When the white metal price surges above the major psychological levels, the famous author of Rich Dad Poor Dad believes it is not just a price move, it is a warning. According to the Robert Kiyosaki silver prediction, the move above $70 is not random, it could be an early signal of hyper-inflation.

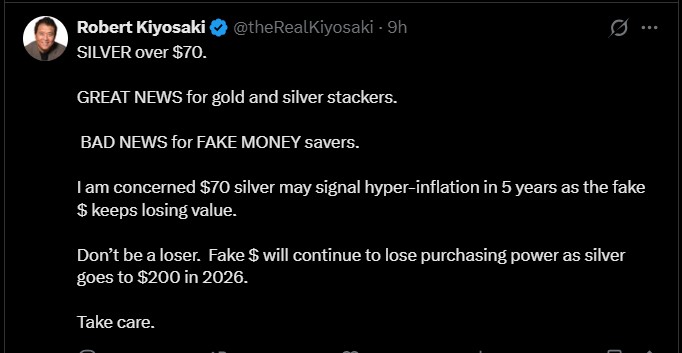

In his latest X post Kiyosaki stated that “SILVER over $70” is great news for commodity stackers but bad news for fiat money savers, calling paper currency “fake money” that continues to lose purchasing power.

This has issued a fresh warning to investors: the era of "fake money" is failing, and the white metal is stepping into the spotlight. Let’s understand what it means, and how the Silver surge will impact BTC price going forward.

In the context of Robert Kiyosaki Silver prediction, a break above the $70 per ounce mark acts as a historic shift in how the world views wealth. He argues that rising metal prices reflect weakening trust in fiat currencies, especially the U.S. dollar.

This continuous precious metal rally will lead to hyper-inflation within the next five years, and the Kiyosaki silver price target $200 by 2026 will turn real.

The "Fake Money" Argument: He often calls the U.S. Dollar "fake" because it is not backed by precious metals.

The Move to "Real Assets": His advice is simple: protect your hard-earned savings by moving away from fiat currency and into "real" assets like Golden and white metal.

This warning aligns closely with broader inflation hedge assets narratives surging in 2025.

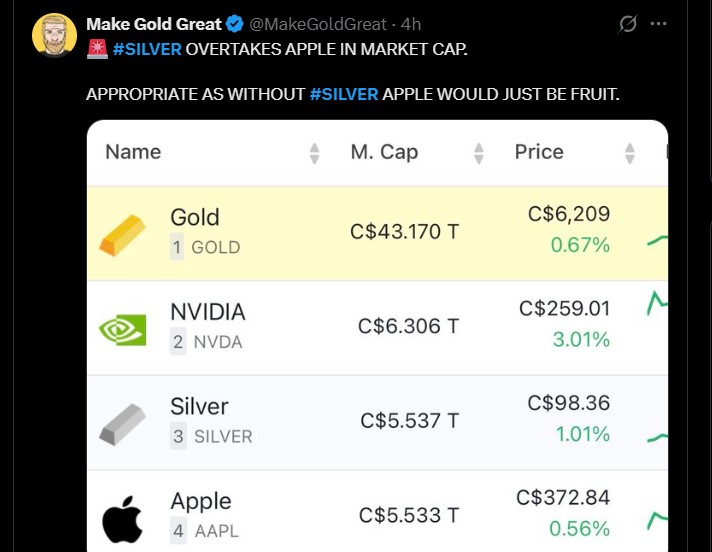

A chart shared by crypto analyst Make Gold Great on X claims that white metal’s total market value has recently climbed around $4.07 trillion, surpassing Apple market cap to become the world’s third-largest asset.

At present, it is trading near $72.30 per ounce, climbing steadily from the $58–$60 range. The price structure shows higher highs and higher lows, confirming a strong bullish trend.

On the other hand, it isn't just one commodity making headlines. Spot gold prices have surged past $4,500 per ounce, a historic milestone. Expert Kashif Raza, founder of Bitning, has labeled gold and another commodity as the true "Dhurandar" (Champions) of 2025.

“His comment reflects a growing expert view that traditional hard assets are outperforming in an environment shaped by inflation fears, currency debasement, and declining confidence in fiat systems.”

The RSI MACD indicators currently show a very "bullish" trend.

RSI is currently high, which means buyers are active and demand is strong.

MACD is moving upward, showing that buyers are controlling the market right now.

The price is moving up very fast in a curved pattern. In the past, such moves usually slowed down near the 4.23 Fibonacci level.

The $70 level, which was earlier hard to break, is now acting as a strong support. Buyers are stepping in around this level.

This TradingView price chart confirms strong upward momentum, setting the narrative of rising prices amid weakening fiat value.

While Robert Kiyosaki Silver prediction of $200 by 2026 is bold, many top crypto analysts are now updating their outlook.

Looking at the bullish trend, technical indicators, and the Rich Dad Poor Dad author’s warning, these are the more realistic price targets ahead:

Base Case:If inflation continues and trust in fiat currencies weakens, it could realistically move toward $120 – $150 in the coming period.

Bull Case ($200): If a major "currency crash" occurs, as Kiyosaki predicts, it could reach $200 by 2026 as people panic-buy hard assets.

Bearish Case: Likely, but trend remains bullish above $65–70.

Kiyosaki’s warning also impacts crypto markets. With $BTC trading near $87,000, he believes that as commodities rise, bitcoin price will also follow.

Currently, according to the TradingView price chart, Bitcoin is moving sideways between the $85,000 – $90,000 range. The RSI is around 47, showing neutral momentum, while the MACD is slightly negative, suggesting short-term consolidation.

If hard assets continue to rise as inflation hedges, and top analysts’ views prove correct, Bitcoin price prediction could target the $180,000 – $250,000 range by 2026.

The Robert Kiyosaki silver prediction is a reminder that the global economy is changing. Whether it hits $200 or stays in the $100 range, the message is to look for "scarcity."

Assets that cannot be printed—like gold, silver, and Bitcoin—are becoming the preferred choice for those worried about the future of the dollar.

Disclaimer: This article is for informational purposes only. It is not financial advice. Investing in precious metals and cryptocurrencies involves high risk. Always DYOR before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.