The cryptocurrency market is starting the New Year with a massive bang, as today, January 6, the Sui price going up is the biggest headline in the financial markets.

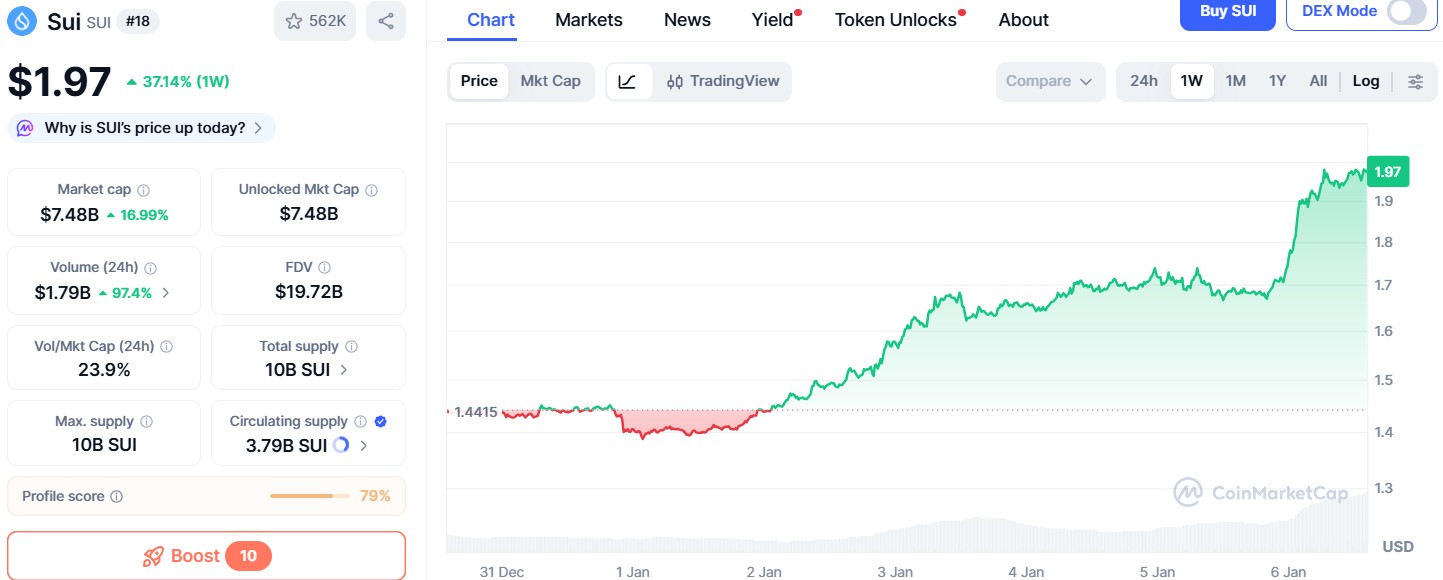

The price has jumped to $1.97, which is a 17% increase in just one day. If you look back just a week, it was trading at a low of $1.30, meaning it has climbed over 37% in seven days.

With momentum increasing, traders around the commuting are now asking: What’s behind the 17% surge, and what’s 2026 price prediction.

At the time of writing, the asset holds a market cap of $7.48 billion, while its 24-hour trading volume has surged to $1.79 billion as seen in the official CoinMarketCap chart, marking an increase of about 97.65%.

This sharp rise holds one of the strongest fundamental Sui price surge reasons: “Private transactions for everyone.”

The official team on X reposted an update from Kostas Kryptos, co-founder of Mysten Labs. According to the post, Mysten Labs, George Mason University, and Yale released a huge study on how to make crypto transactions private and safe.

Kryptos said that 2026 could be a big year for private crypto technology and that the this network is ahead of others because it has a strong global team working on zero-knowledge proofs. This latest SUI news made people more confident and helped push the price higher over the past week.

When we look at the TradingView price chart, the Sui price going up looks very strong and healthy. It isn't just a "fake" rise; it’s a "breakout."

Breaking the Ceiling: The asset broke through its "resistance" level of $1.85, which is also the new support zone of the token.

Momentum (RSI): The RSI is around 74. This means there is a lot of "buying power" behind the move.

The "MACD" Cross: The bars are growing taller and greener, which shows that more buyers are entering the market.

Key Metrics For Traders:

Immediate support lies between $1.85 and $1.90.

The resistance zone is around $2.05–$2.10.

As long as it holds above $1.85 level, the technical structure remains bullish, with a target of $2.10 or higher likely.

Top market analysts are very excited about the potential Sui 2026 breakout scenario, because the crypto market has added $260,000,000,000 to its market cap in the first 5 days of 2026.

This huge liquidity injection is one of the strongest reasons why we might be entering a "Moon Phase" or Altseason.

In the short term (next 2–4 weeks), the price could move up toward $2.10–$2.35 if the market stays strong.

Looking at the mid-term outlook, good market conditions could push the Sui price prediction 2026 around $2.80–$3.50. But if the momentum slows down, the price could drop to $1.40–$1.65 range.

For the long term, if a strong altseason 2026 happens, the Sui price going up trend could reach $5–$7 or more.

Many traders are now wondering if altseason will finally come this year, and past cycles suggest it is possible. Right now, ALT/BTC has been falling for almost four years. Its RSI is at the most oversold level ever, and the MACD has just turned green after 21 months, which often signals a trend change.

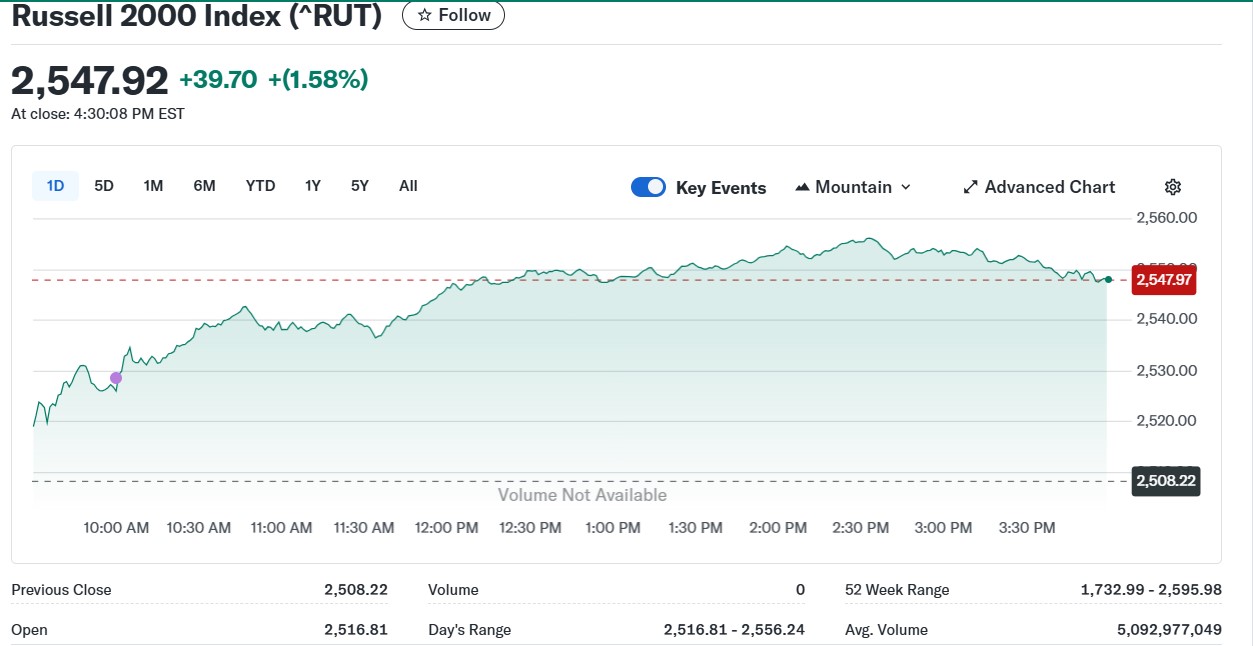

This market structure is very similar to previous early-season rallies. Stock markets also support this idea. The Russell 2000 index, which shows how much risk investors are willing to take, has broken out near its old highs of 2,595.98, as seen in the above chart.

In both 2016 and 2020, altcoins started rising only after ALT/BTC hit a bottom and broke its downtrend, and then altcoins went on to outperform Bitcoin.

This time, the breakout came in Q4 2025, suggesting the cycle may be delayed, but not cancelled. History shows that if altseason starts, SUI price going up trend usually follow them up.

The Sui price going up today isn't just a lucky break; it is backed by strong fundamentals, rising volume, clean technical structure, and improving macro conditions.

While short-term volatility is expected, altseason arrival will define the token’s long term momentum.

YMYL Disclaimer: Investing in cryptocurrencies is very risky, as prices fluctuate quickly. This article is for news purposes only and is not financial advice. Always talk to a professional and do your own research before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.