Today’s Tether freeze has rocked the cryptocurrency market following their blocking of five large Tron wallets that were part of an investigation that is still in process. This development only goes to show that stablecoins are becoming increasingly powerful tools in finance as well as tools for enforcing compliance.

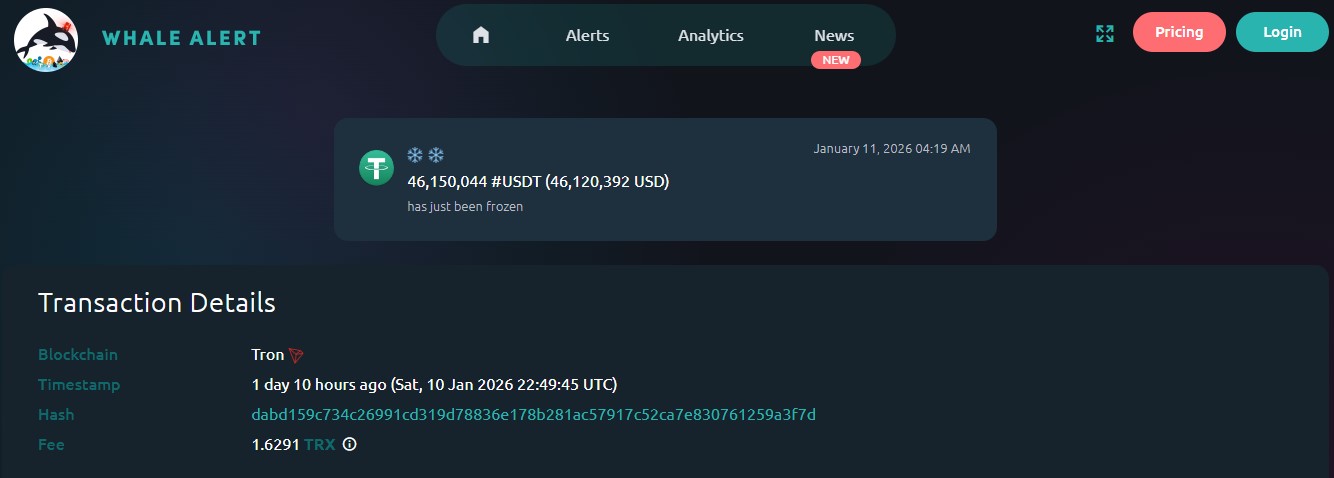

According to Whale Alert, the Stablecoin platform froze more than $182 million in USDT across five Tron addresses on January 11. Each wallet held between $12 million and $50 million. The action was taken within the same day, making it one of the largest single-day wallet freezes on the Tron blockchain in recent months.

Source: Whale Alert

A spokesperson confirmed that the freeze was done after a formal request from law enforcement agencies. The investigation had been active for several months before the action was taken. It stated that it works closely with authorities worldwide and freezes wallets linked to illegal activity or sanctions violations when valid requests are made.

The freezing is in line with Tether’s voluntary freezing policy that began in December 2023. Tether service terms allow it to freeze addresses or access user information when necessary and for legitimate reasons. It respects the OFAC guidelines set by the U.S. Treasury.

The January 11 freeze is specifically important for its scale and coordination. Five wallets were restricted within hours, each holding large balances. Such activity shows how fast centralized stablecoin issuers can act when risks are identified.

The Stablecoin platform has now blocked more than $3B worth of USDT globally. It works with over 310 law enforcement agencies across 62 jurisdictions. As of July 2025, more than 2,380 wallets holding around $1.14 billion were frozen for U.S. agencies including the FBI and U.S. Secret Service.

According to a December 2025 AMLBot report, the total frozen assets since 2023 are nearly 30 times greater than Circle’s USDC, which froze around $109 million in the same period. AMLBot also states that it froze about $3.3B from 2023 to 2025 and blacklisted 7,268 wallet addresses.

Stablecoins are now the main tool used in illegal crypto transactions. A Chainalysis report shows they accounted for 84% of all illicit crypto activity in 2025, totaling at least $154 billion.

At the same time, it dominates the stablecoin market. USDT has over $187 billion in circulation, making up 64% of the total $292 billion stablecoin market. USDC follows with nearly $75 billion in supply.

Tether news today shows how serious the stablecoin market has become. Freezing $182 million in USDT in one day proves that compliance and security now shape crypto’s future. As stablecoins grow, strict enforcement will likely become normal across the digital asset ecosystem.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.