Spur Protocol ($SON) is finally heading toward its first confirmed exchange listing on Coinstore—but after six delays, investors are asking a serious question: Will this launch restore confidence or trigger fresh selling pressure?

With weak presale demand, ongoing market fear, and limited clarity from the team, the upcoming $SON listing has become a critical moment for the project. Let’s break down what the Coinstore listing means, where the price could head next, and what investors should realistically expect.

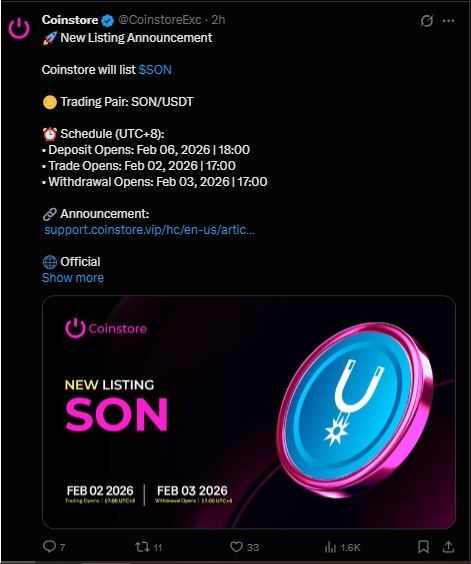

Coinstore has officially confirmed the listing of Spur Protocol’s $SON token, marking its first verified exchange launch.

Key Launch Details:

Trading Pair: SON/USDT

Deposits Open: February 6, 2026 (UTC+8)

Trading Starts: February 2, 2026 (UTC+8)

Withdrawals Enabled: February 3, 2026 (UTC+8)

This announcement ends weeks of speculation, but repeated delays have already damaged trust among early supporters.

The launch has now been delayed six times, shifting from Q4 2025 through multiple January dates before landing on February 2, 2026.

Although the vesting schedule remains unchanged—10% unlocked at TGE and 10% released monthly—the lack of clear updates has raised red flags. Investors often see repeated delays as a sign of operational weakness, especially in early-stage crypto projects.

Presale data shows that only 1.88 million tokens were sold out of 8.33 million allocated, leaving nearly 77% unsold. This low demand has raised concerns about overall interest.

At the same time, the broader crypto market is under pressure:

Total crypto market fell nearly 3.43%

Bitcoin and Ethereum dropped 3–8%

Market sentiment moved into Extreme Fear

These conditions make it harder for new tokens like $SON to perform strongly at launch.

Given current sentiment, the token is unlikely to open at its $0.03 IDO price.

Expected Launch Price Range

Likely opening price: $0.018 – $0.025

Key risks: Selling pressure from airdrops and 10% TGE unlock

Upside limit: Lack of new exchange announcements

Without a strong catalyst, early price action may remain muted.

In the first one to two months after listing, volatility is expected.

Short-Term Forecast

Price range: $0.015 – $0.028

Main drivers:

Token unlocks

Market sentiment

Team communication

Clear updates and stable trading could help the price hold support. Without them, sideways movement or further dips are possible.

The long-term outlook depends heavily on execution.

Positive Factors

Gradual vesting (10% monthly unlock)

Planned Spur DEX launch

Potential future exchange listings

Long-Term Price Target

Bullish scenario: $0.05 – $0.08

Condition: Product delivery + improved market conditions

If the team delivers on its roadmap, confidence may slowly return.

The coming weeks are critical for Spur Protocol.

Investors should closely watch:

Official trading confirmations

Transparent team communication

Product development updates

Additional exchange listings

Without these, downside risk remains.

So the big question remains: Will Spur Protocol turn delays into delivery—or continue to lose momentum?

This content is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency investments carry high risk. Always conduct your own research before investing.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.