In a surprising and dramatic shift in the past 24 hours, President Donald Trump has announced a fresh wave of tariffs targeting major global economies and key industries. Trump announced the following tariff:

Doubled tariff on Indian imports to 50%

Imposed a new 15% on goods from Japan

Introduced a 100% on all imported semiconductors

Announced pharmaceutical tariffs could rise to 250%

These moves follow four months of repeated hints and headlines about potential trade deals with the same countries. Now, those expectations appear to have been replaced by a hardline tariff-first approach, leaving businesses and governments scrambling for answers.

Source: X

Doubling the tariffs on Indian imports, the United States has mentioned the fact that India is still trading in oil with Russia as one of the primary causes. This new policy shift will impact Indian exporters in various sectors, such as textiles, pharmaceuticals, and electronics.

The Ministry of External Affairs (MEA) of India reacted with a sternly worded statement, terming the action

“This is unfair, unjustified, and unreasonable.”

The MEA also reiterated that India has a sovereign right to meet its energy requirements of more than 1.4 billion people, and its oil imports are influenced by market forces. India, too, has taken a swipe at the selective targeting, noting that other nations also import Russian oil without being hit in a similar manner. The government threatened to do anything to safeguard national interests.

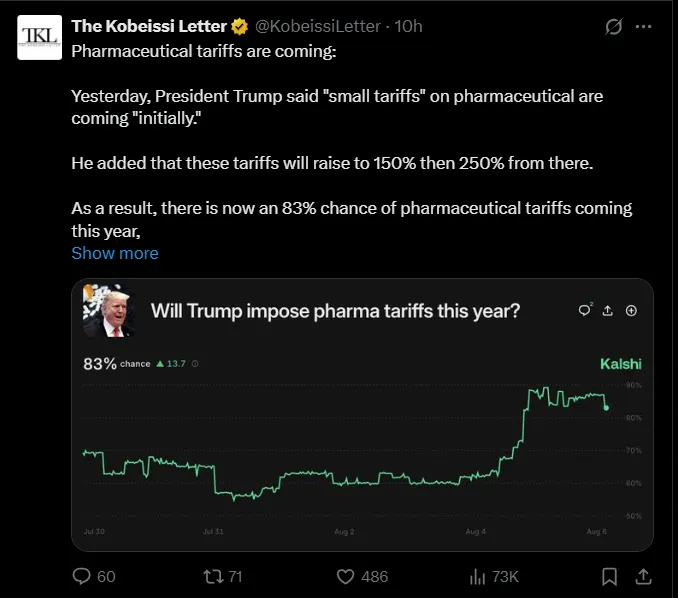

President Trump also announced that “small” tariffs on pharmaceutical imports will begin shortly. However, he added that these could increase to 150%, and eventually 250%.

These proposed Trump pharmaceutical tariffs could deeply affect global drug manufacturers, especially Indian and European companies that export generic medicines to the U.S.

Market prediction platform Kalshi now gives an 83% probability that the pharmaceutical tariffs will be implemented this year.

Source:X

Regardless of the negotiations and constant news reports of a possible U.S.-Japan trade agreement, President Trump has now declared another 15% tariff on Japanese products.

This is a major turnaround in the trade relations between the U.S. and Japan and is likely to have a far-reaching impact on a wide spectrum of imports such as cars, machinery, and electronics

Source: X

One of the most impactful moves came with the announcement of a 100% tax on all imported semiconductors. This has major implications for global chipmakers and could raise costs across the technology sector.

However, Apple and Nvidia have reportedly been exempted due to their major U.S. investments, including Apple’s newly announced $600 billion expansion in American manufacturing.

Interestingly, the market’s reaction was muted. The Semiconductor ETF ($SMH) fell only 0.04%, showing that investors may be less reactive to Trump’s tariff policies than in the past.

Source: X

Apple finds itself in a difficult position. After relocating iPhone production from China to India to avoid past taxes, the new 50% puts those operations at risk. This shift appears to have backfired despite the company’s substantial U.S. investments. As a result, Apple remains caught in a trade war that keeps changing direction without warning.

Trump recently pulled a critical comment on India and Russia trade. He aggressively says, Avoid trade with India and Russia, as they are dead economies. This decision affected many countries and companies' trade sentiments. Companies, particularly those in the tech and manufacturing industries, are preparing to experience even more volatility as Tax Policy 2025 is still being implemented.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.