The Spur protocol listing date has finally arrived after months of delays and uncertainty. According to Coinstore's official X announcement, $SON trading today, February 2, is now scheduled to open with the SON/USDT pair. This update follows repeated postponements that tested community patience and market confidence.

Earlier, the $SON listing date on Coinstore was planned for January 30 at 10:00 AM UTC. However, the project and its ecosystem partner Spores Network issued a public apology, citing last-minute exchange-side adjustments. The revised timeline now gives traders a clear and final window.

Under the new plan (UTC+8), the Spur protocol listing date and related actions are set as follows:

• Deposit opens: February 6, 2026 | 18:00

• Trading opens: February 2, 2026 | 17:00

• Withdrawals open: February 3, 2026 | 17:00

This means SON USDT trading effectively begins today. After six major delays—from Q4 2025 through December 19, January 8, January 26, January 30, and now February 2—the market finally has confirmation.

The team has stated that February 6 will mark the complete $SON airdrop claim listing process, with no further changes expected.

The project operates as a decentralized, community-driven Web3 ecosystem focused on transparency and security. Ahead of the Spur protocol listing date and price expectation, the token contract was officially upgraded to improve ecosystem safety and functionality.

New contract address: 0xf33b4478edB22A650C0d730d47868d4Effa16b40

Ticker: SON (BNB Chain)

Total supply: 1,000,000,000 SON

Vesting: 10% at TGE, then 10% monthly

Total raise on KDG: $50,000

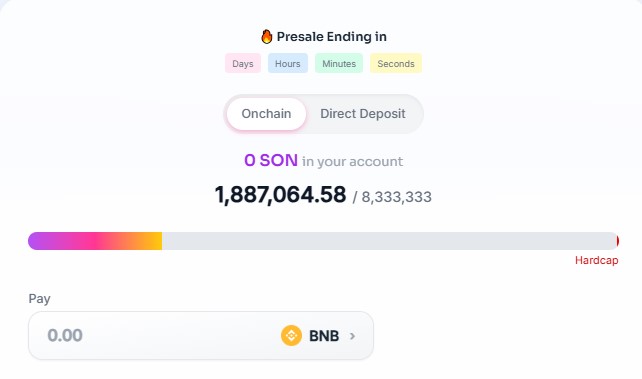

On KingdomStarter, only two hours remain for the IDO claim as of the time of writing. Out of $50,000 USDC, $49,996.3 has already been processed. However, Spur protocol presale performance remains weak. Only 1,887,064.58 tokens were sold out of 8,333,333 at a $0.03 price—just 22.6% completion—leaving around 6.44 million tokens unsold as seen in the below SpurSwap Network chart.

This incomplete presale is critical. Past cycles show that the asset reopened or extended sales even after declaring them closed, mainly due to low demand. Such gaps often create launch-day sell pressure.

Broader market conditions add another layer of risk. Over the last 24 hours, the total crypto market cap dropped nearly 2%. Bitcoin slipped toward $75,000, while Ethereum fell close to 10%. In a risk-off environment like this, holding the $0.03 presale valuation appears difficult.

According to CoinGabbar analysts, when presale weakness, listing delays, and current sentiment are combined, the expected Spur Protocol price prediction on launch day range sits between $0.015 and $0.020. Airdrop-related selling could push prices toward the $0.010 zone shortly after the market debut.

Still, the outlook is not fixed. If listings on Coinstore, MEXC, BingX, and SpurSwap roll out smoothly and market sentiment improves from Extreme Fear (14), a recovery path could emerge. Under stable execution, analysts project a longer-term 2026 range of $0.20–$0.25, dependent on delivery and transparency.

The Spur protocol listing date february 2 marks a long-awaited milestone, but the data shows a cautious start. Trading goes live in 2 hours, yet presale gaps and weak market sentiment may pressure early prices. Long-term performance will depend on execution, liquidity, and trust rebuilt after repeated delays.

YMYL Disclaimer: This article is strictly for informational purposes only and does not constitute financial advice. Cryptocurrency markets are volatile. Readers should conduct independent research and consult qualified advisors before making any investment decisions.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.

3 hours ago

I buy from spur swap can i withdraw it now and trade it?