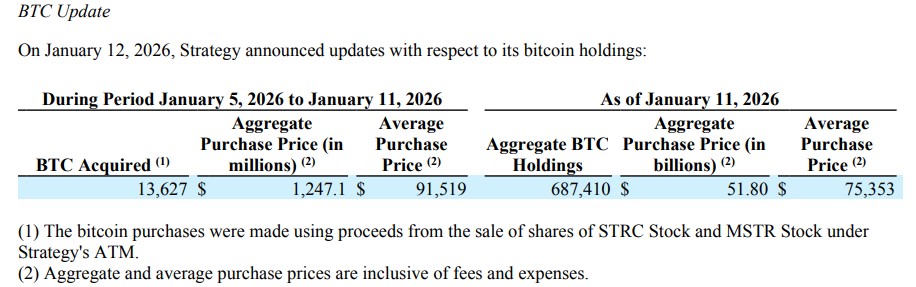

MicroStratey, now known as Strategy, has marked another major Bitcoin purchase on Monday, by adding 13,627 BTC worth $1.25 billion. The purchase was made at an average value of $91,519 per coin, strengthening the company’s position as the largest corporate Bitcoins holder globally.

Source: Official Filing

As of today, Strategy holds a total of 687,410 Bitcoins by investing around $51.8 billion at an average price of $75,353 per BTC. The latest move highlights the potential confidence of the big institutional players in the golden asset as a long term treasury even after recent market volatility.

MicroStratey’s Bitcoin Purchase is supported by an efficient capital markets approach. This company raises capital through various ways, including stock sales, issuance of low-interest convertible notes, as well as preferred stocks like STRC and STRK.

The above technique enables the firm to raise funds when their stocks are performing well. At the end of mid-January 2026, they hold a reserve of approximately 2.25 billion USD that can be used for dividends, interest, as well as day-to-day activities.

After the recent purchase, the market cap of the company is now close to $51.8 billion, with an enterprise value of $65.9 billion. The Bitcoin-reserves of the company are approximately valued at $62.8 billion.

Saylor’s Bitcoin strategy shows confidence in the long term approach. The digital asset currently slipped 0.96% to $90,243 in the last 24 hours, extending its weekly decline to 2.72%, even as it remains up 1.19% on the month. There are several factors that affect the price, including the overall crypto market which dropped 0.81% today.

Source: CoinMarketCap

Despite short-term weakness and fear among small traders, MicroStrategy continues to buy the dip, viewing lower prices as an opportunity to expand its BTC holdings.

The company’s strong conviction in Bitcoin’s long-term value allows it to act counter to market panic, steadily accumulating while others hesitate.

Currently, the firm is sitting on around $11 billion in unrealised Bitcoin profit. It is possible due to its ~$75,000 average cost level. Even after buying recent BTCs at higher prices, the firm’s long-term accumulation pattern keeps it in profit, as long as BTC stays above the ~$75k average price meter.

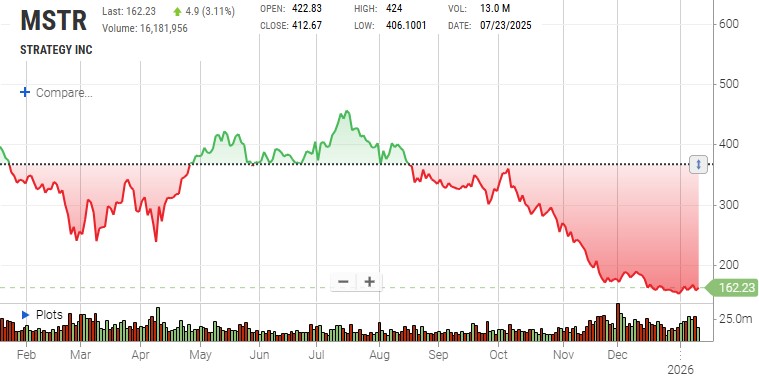

Strategy’s stock, $MSTR, continues to show high volatility, reflecting its close linkage to Bitcoin price movements rather than traditional business fundamentals.

MSTR shares currently trade at $162.23 (+3.11%) on the day, with 47% down over three months and 51% year-on-year. Volatility over the past 30 days is around 57%, while one-year volatility stays elevated at 73%, highlighting ongoing instability in the stock.

Source: Nasdaq Official

Despite short-term price swings, MicroStratey keeps low net leverage of about 10%, supported by a well-balanced mix of funding. Its Bitcoins' holdings provide an estimated 74.5 years of dividend coverage, underscoring balance sheet resilience even during market downturns.

Continued activity in Bitcoin Purchase by Strategy represents an overarching theme in the institution to consider BTC as a Strategic Reserve Asset. Although it has been argued that the model contains risk such as the effects of leverage or volatility, the strategy enhances the long-run value of shareholders because the company’s assets in Bitcoins increase per share.

With the adoption of BTC increasing in 2026, Strategy’s approach not only makes it a software company, but it has actually positioned the entity as a prime corporate proxy for Bitcoins' accumulation, a strategy that continues to shape the traditional as well as the crypto market structures.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.