The Tok Coin KYC verification delay is the biggest news for miners right now. The community who was waiting for January 1 launch is continuously getting hit by the delay-after-delay rock.

On their official X account, the TokCoin Network team admitted that the original KYC timeline was set too early. They explained that they are a young, excited team, but they didn't realize how hard international laws and legal rules would be.

While waiting is frustrating, they said, "It’s better to do it right once than wrong twice."

This TokCoin Network KYC update came after a community vote where Option A won, and the project confirmed it will follow the community’s decision.

Instead of rushing to meet the January 1, 2026, deadline, the team decided to wait until everything was safe. KYC will only start once the technical parts and security checks are 100% finished. This helps keep users private data safe and makes sure the crypto stays stable after market debut.

This Tok Coin KYC verification delay is being framed as “responsibility,” not an indefinite postponement. It will begin close to the TokCoin Network launch date, once everything is verified and implemented properly

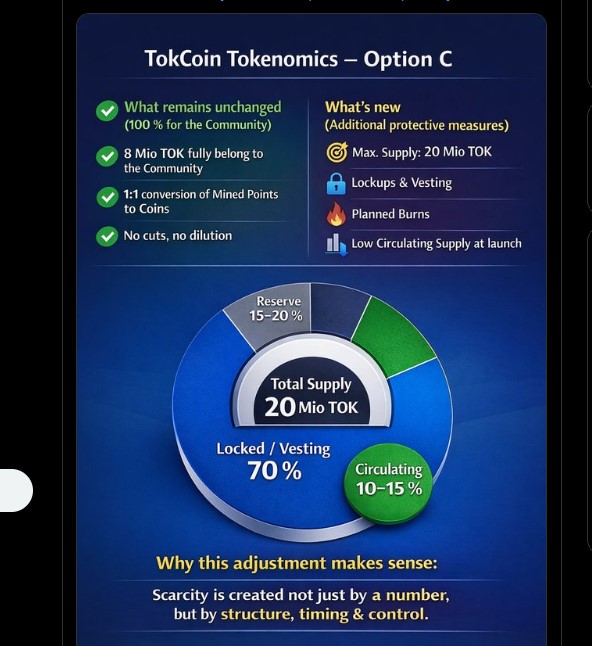

Even with the Tok Coin listing date delay, the community is still in charge. Everyone got to vote on the project's future, and Option A won! Here is what that means for you:

Your Coins are Safe: The 8M tokens belong 100% to the community.

Fair Trade: Your mined points will turn into coins at a 1:1 rate (no cuts!).

Tokcoin Mining Continues: You can still earn points because mining will continue for now.

No cuts, no dilution

This launch strategy clarity is important, because many users were worried after the ongoing postponements linked to changes that reduced community allocation.

The project says adjustments were needed to make the project “stable, secure, and valuable long-term.” The team set a max supply of 20M coins. This small number helps keep the price steady. They expect a realistic launch price of about $0.8 to $2.

Max Supply: 20M coins

Remaining 12M allocation:

App Mining: 6M

Liquidity & Listings: 3M

Reserve/Stabilization: 2M

Burn Pool: 1 Million

The project isn't stopping. They are working on "lockups," which means some coins won't be sold right away. This stops the price from crashing. For the first two months, 1.5 Million assets will be locked up. After that, more assets will slowly be released over a year like:

Phase 1 (0–2 months): 1.5 Million coins (locked)

Phase 2 (3–6 months): 2.0 Million (vesting)

Phase 3 (7–12 months): 2.5 Million assets (slower & scarcer)

No immediate liquidity

The new tokenomics update strategy is the core reason the Tok Coin KYC verification delay exists: the team wants lockups, vesting, and burns ready before the multi-exchange debut.

While some investors and users are questioning its legitimacy, the team says they are being transparent and fair about everything related to the project. They just want to build something that lasts. The launch date will be announced only when the security is perfect.

YMYL Disclaimer: Crypto mining and investing in coins like $TOK, are very risky and prices can change quickly. This article is just to give you information and is not money advice. Always DYOR before taking any action involving crypto.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.