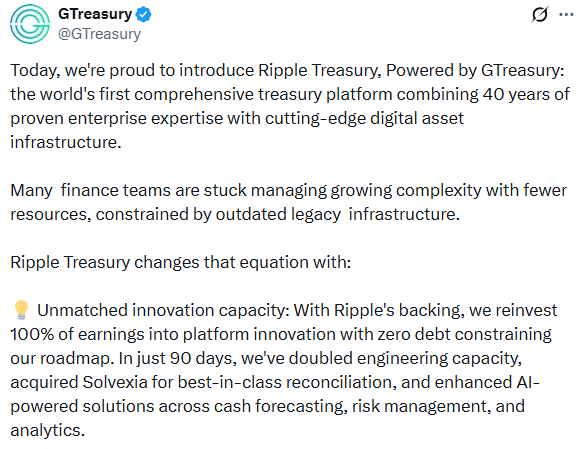

The corporate back office just received a long-overdue upgrade. On Tuesday, January 27, 2026, GTreasury pulled back the curtain on the Ripple Treasury platform, a launch that essentially bridges the gap between forty years of old-school financial wisdom and the high-speed world of digital assets. For the average CFO, the struggle has always been real: trying to manage global money flows using "ancient" software that moves at a glacial pace. This new release isn't just a shiny rebrand; it is a direct attack on the friction that keeps trillions of dollars "stuck" in transit every single day.

Source: X(formerly Twitter)

Source: X(formerly Twitter)

By merging Ripple’s blockchain expertise with GTreasury’s massive workstation, this unified system lets finance teams see their traditional bank balances and their crypto holdings in one single view. Gone are the days of jumping between five different tabs and messy spreadsheets just to figure out where your cash is. The Ripple Treasury platform treats digital assets with the same seriousness as fiat, effectively turning blockchain into a professional tool for the world’s biggest companies.

If you have ever wondered why international payments take three days to clear, the answer is "pre-funding." Big companies have to park millions of dollars in foreign bank accounts just to make sure they can pay their local bills. It is a massive waste of capital. The Ripple Treasury platform changes the game by using real-time settlement rails. Instead of waiting for the weekend to end or the bank to open, businesses can now move money instantly.

This shift in infrastructure provides immediate operational relief for global finance teams:

Unlocking Trapped Capital: By removing pre-funding requirements, companies can reclaim millions in idle cash.

24/7 Yield Optimization: Automated tools ensure that every dollar, even on weekends, is earning interest.

Eliminating FX Lag: Real-time settlements reduce exposure to currency fluctuations during long transit times.

The platform also comes packed with AI-powered "brains" for forecasting and risk management. With the recent addition of Solvexia, the Ripple Treasury platform can now automate the "boring stuff" with a precision previously unseen in corporate finance:

98% Error Reduction: Automated reconciliation minimizes the risk of manual data entry mistakes.

Smart Cash Forecasting: AI-driven analytics predict future liquidity needs across multiple currencies.

Regulatory Reporting: Instant generation of compliance documents across 75+ jurisdictions.

The launch of the Ripple Treasury platform signals a major shift in how the world’s largest brands view digital assets. We are moving past the "speculation" phase and into the "utility" phase. When a company like GTreasury, which is licensed in over 75 jurisdictions, says it is okay to hold crypto and fiat on the same dashboard, the "TradFi" walls have officially crumbled.

Looking ahead, this is about more than just fast payments. It is about preparing for a world of tokenized assets and programmable money like Bitcoin and solana . By building a future-ready infrastructure today, the Ripple Treasury platform is positioning itself as the new central command center for the modern enterprise. The "frictionless" future that crypto advocates have talked about for a decade is finally arriving in the corporate boardroom, and it looks a lot more like a professional workstation than a retail trading app.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.