The crypto market received a major update after the official RLUSD Binance listing was confirmed. Binance, the world’s largest crypto exchange, announced that it will list Ripple’s U.S. dollar stablecoin, for spot trading. Ripple CEO Brad Garlinghouse called the move “eXtRemely Positive,” showing strong confidence in it’s future.

Source: X (formerly Twitter)

This will allow users to trade pairs like RLUSD/USDT and XRP/RLUSD. Trading will start at 8:00 a.m. UTC, with deposits already open on Ethereum and withdrawals beginning on January 23. Support for the XRP Ledger (XRPL) is coming soon, which means users will soon be able to use the stablecoin directly on Ripple’s own blockchain.

This puts Ripple’s stablecoin in front of millions of traders worldwide. Binance brings huge liquidity, global access, and strong trust. This makes the stablecoin easier to use for trading, payments, and financial applications.

The exchange is also offering zero trading fees on select pairs. This will enable more activity and make the stablecoin more attractive for short-term traders and long-term holders.

It was launched in December 2024 and is fully backed 1:1 by U.S. dollars, short-term U.S. Treasuries, and cash equivalents. Today, it has crossed a market cap of $1.3 billion, proving that demand is growing fast.

One special feature of this stablecoin is its multichain design. It already runs on Ethereum and will soon be live on XRPL. The listing supports Ethereum first, with XRPL integration coming shortly after.

Ethereum gives it access to smart contracts and DeFi tools. XRPL will offer faster transactions and lower fees. This makes it flexible and useful for both developers and institutions.

The listing is not limited to trading. Binance plans to add this to:

Portfolio Margin

Binance Earn

Other financial products

This means users can earn yields, use the stablecoin in strategies, and hold it as a stable financial asset. It increases RLUSD’s real-world use beyond simple buying and selling.

The organisation has been pushing stablecoins strongly on the global stage. At Davos 2026 WEF Ripple took part in major discussions about digital finance. The company believes regulated stablecoins will improve cross-border payments and bring speed and transparency to banking systems.

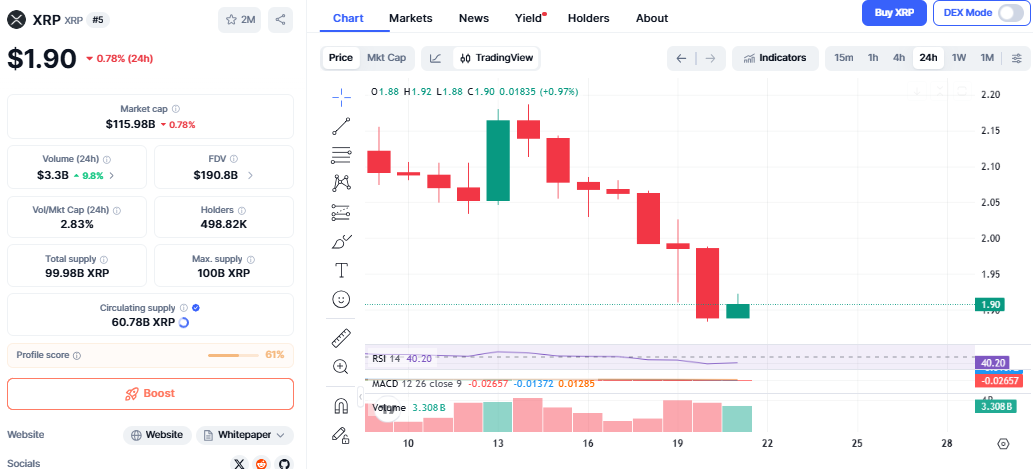

Right now, XRP price is under pressure due to the broader crypto market.

The RLUSD Binance listing can improve sentiment for XRP, but the chart still shows caution.

Source: CoinMarketCap

It is trading near $1.90, down about 0.78% in 24 hours, while volume is rising, which shows active trading.

In the 1-hour chart, the RSI is at 45, implying neutral momentum. MACD is still weak. The altcoin requires strong buying forces for it to move higher.

On the 24-hour chart, RSI is close to 40, close to oversold, but a possible minor bounce is anticipated. MACD is negative, but selling pressure appears to be weakening.

If buyers intervene, XRP can move to $1.95. A break above $1.95 can provide a pathway to $2.00.

If it loses $1.88, price could drop toward $1.81.

In short, the listing supports Ripple’s ecosystem, but XRP still needs to reclaim $1.95 to turn bullish.

This is a big boost for Ripple with the RLUSD binance listing. This is because the move will see the regulated and enterprise-grade stablecoin reach a wider market.

Although XRP is experiencing market pressure, this development shows the organisation is looking towards the future. By listing on the largest crypto exchange, it is clear that Ripple is more concerned about the future of finance rather than the short-term market price moves.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.