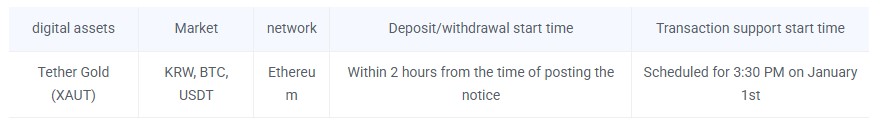

Upbit, South Korea’s largest crypto exchange, has officially announced the XAUT Trading, also known as Tether Gold, on its platform from January 1, 2026 onwards. The new listing allows the users to trade XAUT coins against KRW, BTC, and USDT pairs, expanding access to gold-backed digital assets for native investors.

Source: Upbit Official

The transactions are scheduled to begin at 3:30 PM KST (6:30 AM UTC) on the Ethereum network. Upbit also confirmed that deposits and withdrawals opened within two hours of the announcement. To mitigate early volatility, the exchange enacted short-term trading restrictions during the initial launch window.

XAUT trading offers exposure to the metal through blockchain technology. Unlike gold-ETFs, this digital token provides on-chain ownership backed by redeemable physical gold.

Each XAUT token represents one fine troy ounce of physical gold, backed 1:1 by gold-bars that meet the London Bullion Market Association (LBMA) Good Delivery standard. The backing gold's securely stored in Swiss vaults, ensuring verifiable ownership and transparency.

Where this new launch gives users a more secure option to the physical asset, it also bridges between traditional commodities and blockchain for hedging against broader market volatility.

Even after this major news, the market reaction is not so hyped. At the time of writing, the token fell 0.2% in the past 24 hours to $4,332.01, but stayed strong on a monthly and yearly level with +2.8% and +65.25%. The recent downtrend shows the broader crypto dip of 0.76%.

Source: CoinMarketCap data

When compared it to other purchasing pairs, it follows:

Korean Won (KRW): 6,246,219 per coin

Bitcoin (BTC): 0.04928 per coin

Tether (US Dollar–USDT): 4,332 per coin

Effectively, experts claim that once the trading starts and gains traction, the price level could break in 2026 with new heights. The upcoming US nonfarm payrolls on Jan 5, also seen as a potential safe-haven demand driver.

The XAUT Trading reflects a broader shift toward tokenized real-world assets in Asia. Exchanges and regulators now increasingly favor transparent, asset-backed crypto products as the 2025 year end saw major long-lasting volatilities.

With Gold-prices remaining strong near $4,330 per ounce after a 65% rally in 2025, this launch strengthens Upbit’s position. The platform opened a gateway for regulated digital commodity trading in South Korea. Now, it's going to be exciting to watch how this will affect the upcoming trading scenarios for both traditional and Tether gold.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.