutions still have an interest.

Ripple-Backed Evernorth Holdings, a XRP treasury hold controlled by Ripple executives, is experiencing huge losses that are yet to be realized after a recent decline in the price.

The value of the large holdings of the company has fallen significantly in the context of the XRP overall market corrections, despite the fact that the demand for investment products associated with among institutions is high.

Source: Wu Blockchain X

Evernorth Holdings has around 389 million tokens. These tokens were purchased by the firm at an average price of $947 million, which was done at the more expensive price points.

As of now, the token is priced at approximately $1.86. Evernorth has a holding of approximately $724 million, which translates to a loss of approximately $220 - $223 million unrealized.

The XRP price is down by approximately 16% in the last 30 days, performing poorly in a broader crypto market decline.

Source: CMC

The correction came at a time when Bitcoin price had dropped to below $88,000, exerting selling pressure on the major altcoins. On-chain tracking points to the fact that big holders such as Evernorth are incurring big losses on paper, and this represents short-term market volatility and not actual sell-offs.

U.S.-traded XRP exchange-traded funds (ETFs) have been raising capital despite ripple having weakened in price in the recent past.

According to the data provided by SoSoValue, the cumulative inflows of ETFs have been more than $1 billion since their inception.

This pattern indicates that institutional investors are still hopeful about the long-term performance despite the short-term fluctuation of prices.

Source: X

The ongoing depreciation shows the danger of high treasury positions in a time of increased market volatility.

In case the prices go up, it is possible that the losses of Evernorth decrease without selling its holdings.

The general mood on the market is rather mixed, as short-term caution is explained by the macro uncertainty, and institutional flows are aimed at the long-term confidence in Ripple-related products.

The effect of the recent drop in price on large treasury holders is highlighted by the fact that Evennorth Holdings has a loss of up to $220 million in unrealized losses. Nevertheless, the inflows into XRP ETFs have not stopped, which means that institutional interest is still strong. Although the volatility is short-term, the overall trend is still receiving long-term strategic capital, even though the price is under pressure in the short term.

Disclosure: This is informational and does not form financial or investment advice. Investments in cryptocurrencies are prone to market risk, and the reader is expected to do his or her own research before making any financial decision.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.