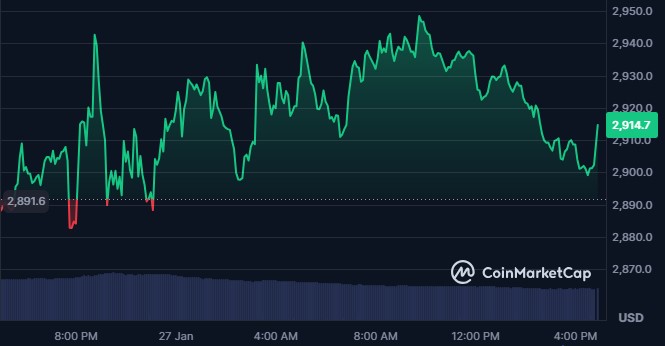

Ethereum is entering 2026 with a familiar feeling in the market: hope mixed with hesitation. Right now, Ethereum is trading near $2,914, after briefly dipping below $2,500 earlier and bouncing back. Daily trading volume is high, nearly $27 billion in 24 hours, which tells us one thing clearly: people are paying attention.

Source: CoinMarketCap Data

Prices are moving, big players are active, and upgrades are coming, but still the digital asset is struggling to gain momentum above the $3,000 mark.

Entering the 2026 after the October crash, Ethereum has been hovering just below this level, teasing a breakout but never fully committing. Traders, however, are still watching $3,000 as a key level as it often decides the token's next big move, but is it really worth watching in the recent price scenarios?

Ethereum’s past explains why this level feels so significant.

May 2021: ETH broke above $3,000 for the first time and later surged to nearly $4,878, its all-time high.

Mid-2025: ETH again crossed $3,000 after months of consolidation between $2,400–$2,800.

Looking at this suggests how $3K level often pushes traders confidence back in the asset.

But the recent trends have changed. During the Fusaka upgrade hype in December 2025, ETH briefly moved above $3,100 but failed to hold. Since then, ETH has crossed $3,000 multiple times, only to fall back quickly. Each failure has led to noticeable pullbacks, making traders extra cautious. This has turned $3,000 into a battle zone, not a celebration point.

After the October 2025 crypto market crash, the series of continuous ups and downs are following the crypto market and its major assets, including Bitcoin, BNB, Solana.

Adding on, back-to-back shocks from geopolitical tensions like war situations, sanctions, tariffs put heavy pressure on the market and the traders, surpassing the positive impact that comes from the new crypto regulations from many regions.

Many market watchers are attributing Ethereum’s struggle to Bitcoin’s performance also. Bitcoin is seen as a major indicator for the market’s mood. Altcoins often surge as Bitcoin rises; however, for now, the golden asset itself is struggling to hold above $1,00,000, after 2025 ATH and the following downtrend.

The ETH/BTC ratio is near multi-year lows, suggesting ETH is waiting for Bitcoin to either break out or calm down. In simple terms, if Bitcoin breathes easy, Ether gets room to run.

Ethereum can still make a comeback, but not overnight. For a strong recovery, the digital asset needs:

A clean break and hold above $3,000–$3,100

Support from ETF inflows instead of outflows, as it recently recorded $611 million in weekly outflows.

Large institutions are also helping in its long-term breakout as they quietly build confidence.

One major signal came when BitMine staked over 209,000 ETH worth $610 million, locking those coins instead of selling them. On top of that, whale wallets have been accumulating more coins, tightening the available supply in the market.

Ethereum is also proving its real-world usefulness. A gold ETF from Hang Seng was tokenized on ether, highlighting its role as a settlement layer, not just a trading asset. This kind of adoption keeps long-term believers interested, even during slow price periods.

If these align, history suggests the token could see 15%–20% upside after confirmation. Without them, ETH may stay stuck between $2,600 and $3,000 for weeks or even months.

Ethereum in 2026 is not in trouble, but it’s not in a hurry either. Macro pressure, ETF outflows, and Bitcoin’s dominance are keeping ETH stuck in a tight range for now but the token has proved itself in a long run where it started with around $0.42.

Strong fundamentals, upcoming upgrades, and heavy staking are still paving the way for growth but it needs a long-term belief.

Disclaimer: This content is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, and readers should conduct their own research before making any investment decisions.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.