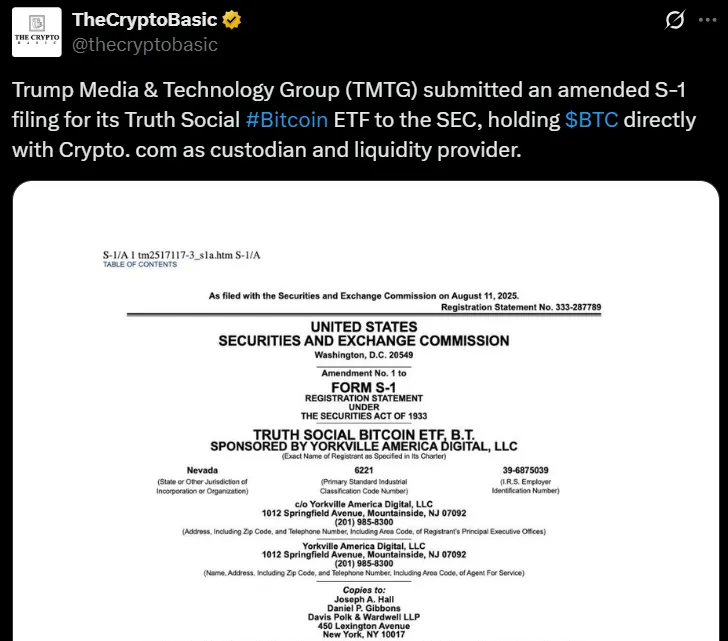

The Trump Media news section today grabbed headlines after submitting an amended for the Truth Social Bitcoin ETF (ticker: B.T.).

This new listed trust intends to hold $BTC directly, which will provide investors with an alternative way to track the token's price in a regulated manner.

With Crypto.com as the exclusive custodian, the exchange traded funds have a credible partner handling storage and execution. While the SEC is still reviewing the application, many in the industry believe approval could lead to a strong boom.

Source: Wu Blockchain

This kind of announcements often cause excitement in the cryptocurrency news space. This filling could open doors for big institutions looking for secure, regulated crypto exposure.

The sponsor Yorkville America Digital will manage the fund, while the Truth Social Bitcoin ETF SEC approval remains the key milestone.

If it gets a green signal, the price could pump billions into the market, influencing btc price analysis and investor sentiment.

Before the listed funds trades on NYSE Arca, two steps are needed:

Form S-1 Acceptance – The SEC must declare the amended registration effective.

Form 19b-4 Approval – The exchange must get clearance to list this traded funds.

The question, “will sec approve bitcoin etf?” is on every investor’s mind. Historically, approval has taken time, but recent acceptance of other spot listed funds makes the odds better. Still, any delay could cool the momentum in the upcoming cycle.

“As a market watcher, I see the coin's price impact from this filing as more than short-term hype. Big brands bring big liquidity. If this goes live, we could see a rally similar to other traded fund launches earlier this year.

The Trump media $BTC news boosted the token price by 1%, bringing it to $120,231, as per TradingView data

RSI (14): 62.85 — Strong, but still under the overbought level.

MACD: Positive crossover forming, showing fresh buying pressure.

Chart Structure: Breakout from sideways range points to rising demand.

Key levels To Watch:

Support: $116,500

Immediate Resistance: $122,500

Major Resistance: $125,000 — This is the big target for bulls.

Short-Term (1–2 weeks):

If buying continues, it may push the price toward $122,500–$124,000. A pullback could see it range between $118,000–$120,000.

Mid-Term (1–2 months):

Bitcoin etf filing sec approval process could drive the value toward $128,000–$132,000.

Long-Term (3–6 months):

If the exchange traded funds join other spot funds and attract investors, BTC price could aim for $140,000+. But global economic weakness could bring it back near $100,000–$105,000.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.