US President Donald Trump has announced two major economic nominations that could influence markets worldwide. Trump’s Fed pick Kevin Warsh as the next Chairperson of the Federal Reserve, while economist Brett Matsumoto has been chosen to head the Bureau of Labor Statistics.

These announcements arrive at a time when investors are closely watching inflation, interest rates, and the credibility of economic data.

Source: Wublockchain Xofficial

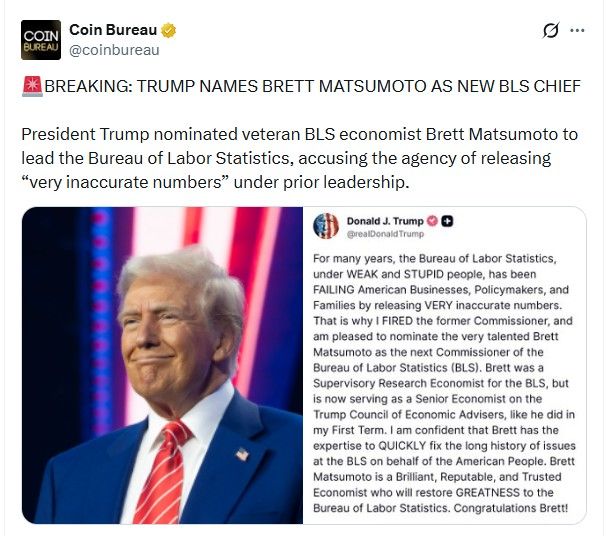

Source: CoinBureau Xofficial

Kevin Warsh previously served as a Federal Reserve Governor between 2006 and 2011, playing a role during the 2008 financial crisis. His experience with crisis-era policy and market dynamics makes him a strong candidate for steering monetary decisions.

Brett Matsumoto has built his career inside America’s economic system, working as a research economist and later advising the White House. His technical background in labor and inflation measurement positions him as a stabilizing choice for BLS leadership.

Trump’s Fed pick also reflect dissatisfaction with current Fed Chair Jerome Powell. Powell has faced criticism for reacting late to rising inflation, maintaining high interest rates for an extended period, and dealing with internal Federal Reserve controversies, including governance and spending scrutiny. Trump’s move is widely seen as an attempt to reset economic leadership.

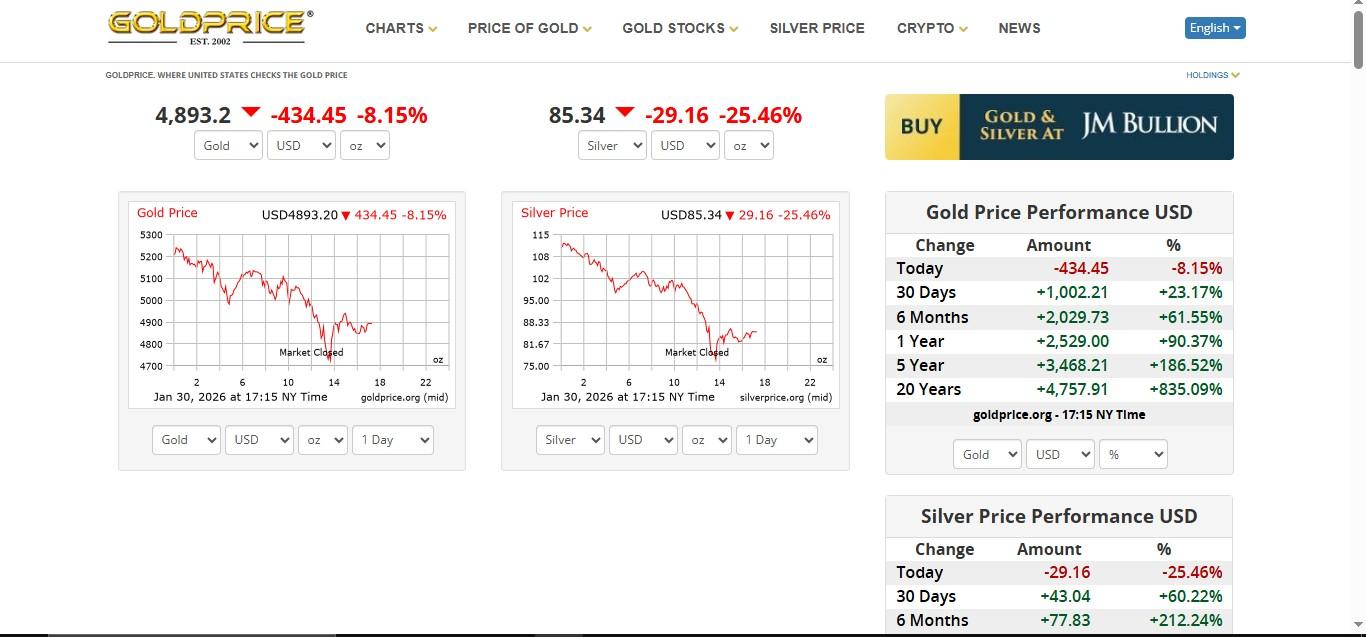

Following the announcement, markets reacted quickly. Gold prices slipped from around $5601 per ounce to near $4893, while silver fell from about $121.6 to $85.16, signaling shifting expectations around future rate policy.

Source: Goldprice official

Kevin Warsh’s crypto exposure : He has direct familiarity with digital assets. He invested in Basis, a project that described itself as an algorithmic central bank, and later served as an adviser to Electric Capital, a well-known blockchain-focused investment firm. This background signals an understanding of crypto economics and liquidity dynamics.

Policy direction impact: If markets expect Warsh to support lower rates or a pro-growth Federal Reserve, crypto typically benefits as liquidity improves, real yields decline, and the dollar weakens. In contrast, a hawkish inflation stance or aggressive balance-sheet reduction (QT) can pressure Bitcoin and altcoins due to tighter liquidity and reduced risk appetite.

Headline vs reality: While nomination headlines can move prices quickly, the real crypto impact will depend on Warsh’s Senate testimony, policy guidance, and actual Fed actions, not the announcement alone.

Brett Matsumoto’s role: BLS data on jobs and inflation strongly influence the Fed’s rate path. If Matsumoto ensures credible and stable labor data, rate expectations become clearer, often reducing sharp BTC and ETH volatility around CPI or jobs reports. Because he is seen as a technocratic, data-focused pick, markets view his nomination as supportive of data trust, which indirectly benefits crypto and other risk assets.

Short-term impact: Initial volatility across crypto, commodities, and equities reflects uncertainty around leadership change.

Medium-term potential: Clearer monetary signals under Warsh and improved data credibility under Matsumoto could reduce sudden market shocks.

Long-term view: Predictable policy and trusted data often attract institutional capital, which historically supports risk assets, including cryptocurrencies.

YMYL Disclaimer: This article is for informational and educational purposes only. It does not constitute financial, investment, or legal advice. Market conditions can change rapidly. Readers should conduct their own research and consult qualified financial professionals before making any investment decisions.

Krishna Tirthani is a dedicated crypto news writer with 1 year of hands-on experience in the cryptocurrency market. With a strong focus on market trends, token launches, price movements, and blockchain innovations, Krishna delivers timely, accurate, and easy-to-understand crypto content for both beginners and experienced investors.

Over the past year, Krishna has closely followed major developments across Bitcoin, Ethereum, altcoins, DeFi, NFTs, Web3, and emerging crypto projects. His writing style blends data-driven insights with clear explanations, helping readers stay informed in a fast-moving and often complex market. From breaking crypto news and exchange listings to tokenomics analysis and price predictions, his work aims to simplify information without losing depth.

Krishna believes that credible research, transparency, and consistency are essential in crypto journalism. Each article is crafted with SEO best practices in mind, ensuring high visibility while maintaining originality and factual accuracy. His growing experience in the crypto space allows him to spot early trends and explain their potential impact on the wider market.

With a passion for blockchain technology and digital assets, Krishna Tirthani continues to evolve as a crypto writer, committed to delivering reliable, engaging, and value-driven crypto news content.