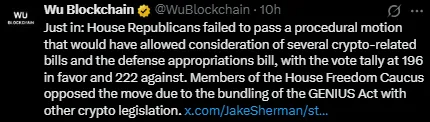

The Crypto Week started with tension in the U.S. Congress as lawmakers failed to move forward with key laws. On Tuesday, the House voted on a plan to begin debate on three big bills: the Genius Act, the Clarity Act, and the Anti-CBDC bill. But the plan failed with a vote of 196–223. Some Republicans joined Democrats to block the vote.

Source: X

The vote was expected to launch formal discussions around defining U.S. laws.

Rep. Marjorie Taylor Greene opposed the plan due to the lack of a clear CBDC ban.

Democrats, led by Maxine Waters, called it “Anti-Crypto Corruption Week” and rejected all digital asset proposals.

As a result, the Crypto Bill in Congress stalled, delaying progress and creating uncertainty across the space.

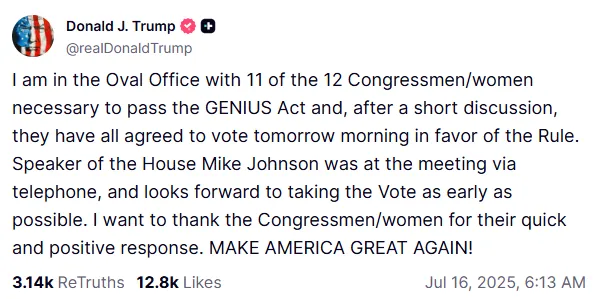

After the vote failure, President Donald Trump acted swiftly. He hosted an urgent Oval Office meeting late Tuesday with 11 of the 12 Republican lawmakers needed to support the bill. House Speaker Mike Johnson also joined the call.

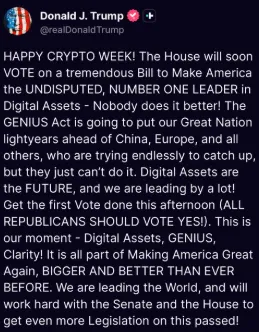

This emergency meeting followed Trump’s social media post saying, “Happy Crypto Week,” where he promised to make America a leader in digital assets. His direct involvement gave the bills a new push.

Source: Truth Social

These Bills, if passed, would regulate stablecoins, define commodities, and block the creation of a U.S. government-controlled digital currency (CBDC). Trump’s move revived hopes for a successful re-vote.

Following Trump’s intervention, political momentum shifted. Lawmakers are now more aligned to pass the bill package in today’s re-vote. Trump shared the discussion details over Truth Social platform. The key proposals include:

Source: Truth Social

The Genius Act – Focuses on safe stablecoin regulation

The Clarity Act – Defines digital assets as commodities

The Anti-CBDC Bill – Bans a central bank digital currency

This new momentum has reignited excitement in the industry. If passed, the bills could bring clarity to the U.S. regulatory framework, boost innovation, and offer legal certainty for blockchain businesses.

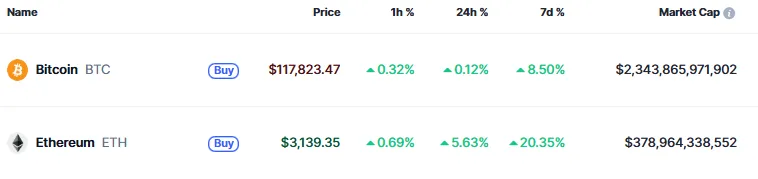

Crypto markets reacted quickly. Bitcoin and Ethereum both experienced immediate responses after Trump's sit-down and change in political winds:

Bitcoin price jumped to $117,823.47 with a market cap of $2.34 trillion

Ethereum price jumped above $3,139.35, more than 6% higher within a day

Source: CoinMarketCap

The overall capitalization of the world's crypto market increased 1.16% to $3.7 trillion. The move was taken by investors as a bull sign, who read Trump's action and potential bill approval in the same way.

If they pass, these pieces of legislation would redefine the U.S. position on digital assets. The GENIUS Act would mandate stablecoin disclosure, while the Anti-CBDC bill would prohibit the establishment of a federal digital currency considered by most to be a privacy threat.

Collectively, such enactments have the potential to make companies be based outside of the U.S., solidifying the country's position at the forefront of blockchain and virtual assets. The majority in the industry view this time as the pinnacle for innovation and decentralization in America.

The proposal in Congress suffered a huge blow, but Trump's move can bail it out on a lifeline during today's re-vote. Whether the House will vote for the Crypto Bill is uncertain, but the international community is watching it closely.

Disclaimer: The above article is for information purposes only. It is not financial or legal advice. Readers are advised to make their own inquiries before any investment or political action.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.