Highlights

Tria Airdrop claim checker displays 90%+ users as ineligible, leading to scam allegations.

The S1 had very demanding XP and spending requirements, whereas S2 is still in progress.

A team offers future rewards and incentives on the basis of loyalty distribution.

Currently, the most discussed subjects with the airdrops checker declare more than 90% of users as Not Eligible.

This response was disheartening to users, and it was especially severe among premium members and the initial participants who had spent time, money, and effort in the ecosystem.

The backlash got even worse, with tokenomics that were offering more than 41% of its 10 billion total supply to the community, which cast serious doubts on the aspects of fairness, transparency, and eligibility requirements.

Source: Cryptolakhan X

On January 30, 2026, the snapshot was taken officially.

Any activity on or after this date does not qualify as S1 and is charged against S2.

This is one of the key reasons why many active users could not receive any rewards even after they continued to use it.

Season 1: Concluded

Single reward on the basis of stringent rules.

Required approximately:

25,000 XP, or

$100+ paid membership, or

$25,000 futures trading volume

Most of the users did not exceed these thresholds.

The claim can be earned by eligible users within the app.

Tria Airdrop Season 2: Currently LIVE

Rewards are given out in bits through loyalty token rewards.

Focuses on:

XP accumulation

Staking

Active usage of the Tria wallet

Rewards in Season 2 will be bigger than in Season 1.

The term is trending at the moment, yet no official evidence of fraud has been established as yet. Rather, the scandal is due to:

Failure to communicate XP requirements.

High spending thresholds

There was a lack of clarity prior to subscriptions by the users.

Some influencers have not said anything, supposedly because they are active in other SocialFi sites, which compounded the lack of trust in the community.

Based on official tokenomics:

Total Supply: 10,000,000,000 tokens

Community Allocation: 41.04%

Circulating Supply at TGE: 21.89%

Tria TGE and Vesting:

TGE done on February 3, 2026

Unlocked at TGE: 20% of distributed tokens.

Vesting: 3-month cliff and 6-month linear.

Tria airdrop listing date is the same as TGE, and is listed on such large exchanges as Binance, Bybit, Bitget, and KuCoin on Feb 3, 2026. This has augmented short-term speculation of Tria crypto.

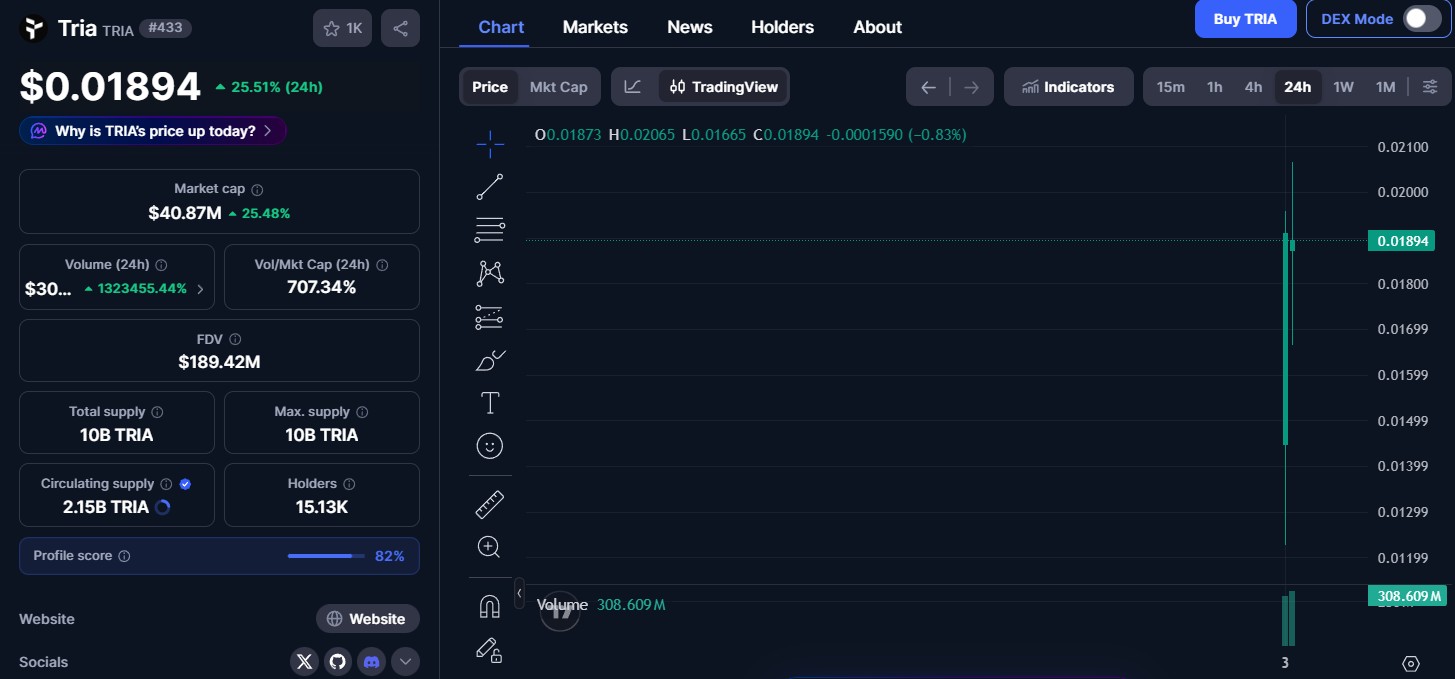

The token price today stands at $0.01894, up 25.51% in 24 hours, with a market cap of $40.87M and strong 24-hour trading volume of $308.6M, reflecting heightened market activity. It is recommended that investors follow the news on tokens before making decisions.

Source: CMC

The controversy underlines ineffective communication, rather than the case of proven fraud. Season 2 remains crucial. It will be transparency that will determine whether it will regain trust or be a lesson in crypto.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highly volatile and you can lose your entire investment.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.