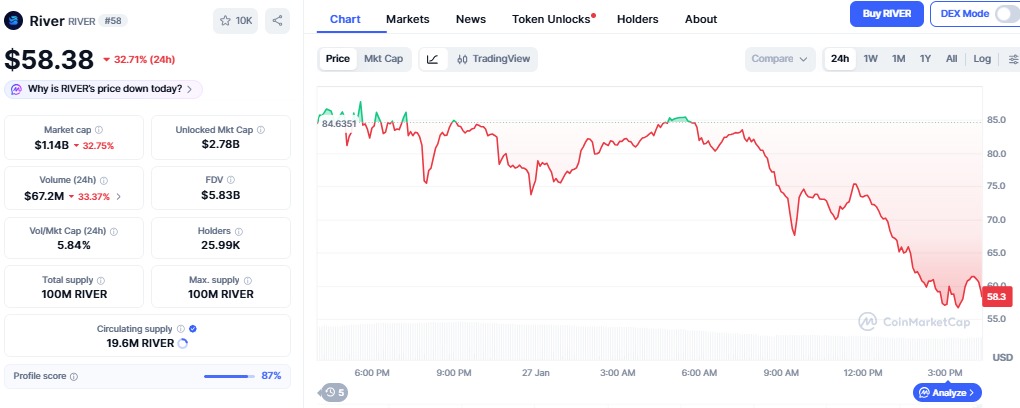

The River Price Crash has shocked traders after RIVER dropped sharply from its record high near $84. The token is now trading close to $58, losing more than 30% in a single day as per the CoinMarketCap. This fall came right after an explosive rally of over 1,900% in just 30 days. When a coin rises this fast, a correction is almost always expected. Many early buyers took profits, while late buyers rushed to exit, which increased selling pressure.

Source: CoinMarketCap

Fast rallies are interesting, but they also involve danger. The price drop illustrates how fast market sentiment can shift when a token becomes too popular and too many people want to get out of it at the same time.

It was launched in late 2025 by RiverdotInc. The platform enables users to lock assets from other blockchains, such as Ethereum and Sui, to create overcollateralized satUSD stablecoins through cross-chain technology. The concept gained popularity because it made it easier to transfer assets between different networks.

The growth accelerated with the completion of a $12 million funding round, led by TRON DAO Ventures. Large investors gave the project credibility. Shortly after, RIVER was listed on prominent exchanges such as Binance and OKX. This listing gave the token massive publicity and easy access to traders around the world.

At its peak, daily perpetual futures volume reached almost $6 billion. This massive activity pushed prices higher very quickly. However, much of this growth was driven by derivatives trading rather than real spot buying, which made the price more fragile.

One of the biggest reasons behind the River Price Crash is simple profit-taking. After a 1,900% rise, many traders felt it was the right time to lock in gains. This is normal market behavior.

The situation became worse when Bitcoin dipped below $88,000. This created fear across the market. When traders feel uncertain, they usually sell risky assets first. It, being one of the most overextended tokens, became a natural target for selling.

Once the price started falling, panic selling increased as more traders tried to protect their profits.

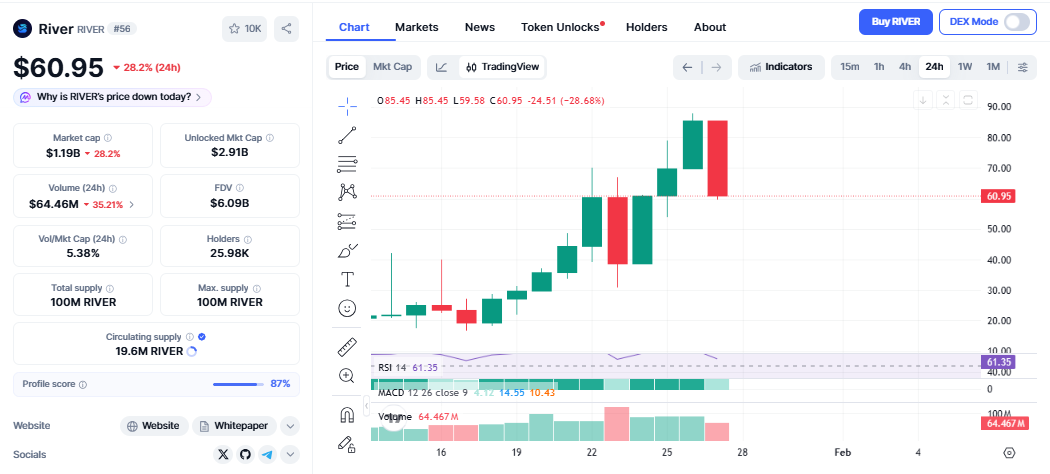

Technical indicators were already giving warning signs before the crash. The RSI was above 77, showing it was extremely overbought. When RSI stays this high, a correction usually follows.

Source: CoinMarketCap

It also failed to hold above the $68 level after rejecting near $87.79. When this support broke, selling pressure grew fast and pushed the price lower.

These signs showed the rally was running out of strength.

Another major factor behind the River Price Crash is heavy leverage. Futures trading volume was much higher than spot trading. This means the price was driven mostly by leveraged positions instead of real buying demand.

When leverage is high, liquidation chains become dangerous. A small drop can force many traders to close positions automatically, pushing the price down even faster.

It is around $59. The most important support is near $55. If it holds above this level, the price may stabilize. If it breaks, the next strong support lies near $46, where buyers may step in.

Bullish case: If BTC stabilizes and the altcoin holds above $55, a bounce toward $68–$72 is possible.

Base case: Price may move sideways between $55 and $65 as the market cools down.

Bearish case: If $55 breaks, it could fall toward $46–$48 before finding strong support.

Disclaimer: This article is for informational purposes only and not a financial advice, kindly do your own research before investing in the market.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.