The Tria airdrop is entering its most critical phase as the project prepares for its Token Generation Event (TGE) and first public trading on February 3. Binance Alpha will be the first platform to feature the token, setting the stage for price discovery across multiple top exchanges.

With airdrop claims, confirmed listings, and full tokenomics now public, the market finally has the data it needs to assess a token's early trajectory.

Binance listing Tria today is in the spotlight as eligible users will be able to claim the rewards using points via the Alpha Events page once trading opens.

Source: Binance Wallet X Account

The Tria listing date and time process officially begins on February 3 through Binance Alpha’s Events page. Trading is scheduled to start at 10:00 UTC, setting a global benchmark price before other venues activate full liquidity.

The launch is followed by confirmed spot listings on Bybit and Kraken. OKX and MEXC are also listing the token, backed by a $10 million prize pool. Traders should note that the registration of prize pool closes at 7:00 AM UTC on February 3, with Tria airdrop claims going live at 8:00 AM UTC for CeDeFi users.

KuCoin has also confirmed trading at the same time and Coinbase has added the asset to its asset roadmap, reflecting institutional visibility around the token. This broad exchange coverage means the Tria airdrop listing will meet real liquidity immediately, reducing launch-day uncertainty.

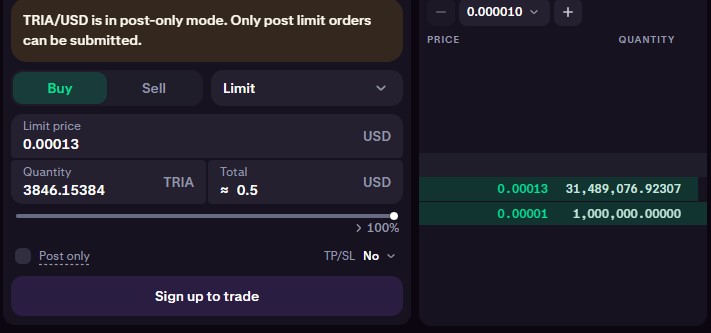

Ahead of full execution, Kraken listing has enabled post-only trading for the its USD pair. This mode allows only limit orders, offering a preview of trader intent without market execution.

As seen in the above chart, buyers are placing bids around $0.00013, while the order book shows heavy sell-side liquidity, including a large sell wall of over 31 million coins at the same level. This setup reflects classic pre-listing price discovery, where limit orders shape expectations before market orders go live.

The visible sell pressure suggests early crypto airdrop and liquidity unlocking. Once full trading opens, price direction will depend on how quickly buyers absorb that supply.

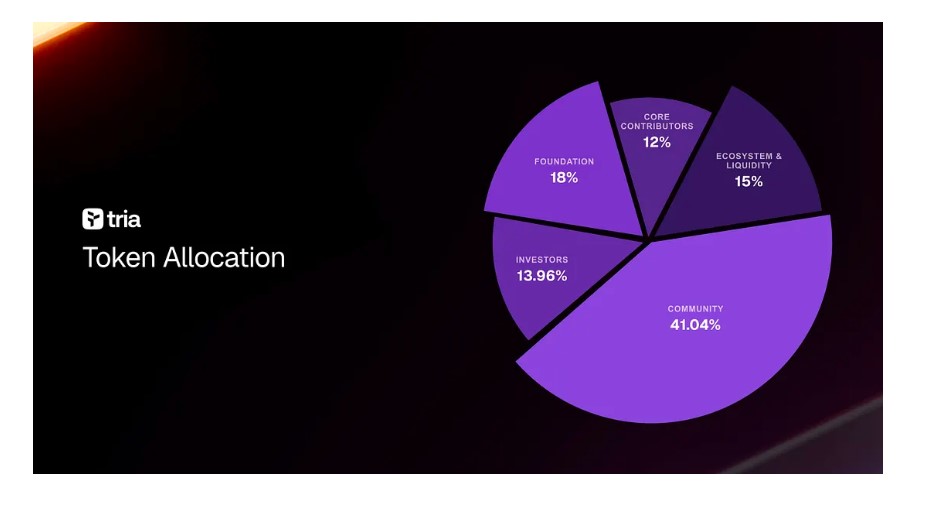

The project’s total supply is fixed at 10,000,000,000 coins, with no inflation mechanism, and all tokens pre-minted at TGE. The token is ERC-20 on Ethereum mainnet, and circulation happens only through predefined vesting schedules.

Genesis circulating supply stands at 2.188 billion tokens, representing 21.89% of total supply. Allocation favors long-term ecosystem health: Community (41.04%), Foundation (18%), Ecosystem and Liquidity (15%), Investors (13.96%), and Core Contributors (12%).

Source: Medium Tria Tokenomics

Investor tokens remain fully locked at TGE, while team allocations follow delayed, multi-year vesting schedules.

Based on the current pre-trading data’s liquidity signals, strong tokenomics, and multi-exchange support, a more realistic listing price prediction range is estimated between $0.08–$0.15.

As per Coingabbar’s crypto analysts, if demand absorbs early selling, upside to $0.15–$0.25 is possible. Over the first 24–72 hours, a pump-dip-stabilize pattern is likely. Sustained volume could push the asset toward $0.18–$0.28, while heavy selling may retest $0.08–$0.12 zone.

Longer term, with fixed supply and real neobank utility, a neutral 2026 range sits at $0.20–$0.45. In a strong altcoin cycle, $0.50+ is possible. The TGE Partnerships with Arbitrum, Polygon, Injective, Talus, Bitlayer, and more strengthen long-term credibility.

The Tria airdrop listing date February 3, 2026, marks a data-rich launch with clear tokenomics, wide exchange access, and visible order-book signals. Market experts believe that current token structure shows short-term volatility due to overall crypto market breakdown, but it has a clear long-term framework for a successful survival.

YMYL Disclaimer: This article is strictly for informational purposes only and does not give any financial advice. Cryptocurrency markets involve risk. Readers should do their own research before making any investment decisions.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.