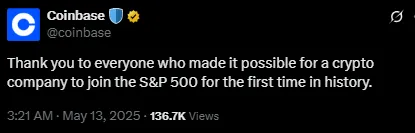

In a major move, Coinbase is set to join the S&P 500 index starting next Monday, May 19. This is a big win for the crypto world as it becomes the first major crypto platform to be part of this popular stock market index. The news came directly from S&P Global, which announced that Coinbase will take the place of Discover Financial Services.

Source: X

This decision had an immediate effect on Coinbase stock (COIN), which jumped 3.96% during the day and surged another 10.9% in after-hours trading. Investors seem very excited about this listing and what it could mean for the future of crypto in traditional finance.

The S&P 500 is a top stock market index in the U.S. that tracks 500 of the largest companies.

Coinbase will officially replace Discover Financial Services, recently acquired by Capital One.

This listing gives bigger financial players exposure, and in turn, to the crypto space.

This is not just a price move — it's a sign that the crypto industry is becoming more acceptable to the traditional financial world. Even its CEO, Brian Armstrong, called this a clear message that “crypto is here to stay.”

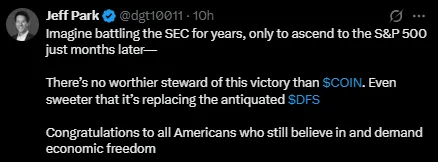

Another key voice, Jeff Park from Bitwise, said on X (formerly Twitter), “Imagine battling the SEC for years, only to ascend to the S&P 500 just months later.” This refers to the exchange's long legal fight with the SEC, which ended in February after the agency dropped its case.

Source: X

Now that Coinbase has a new position on the big S&P 500 table, everyone is curious whether this will impact its largest rival, Binance. They are both big crypto exchanges, but each does things differently:

It emphasizes U.S. regulation, with strict security and 1:1 offline storage.

Binance has experienced some regulatory issues and even had its CEO, Changpeng Zhao, resign over an alleged case of money laundering.

Although Binance lists more tokens (over 350 worldwide), it has previously had the issue of numerous projects exploding after listing, such as Doodles (DOOD), Space and Time (SXT), Initia (INIT), and Hyperlane (HYPER).

Binance is attempting to change this by instituting a community voting system to select quality projects.

Meanwhile, the new position of Coinbase in the index may make it appealing to institutional investors. It provides users with a sense of security and long-term stability.

The inclusion into the S&P 500 could lead to more attention from large investors such as pension funds and hedge funds, which tend to track the index. Additional purchases of COIN shares will be likely to push the price firmly in the short term.

For the cryptocurrency world, this is a victory. It implies that the sector is growing up and being considered seriously. It also puts pressure on Binance harder to sort out its own business and concentrate on actual, valuable projects.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.