Why would a public company stake such a huge amount of Ethereum when prices are shaky and investor confidence looks weak? That question is now being asked across the crypto market after a major move by Sharplink Gaming.

Sharplink Ethereum Staking has become one of the biggest talking points in crypto news this week, as the company quietly made a long-term bet while most traders remain cautious.

SharpLink Gaming has deployed and staked around $170m worth of ETH on Linea, a layer-2 network. With this move, SharpLink now holds close to 864,800 ETH, worth nearly $2.7 billion.

Source: X (formerly Twitter)

That makes SharpLink the second-largest public Ethereum treasury firm, just behind Bitmine.

A key detail here is leadership. SharpLink’s chairman is Joseph Lubin, who is also the founder and CEO of Consensys. Consensys is the company that incubated Linea.

This shows the decision was not random. It was planned, strategic, and clearly long-term.

Linea’s Total Value Locked has dropped sharply since its token launch.

• Peak TVL: $1.64 billion

• Current TVL: around $186m

• Decline: nearly 89%

Normally, such a drop scares investors away. But this staking news suggests the opposite. Big players are willing to move in when activity is low, not when hype is high.

Staking ETH on Linea helps the network stay secure and boosts activity, sending a strong signal that the insiders still believe in its future.

Bitmine has recently invested another $105 million into this cryptocurrency, bringing the total balance to over 4.07 million tokens-about 3.36% of the total supply. The company aims to get to 5% of this crypto’s supply by 2026.

Bitmine’s ETH staking reaches 1.032m tokens, with more than $2.87 billion locked. With $915 million still available in reserves, Bitmine clearly sees this digital currency as a long-term asset.

Together, Sharplink and Bitmine Ethereum Staking show that institutions are accumulating, not exiting.

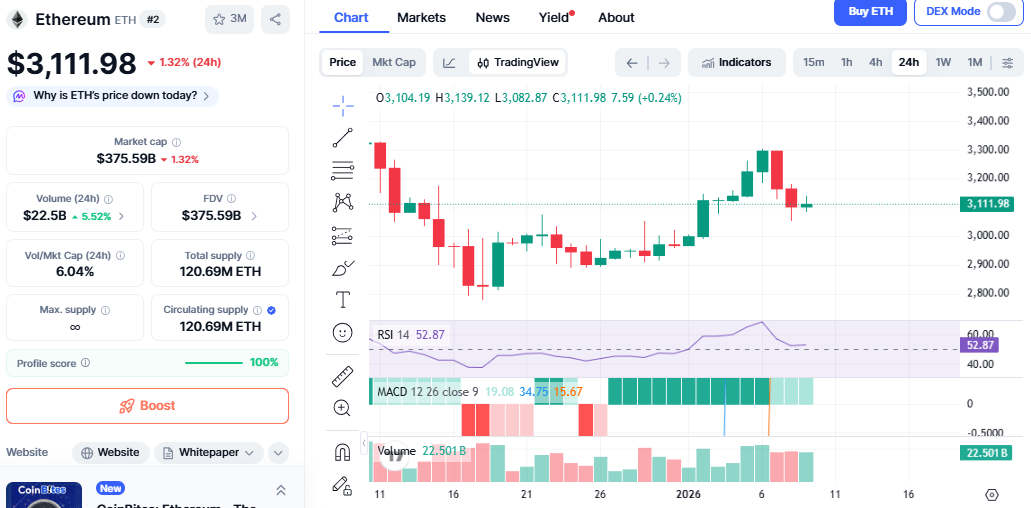

The price slipped around 1.32% in the last 24 hours, trading near $3,112. This drop is not random.

Main reasons include:

• $159.9 million in outflows from U.S. spot ETH ETFs as per Sosovalue data.

• $116 million in this crypto's long liquidations after Bitcoin fell below $90,000

• A $26.4 million exploit linked to Truebit, hurting short-term sentiment

Still, it remains up over 3% this week, showing buyers are not gone.

It is holding a key support zone between $3,080 and $3,120. RSI is near 52, which means the market is balanced, not over-sold. MACD is positive but slowing, suggesting consolidation.

Source: CoinMarketCap Chart

If it stays above $3,080, a move toward $3,280–$3,350 is possible. If support breaks, it could dip toward $2,950 before buyers step back in.

Sharplink Ethereum Staking is not a short-term trade. It is a clear message from institutions that it is becoming a productive treasury asset. While prices may stay volatile, smart money appears to be positioning early, not running away.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.