The crypto market is watching closely as Tria prepares for its high-impact launch with multiple top exchanges listing the token at the same time. With confirmed airdrops, early trading access, and strong community backing, many investors are asking one big question: Can it deliver strong price growth after launch?

This article breaks down Tria airdrop price predictions in simple terms, covering short-term, medium-term, and long-term expectations based on tokenomics, circulating supply, and market momentum.

The token officially begins trading at 10:00 UTC on February 3, setting a global benchmark price before broader liquidity enters the market. Binance Wallet has confirmed the TRIA airdrop, with claims opening at 8:00 UTC, followed by early trading via Binance Alpha.

At the same time, major exchanges like Bybit, Kraken, OKX, MEXC, and KuCoin will list it, while Coinbase has added to its asset roadmap, signaling growing institutional visibility. This coordinated launch increases liquidity, visibility, and trading demand.

It is an ERC-20 token on Ethereum with a total supply of 10 billion. At the Token Generation Event (TGE), 2.19 billion token (21.89%) entered circulation, which helps balance early liquidity with long-term sustainability.

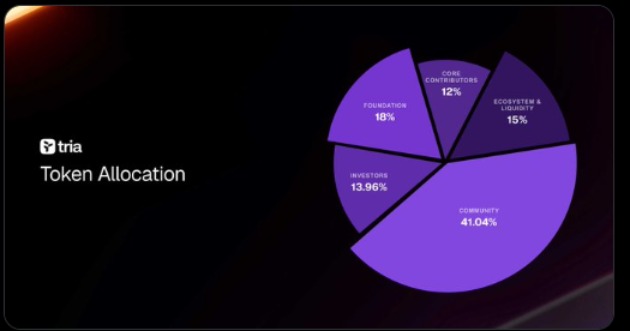

Community: 41.04% (20.9% unlocked at TGE)

Foundation: 18%

Ecosystem & Liquidity: 15%

Investors: 13.96%

Core Team: 12%.

The strong community allocation supports user growth, rewards, and ecosystem adoption, while controlled unlocks reduce extreme supply pressure early on.

With just 22% of the total supply circulating at launch, early demand could outweigh available tokens—especially as airdrop recipients and early traders enter the market.

Given the scale of exchange listings and Binance Alpha exposure, it could debut between $0.012 and $0.018 in the short term. Volatility is expected in the first few days, but strong liquidity across multiple platforms may help absorb selling pressure.

As additional community tokens unlock gradually and ecosystem incentives roll out, trading volume and real usage could increase. If Tria continues to deliver on development and maintains positive sentiment, the price may trend higher.

In this phase, it could move into the $0.025–$0.035 range, driven by adoption growth rather than pure launch hype.

Over the long run, its value will depend on platform adoption, partnerships, and sustained ecosystem activity. As more tokens circulate and the project matures, price discovery should stabilize.

If it scales as planned and maintains user demand, the price could settle between $0.05 and $0.08, with further upside possible during strong market cycles.

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk. Always do your own research.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.