The South Korean digital asset world reached a major milestone today. Upbit Bittensor TAO listing officially went live on February 16, 2026. By adding trading pairs for the Korean Won (KRW), Bitcoin (BTC), and Tether (USDT), Upbit is providing the local tools needed for people to join the world's leading decentralized AI network. This move is very important because Korean retail investors are often very active in the crypto trading arena.

Source: X(formerly Twitter)

Source: X(formerly Twitter)

Bittensor works as a peer-to-peer market for machine intelligence. Unlike normal AI models, this network rewards people based on how much their AI work helps the whole system. With many subnets focusing on different AI tasks, the Upbit Bittensor TAO listing lets Korean users support a system where only the best AI models win.

To keep the market stable during the busy launch, Upbit has set several trading rules. These rules help protect users from the fast price changes that happen when a lot of money enters the market at once.

Order Limits: For the first five minutes after the Upbit New listing, buy orders are not allowed to stop prices from rising too fast.

Price Protection: During this same early time, sell orders that are more than 10% below the day before's price will be blocked.

Execution Controls: For the first two hours, only limit orders will be allowed; trading arena orders are turned off to help find the right price safely.

Network Rules: You can only send and receive tokens using the native Bittensor Network. Upbit warned that using other networks like EVM will not work and could take a long time to fix.

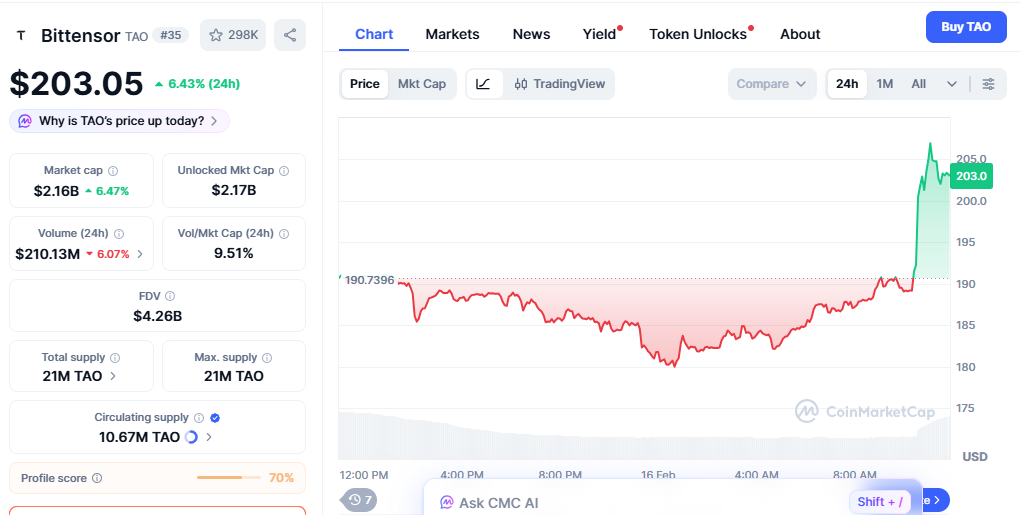

As of February 16, 2026, the Bittensor market is showing intense volatility following the exchange news. At the time of writing, TAO was trading near $203.05, marking a 6.43% increase in the last 24 hours. This rally is part of a broader weekly trend where TAO has surged by over 24%. The current trading arean capitalization stands at $2.16 billion, ranking it #35 among all cryptocurrencies.

Source: CoinMarketCap Data

Source: CoinMarketCap Data

The network's supply remains highly constrained, with 10.67 million TAO in circulating supply out of a maximum of 21 million. This scarcity, combined with a daily trading volume that has reached $210.13 million, reflects the high demand from traders looking to capitalize on the Artificial Intelligence narrative. Community sentiment remains overwhelmingly positive, with 82% of voters expressing a bullish outlook.

The Upbit Bittensor TAO listing comes at a time when AI is a top trend in crypto. the protocol aims to be a neutral place for Artificial Intelligence to grow without being controlled by "Big Tech". The native tokens are the lifeblood of this system, used for payments, staking, and rewards for developers.

Looking ahead, the market is watching to see if Bittensor can truly become a global hub for machine learning. While prices can be volatile after a new listing, the long-term goal is to make AI tools available to everyone. As more people use the network, the demand for decentralized compute resources may continue to grow.

Your Money Your Life (YMYL) Disclaimer:

Cryptocurrency trading involves high market volatility and risk. This article is for informational purposes only and does not constitute investment advice. Readers should conduct independent research before making financial decisions.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.