The Tok Coin Listing Date has entered a critical phase as 2025 is ending soon, and the TokCoin Network is letting its users decide what comes next for the project.

With KYC (Know Your Customer) verification set to begin on January 1, 2026, and earlier expectations debut on top crypto exchanges by February 1, 2026, the community vote now is being set on whether to launch fast or build a stronger foundation first.

Source: Tokcoin Network Official Account

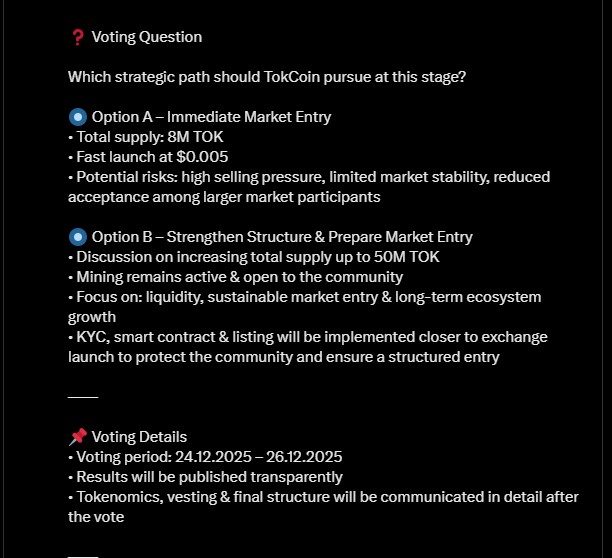

Earlier projections around the Tok Coin Listing Date were tied to a faster launch roadmap, however, now the team has presented two very different paths.

The community vote, running from December 24 to December 26, 2025, asks users to pick their preferred strategy: This means the community's choice right now will directly impact the launch and the long-term value of the coins people have been mining.

Option A: This path prioritizes getting the Tokcoin launch date on the calendar as soon as possible, with 8 Million assets.

Price: Around $0.005 (Note: This is not a guaranteed price).

The Risk: High selling pressure could cause the price to drop quickly after launch.

Option B: This strategy focuses on long-term growth and protecting the tokcoin network price, with increasing the total supply up to 50 Million coins.

Tok Coin Mining: Remains active.

The Goal: Better liquidity and a smooth, professional listing on top exchanges.

As per the official announcement on its Twitter account, “Detailed Tokenomics, vesting schedules, and the final structure will be announced after the vote concludes.”

One of the most exciting parts of the tokcoin network update is the potential for a higher starting price under Option B. The team explained that by using "lockups" and "vesting," the asset could realistically start in the $0.8–$2 range.

What does this mean for investors?

Lockups: Up to 70% of tokens might be locked at first.

Vesting: Tokens will be released slowly, like 10% every 2–3 months.

Why it helps: It stops people from selling everything at once when trading starts. This reduces pump and dump risk.

As per Coingabbar’s market analysts, this structure will support utility development, partnerships, and ecosystem expansion for asset’s long term growth.

Market analysts are closely watching the results of this vote. Current price target models show two scenarios:

If Option A wins: Prices might start near $0.005 but could face a "bearish" trend, potentially dropping toward $0.002 if investors get frustrated by high volatility.

If Option B wins: The Tok Coin Listing Date may be a little late. But the price could start above $0.80 because the launch will be stronger and safer.

Traders should note that the final price and result mainly depend on the community vote and how the Tok Coin Listing Date is planned.

If you are wondering "Is tokcoin legit?" or when you can trade, keep December 27, 2025 voting results date on your radar.

The Tok Coin Listing Date is no longer a fixed point on a map; it is a destination the community is choosing together. Whether the new token listing goes for immediate market exposure or stays in the "mining phase" to build value, the power is in the users' hands now.

Disclaimer: This article is for informational purposes only and is not financial advice. Always do your own research before investing in any new crypto token.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.