The political storm around digital asset regulation intensified on February 12 as Warren vs Trumps SEC became the center of attention during a tense Senate hearing. Senator Elizabeth Warren directly questioned Securities and Exchange Commission Chair Paul Atkins over the agency’s decision to drop multiple crypto enforcement actions involving companies that contributed to Donald Trump’s inauguration.

Source: X official

Atkins defended his leadership, saying he is ending what he calls “regulation by enforcement” and steering the watchdog back to core goals like investor protection and fair capital markets. The clash unfolded as the American Bankers Association urged regulators to pause new crypto bank charter approvals until clear frameworks are finalized.

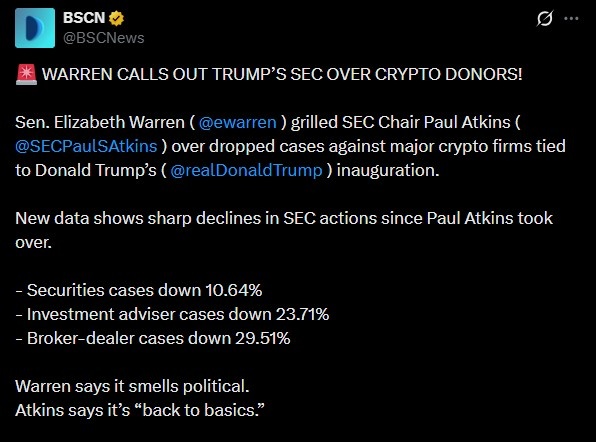

Warren presented public data suggesting a noticeable drop in activity:

Securities offerings cases declined 10.64% between 2024 and 2025.

Investment adviser matters fell 23.71%, while broker-dealer actions slipped 29.51%.

Atkins challenged those figures, noting that official year-end data has not been released. He framed his tenure as a reset focused on fraud prevention rather than targeting registration violations. Independent research from Cornerstone Research confirmed fewer settlements in fiscal 2025 compared with fiscal 2024, though analysts remain divided on why.

Supporters of the current leadership argue that the prior commission, under Gary Gensler, leaned heavily into aggressive enforcement around token registration rather than clear rulemaking. Critics believe reduced action weakens accountability in the crypto industry.

Warren pointed to dismissed proceedings involving major platforms that donated to Trump’s inauguration:

Kraken – $1 million contribution, case dismissed

Coinbase – $1 million contribution, case dismissed

Gemini – $1 million contribution, case dismissed

Binance – linked to a $2 billion boost tied to a Trump family stablecoin deal, case dismissed

Warren stated that these companies collectively gave $85 million toward inauguration efforts, arguing the timing raised conflict concerns. She claimed possible investor harm may have been overlooked once political ties strengthened.

Atkins responded that the dismissed matters involved technical registration disputes rather than fraud. According to him, prior leadership pursued actions without clear digital asset guidance, making compliance difficult for exchanges. He said the new approach seeks legislative clarity instead of courtroom battles.

The debate centers on whether unregistered token sales equal misconduct. The crypto sector has long argued that unclear definitions around securities classification made proper filing impossible. Atkins supports the Digital Asset Market Clarity Act of 2025, which aims to divide oversight between the SEC and the Commodity Futures Trading Commission.

Opponents fear reduced enforcement could embolden bad actors. Proponents in Warren vs Trumps SECsist structured legislation will create stability for blockchain innovation, crypto compliance, and fintech growth.

When asked to identify ongoing cases against inauguration donors, Atkins did not provide examples during the hearing, maintaining that enforcement priorities have shifted.

Warren also highlighted three executives who received presidential clemency and later saw regulatory cases dropped:

Devon Archer – linked to $60 million in bond losses

Carlos Watson – accused of misleading investors

Trevor Milton – convicted of fraud, donated $1.8 million

Atkins noted civil proceedings can continue despite pardons, but clemency complicates practical enforcement. This raises constitutional questions about the separation between criminal punishment and civil accountability.

The unfolding Warren vs Trumps SEC dispute reflects a deeper divide over crypto enforcement policy, political influence, and regulatory philosophy. Whether the shift signals fairness or favoritism remains contested, but the outcome could shape digital asset oversight and investor confidence for years ahead.

YMYL Description: This article is for informational purposes only and does not constitute financial or legal advice. Cryptocurrency regulations are evolving rapidly. Readers should verify information and consult qualified professionals before making investment or compliance decisions.

Krishna Tirthani is a dedicated crypto news writer with 1 year of hands-on experience in the cryptocurrency market. With a strong focus on market trends, token launches, price movements, and blockchain innovations, Krishna delivers timely, accurate, and easy-to-understand crypto content for both beginners and experienced investors.

Over the past year, Krishna has closely followed major developments across Bitcoin, Ethereum, altcoins, DeFi, NFTs, Web3, and emerging crypto projects. His writing style blends data-driven insights with clear explanations, helping readers stay informed in a fast-moving and often complex market. From breaking crypto news and exchange listings to tokenomics analysis and price predictions, his work aims to simplify information without losing depth.

Krishna believes that credible research, transparency, and consistency are essential in crypto journalism. Each article is crafted with SEO best practices in mind, ensuring high visibility while maintaining originality and factual accuracy. His growing experience in the crypto space allows him to spot early trends and explain their potential impact on the wider market.

With a passion for blockchain technology and digital assets, Krishna Tirthani continues to evolve as a crypto writer, committed to delivering reliable, engaging, and value-driven crypto news content.