The US government shutdown today is no longer a political headline — it is now a live market risk. After Congress missed the January 30 funding deadline, parts of the federal govt. officially shut down at midnight US Eastern time. With markets already pricing the risk, will Monday’s deadline trigger relief—or deeper volatility for investors?

Source: The Kobeissi Letter X Account

Prediction platforms had already priced this outcome with near certainty, but the U.S. government partial shutdown confirmation has added fresh pressure on risk sentiment, including crypto.

This US government shutdown began even after the Senate approved a short-term funding deal. The problem lies elsewhere. The congress funding bill 2026 lapse started when the House failed to approve the Senate-backed bill that would fund most federal agencies until September.

The deal included only a two-week extension for the Department of Homeland Security (DHS), which oversees immigration enforcement. The House of Representatives did not vote on it, and remains out of session. As a result, several govt. agencies were forced to initiate a pause plan.

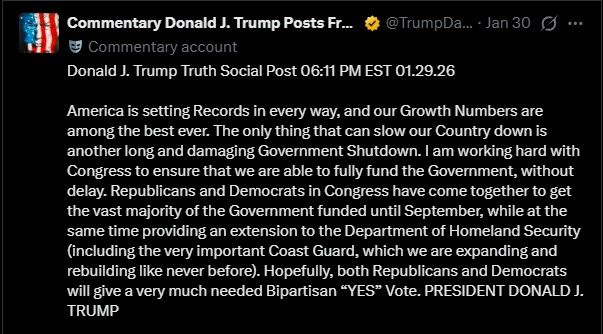

President Donald Trump publicly cautioned that a prolonged a federal pause could slow United States growth, even as he praised strong economic numbers. While this pause is expected to be shorter, the uncertainty is already weighing on markets.

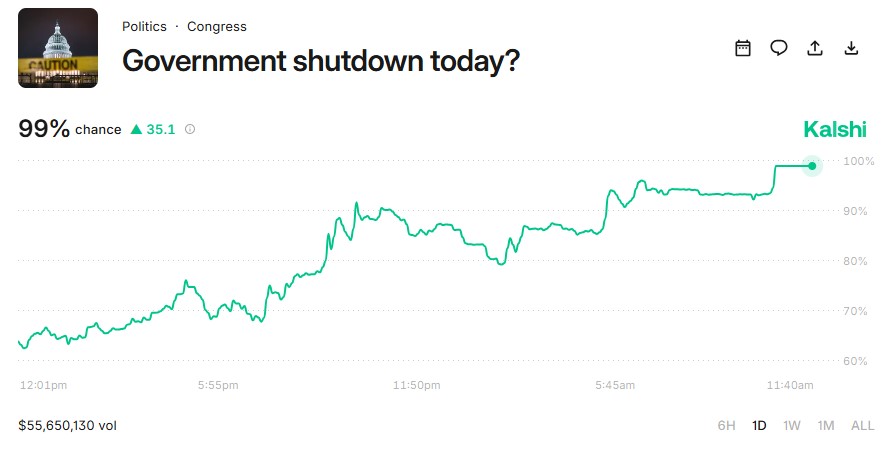

Kalshi Prediction markets anticipated failure well ahead of official confirmation. On Kalshi, the current US govt shutdown probability surged to 99%, supported by around $55.6 million in trading volume. That sharp move showed traders were convinced Congress would miss the deadline.

This matters because markets now react faster to political dysfunction than traditional headlines. By the time confirmation arrives, assets are already repriced. This news on government shutdown in United States is another example of expectations moving markets before policy decisions are finalized.

Monday is critical for ending the US government shutdown. Congress has until then to pass a funding deal and reopen affected agencies. Three outcomes matter most for investors:

Quick approval: If the House of Representatives passes the 2026 funding bill, the federal pause could end quickly, easing volatility and supporting risk assets.

More delays: Continued talks without a senate vote may keep markets unstable and investors defensive.

Negotiation breakdown: Any new U.S govt update could trigger broader sell-offs and push investors toward safe assets.

“Will House of Representatives pass the funding bill trend” is already reflected in crypto prices. Total crypto market cap fell about 3% to $2.87 trillion. Bitcoin dropped to the $83,000 range, down nearly 7% over the past week. Ethereum slipped toward $2,693, while XRP traded near $1.73 and Solana around $118, both down roughly 8% weekly.

Sentiment remains fragile. The Fear and Greed Index stands at 20, signaling extreme fear. Even traditional safe assets like gold and silver failed to attract strong demand, highlighting a broader risk-off move.

For crypto traders, during the current US government pause, several signals matter most. Coingabbar market analysts note that any confirmed House vote timing, DHS funding language, and White House messaging will shape short-term sentiment.

As per the technical view, If Bitcoin holds above $82,500, the short-term structure remains intact. A sharp break below that level could signal renewed panic. Each headline can quickly move markets during the current political phase.

The current US government shutdown is less about funding gaps and more about confidence. Monday’s decision will shape near-term market direction. Until Congress acts, volatility stays high, crypto remains fragile, and investors are likely to trade headlines rather than fundamentals.

YMYL Disclaimer: This article is for informational purposes only and does not constitute financial advice. Market conditions can change rapidly. Always do your own research before making financial decisions.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.