The Spur Protocol listing date has once again been pushed back, adding fresh uncertainty for investors already shaken by weak market sentiment. In a new update shared on X, Spore Network confirmed a new $SON token listing date on Coinstore, shifting the launch into February 2026.

This marks the sixth change to the timeline, following a trail of missed dates that has begun to erode community confidence. With the broader crypto market under pressure, questions are now growing around presale reopening, exchange support, and whether further delays are still ahead.

According to the latest Spores Network announcement, the Spur Protocol launch delayed February 2026 is in the spotlight today. The launch has moved repeatedly over the last few months: Q4 2025 → Dec 19 → Jan 8, 2026 → Jan 26 → Jan 30→ Feb 2, 2026.

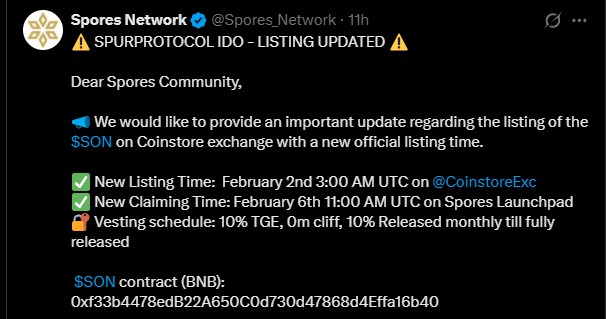

Now, the debut is scheduled at 3:00 AM UTC on Coinstore, while token claiming will begin on February 6 at 11:00 AM UTC via the Spores Launchpad.

The vesting schedule remains unchanged, with 10% unlocked at TGE and 10% released monthly afterward. Despite this clarity, $SON itself has remained largely silent. No detailed trading timeline, USDT pair confirmation, or withdrawal schedule has been officially shared. This lack of follow-up communication has fueled speculation and anxiety within the community.

Adding to the complexity, KingdomStarter confirmed that the SON smart contract has been migrated to a new BNB address:

0xf33b4478edB22A650C0d730d47868d4Effa16b40.

The team stated that tokenomics and total supply remain unchanged and warned users not to interact with the old contract. At the same time, Spur Protocol listing date updates are locked across several platforms, including MEXC, BingX, PancakeSwap, SpurSwap, and Coinstore.

However, some community experts now claim that Coinstore listing may be distancing itself from the project, even warning users about potential scam risks. These claims remain unverified, but they have intensified scrutiny around the son coin update today.

As per Coingabbar’s analysis, projects that fail to stabilize timelines often face higher volatility and longer recovery periods.

On-chain data from the SpurSwap presale dashboard shows that only around 1.88 million tokens were sold out of an 8.33 million allocation—just 22–23% filled, leaving nearly 77% unsold.

This has led analysts to believe the $SON presale could reopen again, possibly between January 31 and February 1, especially given the project’s history of extensions. Still, until an official announcement is made, this remains community-driven speculation, not confirmation.

The weak presale performance is closely tied to the broader market crash. Around January 30, total crypto market cap fell nearly 5%, while Bitcoin, Ethereum, XRP, and Solana dropped 7–9% in 24 hours. Investor sentiment also plunged, with the Fear & Greed Index sitting near Extreme Fear (20). It is a backdrop that explains fading demand but does not fully justify repeated delays.

Given repeated delays, weak crypto market sentiment, and unclear exchange support, many analysts expect the token to list below its $0.03 IDO price. Without a strong confidence-boosting announcement or new CEX listings, estimates suggest an opening range of $0.018–$0.025.

Short-term trading on the Spur Protocol listing date could remain volatile, because of early sell pressure from airdrops and TGE unlocks which can push the price between $0.015 and $0.028.

The repeated shifts in the Spur Protocol listing date, combined with weak market sentiment and limited transparency, have put investor trust under strain. While February 2 is now the official $SON listing date, the absence of clear exchange details keeps uncertainty high. Traders should that until stronger confirmation arrives, caution remains justified.

YMYL Disclaimer: This article is for informational purposes only and does not provide any financial advice. Cryptocurrency investments carry high risk. Always do your own research before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.