Semler Scientific, operating as a medical device manufacturing firm, purchased $50 million more of BTC between May 13 and May 22. This latest buy brings the total value to $474.4 million of the company’s digital asset holdings with a total number of 4264 BTC. Now the company Semler is among the top 13 public organisations holding this digital asset as part of their business planning.

Source: Semler Scientific

The company bought 455 coins during the latest purchase as per the data from latest SEC filing, paid an average price of $109,801 each, which includes the fees. It started purchasing this digital currency in May 2024 as part of a strategy to protect its finances and add a new category of asset to diversify its portfolio.

Source: SEC Filing

To raise funds for this latest buy, Semler Scientific sold more than 3 million shares of its own stock. It was executed through an at-the-market (ATM) program launched in April 2025. This event has brought about $115 million of funds. This approach helped the company raise cash without borrowing or putting too much pressure on the present shareholders.

Even with this huge investment, Semler’s stock fell by 1.36% on May 23, the same day it revealed the news. But that drop is similar to what happened to the tech-heavy Nasdaq index, which went down about 1% that day.

Eric, the chairman of the firm, pointed to something called "BTC yield" to show how their plan is working. This number shows how much of the digital asset the company holds per share. In the year 2025, the yield has grown by 25.8%, depicting that the price jump in the currency has assisted in maintaining the overall position of the firm.

Since starting this new strategy in 2024, company's own stock has also gone up by 53%. However, due to a 44% drop in earnings for the first quarter of 2025, the company’s shares are still down 18% overall for the year as per Google finance.

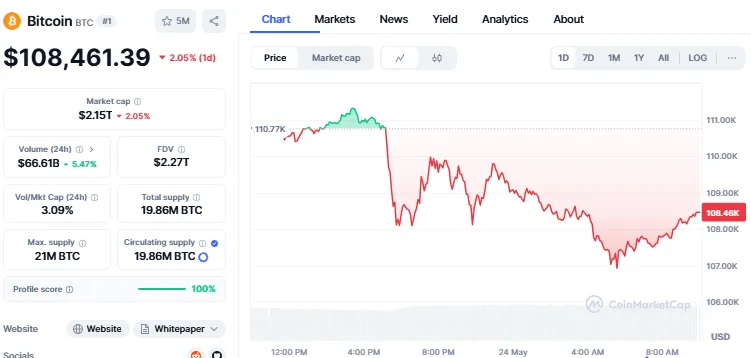

Bitcoin hit an all time high of $111,000 on 22nd of May making a new record, which made a buzz in the industry. Currently it is trading at $108,461.39 with a decrease of 2.05% in a day, while the trading volume has increased by 5.47% as per the CoinMarketCap.

Source: CoinMarketCap

Semler Scientific is not alone in this move. Other major companies such as Strategy, Metaplanet, BlackRock, Mara, Riot, and Hut8 have also begun adding the digital asset to their financial plans in 2025. Many of them have used similar stock sale strategies to build their reserves.

While Strategy is known for its bold moves, Semler is taking a more careful path. Still, the firm is committed to its plan and even created a public dashboard to let people see its holdings and track performance.

The growing digital asset strategy of Semler Scientific shows how more traditional firms are exploring new ways to protect their money and grow value. Despite some challenges like falling revenue, the strong performance of its new asset holdings and focus on being open with investors may help it stay ahead in the long run.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.