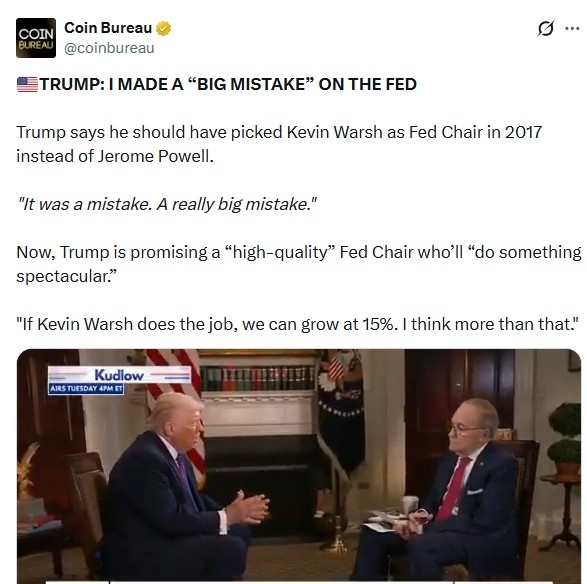

During a recent Fox News interview, former U.S. President Donald Trump said choosing Jerome Powell as Federal Reserve chair in 2017 was a “mistake.” He added that if Kevin Warsh leads the central bank and performs effectively, the American economy could expand 15% annually or higher. The comment quickly sparked debate across financial circles, with many evaluating the Trump Fed crypto impact on global markets.

Source: X official

Analysts say stronger U.S. growth could boost risk assets like Bitcoin, which often reacts positively when liquidity rises and investor confidence improves. Historically, BTC has shown sensitivity to macro trends; during expansion phases, institutional demand and trading volumes typically climb. With Bitcoin still dominating over 40–50% of total crypto market share in recent cycles, any growth-driven optimism could spill into the broader digital asset space.

Historical reality: America’s GDP has generally expanded by 2–3% annually. Sustained double-digit expansion would require exceptional productivity, spending, and policy coordination.

Policy expectations: Trump’s statement appears rooted in the belief that more accommodative monetary settings — including potential rate reductions — could unlock faster activity. However, economists caution that inflation pressures and supply constraints could limit such acceleration.

Market psychology: Even ambitious projections can influence sentiment. Forward-looking narratives often shape investor behavior before actual data confirms them.

The discussion around Trump Fed crypto impact highlights how macro signals can ripple into digital markets.

Bullish Indicators

Stronger expansion expectations may attract capital into higher-return sectors. Bitcoin often benefits when investors move away from low-yield instruments.

Improved confidence can encourage fresh inflows into exchange-traded products and institutional vehicles tied to digital assets.

Potential Risks

Rapid expansion could reignite inflation, forcing policymakers to tighten conditions again, a scenario that historically pressures speculative assets.

Sudden policy shifts can heighten volatility, making price swings sharper.

Overall, macro strength tends to support adoption narratives, yet balance remains crucial.

Liquidity May Increase: If borrowing conditions ease, additional capital could enter financial ecosystems. Greater liquidity usually supports trading activity and price momentum across digital assets.

Rate Cuts Could Follow: Reduced benchmark rates often push investors toward alternatives with higher return potential. Virtual assets has historically gained traction during periods of monetary easing.

Institutions May Allocate More: Growing economic confidence can motivate hedge funds and asset managers to diversify into digital holdings. Larger participation frequently enhances credibility and long-term inflows.

Strong Economy = Risk-On Sentiment: When expansion outlook improves, investors typically embrace risk-oriented strategies. Crypto frequently thrives in this environment because it is perceived as a high-growth segment.

Looking ahead, macro direction will likely shape market trajectories. If expansion strengthens alongside supportive policy, digital assets could attract renewed institutional attention and broader participation. Still, inflation risks, regulatory developments, and global economic cycles remain critical variables.

The Trump Fed crypto impact narrative shows how political and monetary signals can shape digital asset sentiment, with stronger growth expectations potentially lifting Bitcoin while policy uncertainty keeps investors alert in an evolving macro environment.

YMYL Description: This article is for informational purposes only and does not constitute financial, investment, or trading advice. Crypto markets involve risk and volatility.

Krishna Tirthani is a dedicated crypto news writer with 1 year of hands-on experience in the cryptocurrency market. With a strong focus on market trends, token launches, price movements, and blockchain innovations, Krishna delivers timely, accurate, and easy-to-understand crypto content for both beginners and experienced investors.

Over the past year, Krishna has closely followed major developments across Bitcoin, Ethereum, altcoins, DeFi, NFTs, Web3, and emerging crypto projects. His writing style blends data-driven insights with clear explanations, helping readers stay informed in a fast-moving and often complex market. From breaking crypto news and exchange listings to tokenomics analysis and price predictions, his work aims to simplify information without losing depth.

Krishna believes that credible research, transparency, and consistency are essential in crypto journalism. Each article is crafted with SEO best practices in mind, ensuring high visibility while maintaining originality and factual accuracy. His growing experience in the crypto space allows him to spot early trends and explain their potential impact on the wider market.

With a passion for blockchain technology and digital assets, Krishna Tirthani continues to evolve as a crypto writer, committed to delivering reliable, engaging, and value-driven crypto news content.