Tether launches USA₮, a new stablecoin created especially for the United States market. Until now, it's main product, USDT, has been a global crypto dollar, widely used on exchanges and in DeFi. But USDT was never designed to fully match American regulations. As America prepares stricter legal rules for stablecoins, The blockchain firm has decided to launch a separate, compliance-focused digital currency that fits directly into the U.S. financial system.

USA₮ is not a replacement for USDT. It is a new gateway for Tether into American banking and institutional finance.

Source: X official

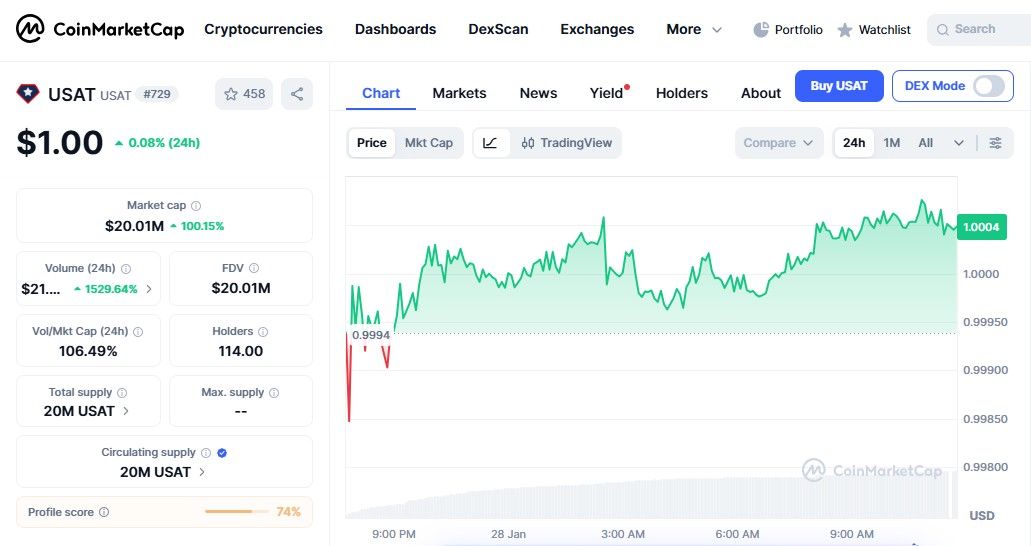

USA₮ is a dollar-pegged digital currency, meaning its value is designed to stay equal to $1 at all times. One USA₮ represents one real U.S. dollar in value. It will be fully backed by real dollars or safe dollar-equivalent reserves such as U.S. Treasury assets.

In simple terms, USA₮ is a digital currency that carries real financial backing, not just market confidence. This backing is what makes it stable and trustworthy for banks, payment platforms, and regulated financial institutions.

The main reason behind the new U.S. stablecoin is regulation. The financial system needs transparency, oversight, and legally structured issuers. That is why the the federally structured tokens will be issued through Anchorage Digital Bank, a federally regulated crypto bank in the United States.

This is a big shift for the blockchain firm. It shows that stablecoins are no longer staying outside traditional finance. They are entering it. The new U.S. stablecoin is designed for:

Institutional settlements and regulated payment systems

USDT is Tether’s global stablecoin. It is built for worldwide crypto markets, traders, and decentralized platforms. It moves fast and is widely accepted, but it is not designed around American banking laws.

USA₮ is Tether’s American Crypto-backed dollar. It is structured for American compliance, American institutions, and legal clarity.

Not immediately. Traditional systems like ACH, SWIFT, and wire transfers are deeply rooted. Large banks and financial elites move slowly and resist fast disruption. The new U.S. stablecoin is more likely to become a parallel settlement layer, working alongside existing systems rather than replacing them at once.

In the beginning, The The federally structured stablecoin will mostly be used by:

Regulated crypto exchanges

Fintech platforms

Institutional crypto settlement networks

Over time, it could expand into broader payment systems.

At launch, adoption will be moderate. Banks and institutions will test it slowly. But long-term potential is strong. The The new U.S. Crypto-backed dollar can challenge USDC inside the U.S. market while USDT continues to dominate globally.

Future assumption:

USDT stays the world’s most used crypto dollar

The new Crypto-backed currency becomes Tether’s official entry into American finance

The total stablecoin market grows, not shrinks

This launch is not just about one new token. It is a proof that Crypto-backed currencies are becoming the part of mainstream finance, shaping how digital currency move in the real world.

Conclusion: Tether launches USA₮ as a strategic move into regulated finance, showing how Crypto-backed dollars are evolving beyond crypto trading. It strengthens trust, expands adoption, and positions digital dollars closer to traditional banking systems in the United States.

Krishna Tirthani is a dedicated crypto news writer with 1 year of hands-on experience in the cryptocurrency market. With a strong focus on market trends, token launches, price movements, and blockchain innovations, Krishna delivers timely, accurate, and easy-to-understand crypto content for both beginners and experienced investors.

Over the past year, Krishna has closely followed major developments across Bitcoin, Ethereum, altcoins, DeFi, NFTs, Web3, and emerging crypto projects. His writing style blends data-driven insights with clear explanations, helping readers stay informed in a fast-moving and often complex market. From breaking crypto news and exchange listings to tokenomics analysis and price predictions, his work aims to simplify information without losing depth.

Krishna believes that credible research, transparency, and consistency are essential in crypto journalism. Each article is crafted with SEO best practices in mind, ensuring high visibility while maintaining originality and factual accuracy. His growing experience in the crypto space allows him to spot early trends and explain their potential impact on the wider market.

With a passion for blockchain technology and digital assets, Krishna Tirthani continues to evolve as a crypto writer, committed to delivering reliable, engaging, and value-driven crypto news content.