What happens when a “user-owned neobank” finally launches its token after months of anticipation? The Superform airdrop listing date goes live today, marking a key moment for the on-chain banking platform.

With $9.5 million in funding completed and $UP token listing on popular exchanges starting today, the project is entering real price discovery while testing market demand.

Superform positions itself as the first stablecoin neobank where users can save, swap, send, and earn on-chain while keeping full control of assets.

The Superform airdrop registration closed on February 6 at 10am EST (15:00 UTC) after 59,487 users signed up. Claims go live today at 12:00 ET / 17:00 UTC on Base.

Trading on Kraken will begin on February 10 at 17:00 UTC. MEXC will list UP Token once enough liquidity is available, and withdrawals are expected from February 11. The token is also available on Unich’s pre-market OTC, while LBank and KuCoin has also confirmed a listing that will go live soon.

Users can already trade it through the Bitget Wallet DEX, and there is market speculation that major exchanges like Binance, OKX, Bybit, and Gate.io may add the coin later.

Coinbase has already added the asset to its roadmap, signaling growing exchange attention as the debut unfolds.

Key mechanics that investors should know now:

45-day staking cooldown

33%+ APY rewards

50% Early Exit Fee in ETH for users who claim early

Tokens vest across TGE, Month 1, Month 2, and Month 3

1.3375% unlocked at $UP TGE, with 2.2625% vesting over three months

Notably, 100% of early exit fees flow into the project’s Assistance Fund, reinforcing long-term ownership incentives.

The project confirmed that zero tokens were allocated to exchanges for listing or marketing — a rare approach aimed at community alignment.

Source: Official $UP Blog

Initial supply: 1,000,000,000 UP coins, hard-capped for three years with no minting.

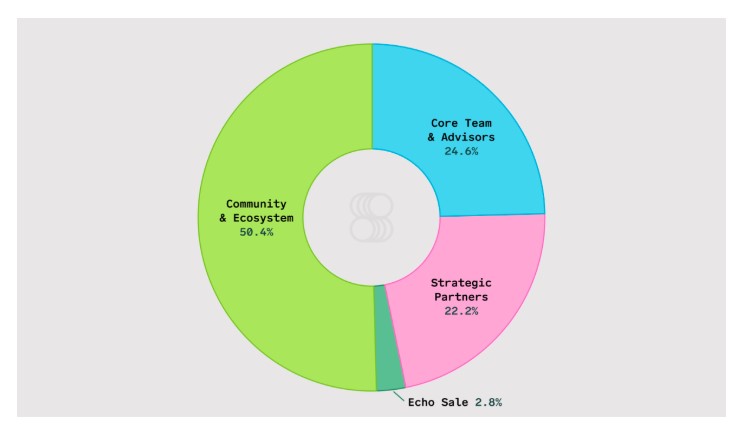

Allocation structure:

Community & Ecosystem — 50.4%

Core Team & Advisors — 24.6%

Strategic Partners — 22.2%

Echo Sale — 2.8%

At TGE, the Day One supply is 13.92% on Base, broken down as:

Community & Ecosystem: 5.89%

Community Sales (Legion + Echo): 3.72%

Liquidity: 2.98%

Airdrop One: 1.3375%

This planned token release shows the project is trying to control supply and avoid too many tokens entering the market at once during the Superform airdrop listing date and price phase.

According to the Whale Market data, the premarket price is trading around $0.075 with only $73–$75 volume. A 42.58% drop in 24h volume is signaling weak liquidity rather than clear demand. Meanwhile, Oriole prediction markets expect a $0.152–$0.254 debut price.

Given the market forecast, and launch behavior pattern, Coingabbar’s crypto analysts have given a realistic Superform price prediction for 2026.

Realistic debut: $0.12–$0.18, if momentum builds and more exchanges join the race, a possible move towards $0.20 is possible, but thin pre-market data signals caution.

Short term (2,3 weeks): $0.18–$0.32, initial volatility is likely as early buyers take profits while new traders enter.

Long term (3–6 months): $0.30–$0.55, sustained growth will depend on adoption, liquidity, and broader market conditions.

The Superform airdrop listing date marks a critical launch phase for the stablecoin neobank. Structured tokenomics, and controlled supply support long-term alignment, but early liquidity will determine price direction.

Investors should watch adoption metrics closely as real trading begins and market sentiment forms around UP token listing.

Disclaimer: This content is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.