What happens if a country quietly builds one of the world’s largest Bitcoin stockpiles and then loses control of it? That question is now gaining attention after CNBC reported that the Venezuela Bitcoin Reserve could become a target for U.S. seizure, potentially involving hundreds of thousands of Bitcoins worth billions of dollars.

Source: X (formerly Twitter)

The debate follows US action in Venezuela after Donald Trump accused Nicolás Maduro of drug trafficking, weapons charges, and sanctions violations.

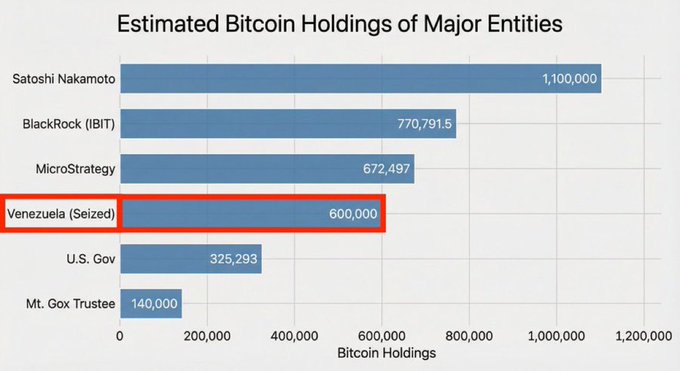

According to the whalehunting report, the country is believed to have a large amount of seized BTC, with estimates above 600,000 BTC. Although the exact figure is yet to be confirmed, even the lowest estimates would place the country among the top BTC holders in the world.

It was reported that the Venezuelan government resorted to cryptocurrency as the sanctions tightened, making the banking channels difficult to use.

The Venezuelan government allegedly accepted payments for oil sales in Tether (USDT), a dollar-pegged cryptocurrency. This was followed by the transfer of some of these amounts to BTC.

This trend did not happen by accident. Hyperinflation, bank crises, and various forms of capital control had driven both individuals and institutions to rely on systems centered on cryptocurrencies.

Eventually, stablecoins and peer-to-peer markets offered by cryptocurrencies grew to become an essential element for the economy within Venezuela. Occasionally, the same systems were possibly being used for state-connected trading.

The story took a sharper turn after U.S. President Donald Trump announced a more direct stance toward the country, saying the U.S. would oversee the country until a “safe and proper transition” is possible. Trump also confirmed plans for U.S. oil companies to invest in Venezuela’s oil infrastructure.

At the same time, analysts pointed out that any future seizure of crypto assets could strengthen crypto asset’s long-term outlook. It is a “bull case” for the coin, arguing that seized coins are often held for years, reducing supply in open markets.

Current estimates suggest the Venezuela Bitcoin Reserve could exceed 600,000 BTC, placing it well above the U.S. government’s known holdings of around 325,000 BTC, which mostly come from criminal seizures. Such a position would also rival major institutional holders and even some nation-state reserves.

Source: X (formerly Twitter)

Another analysis claims the total could be much higher, based on historic gold exports and early Bitcoin prices. However, these figures rely on intelligence sources and have not been proven through blockchain data.

Bitcoin also flourished on the back of broader developments to climb back by about $94,000 after slipping below $90,000. The more important part is, traders are closely monitoring the developments as any confirmation of seized coins getting locked into long-term reserves would immediately create a tighter supply.

Meanwhile, debates about how seized BTC should be handled continue in the United States. Senator Cynthia Lummis recently warned against selling these assets and has come to believe that Bitcoin is a strategic resource due to how certain nations are accumulating it.

For now, the story of the Venezuela Bitcoin Reserve remains one in development. What will bear relevance next is verification, official filings, and whether these coins form part of a growing sovereign crypto narrative or stay hidden behind unconfirmed reports.

Disclaimer: This article is for informational purposes only and not a financial advice, cryptocurrency investments can be risky, kindly do your own research before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.