Why did the crypto market fall today even when there was no major tech or exchange-related bad news? The answer lies in geopolitics. The Trump Russia sanctions bill has moved closer to reality, and markets are starting to price in risk.

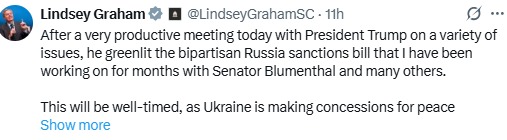

US President Donald Trump has agreed to move forward with a new Russia sanctions bill backed by US Senator Lindsey Graham. If this bill becomes law, it would allow the US to impose up to 500% tariffs on countries that continue buying Russian oil and energy.

The Russia sanctions bill is a bipartisan proposal by Senator Lindsey Graham and Senator Richard Blumenthal. It allows the US President to impose heavy tariffs and secondary sanctions on countries that buy Russian oil, gas, uranium, and energy products.

Source: X (formerly Twitter)

Countries like India, China, and Brazil are directly mentioned because they import large volumes of Russian oil. Just a few days back Trump threatened India with Tariffs spike for Russian oil trade.

It is important to note that this draft is not law yet. It still needs approval from the US Congress. However, Trump’s public support has increased the chances of it moving forward.

If it passes, this proposal from the Trump Administration could drive the price of oil and trade higher around the world. Higher tariffs tend to translate to higher inflation and slower economic growth.

This is more than just political. It directly affects oil prices, exchange rates, gold, as well as risk assets such as cryptos. The recent events in the U.S. have shaken the Venezuelan leadership as well as given the US control over Venezuelan oil exportation.

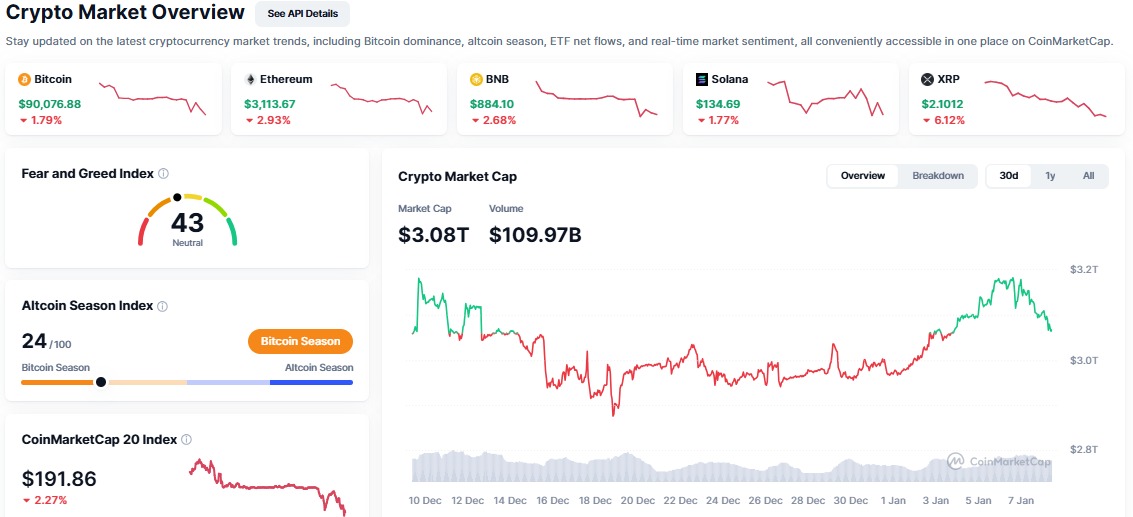

In the last 24 hours, the total crypto market fell 2.87%, wiping out part of its recent weekly gains as per the CoinMarketCap. This move fits a classic “risk-off” reaction. When global tensions rise, investors reduce exposure to volatile assets and move toward cash or safer options.

Source: CoinMarketCap

According to bitcoin news data, Bitcoin dropped 2.14% in the past 24 hours to around $89,900. The fall was sharper than the overall market. The major reasons behind Bitcoin price crash are:

ETF Outflows: Around $486 million exited spot Bitcoin ETFs, the biggest single-day outflow since November 2025. XRP ETFs also saw $40.8 million in outflows.

Liquidation Cascade: A break below the $90,000 level triggered over $128 million in long liquidations, adding selling pressure

The Crypto Fear and Greed Index currently stands near 43, indicating neutral-to-cautious sentiment. Clearly, traders are nervous as the Russia sanctions bill adds another layer of uncertainty to global markets.

If it moves to a Senate vote next week, volatility may continue. Any updates related to Trump news on tariff or trade pressure on India and China could further impact crypto prices.

For now, the crypto market is reacting not to blockchain news, but to global power shifts, trade wars, and energy politics.

The Trump Russia Sanctions Bill is a major macro risk event. Even before it was signed into law, it had already shook global markets and pushed crypto into this short-term pullback. With geopolitics heating up, more volatility in Bitcoin, altcoins, and traditional markets is what a trader should expect.

Disclaimer: This article is for informational purposes only and not a financial advice, kindly do your own research before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.