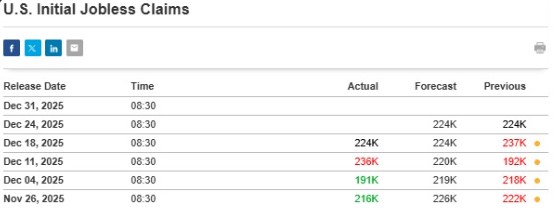

The U.S. Initial Jobless Claims report is scheduled for release today at 8:30 AM ET (13:30 UTC), making it the final major U.S. labor-market indicator before the holiday period. With markets already under pressure, investors are closely watching whether the data reinforces economic resilience or signals further slowdown.

Initial jobless claims measure the number of Americans filing for unemployment benefits for the first time. Even though it’s not as detailed as monthly jobs data, this report is watched closely for early signs of a weak or strong job market. Any big surprise can quickly affect bonds, stocks, and digital assets.

The market expectations are fairly well understood before this event. A figure below 220,000 would be taken as a sign of a robust job market, and this would lead to supportive market conditions for risk assets such as equities and crypto.

Levels ranging between 220,000 and 230,000 are quite expected and will likely result in little market action.

Source: Wise Advice

However, a number above 230,000 could raise concerns about a slowing economy or recession and may put pressure on financial markets.

Recent data shows mixed signals. Figures stood at 224,000 for today’s announcement, same as last Dec 18 data, while the previous week recorded 236,000, highlighting rising sensitivity to labor data as financial conditions tighten.

Hard Assets Outperform as Crypto Faces Pressure

Ahead of the initial jobless claims release, investor behavior highlights a clear contrast between hard assets and digital assets.

Precious metals have continued to outperform, with gold (+0.50%), silver (+0.90% YTD), and platinum (+1.35% YTD) posting strong gains today as investors seek inflation hedges and safety.

In contrast, the crypto market has weakened. Total crypto marketplace capitalization fell 1.06% in the last 24 hours, extending a 1.7% weekly decline.

Source: CoinMarketCap Data

The major contributors to this decline include leverage unwinding, which saw Bitcoin record liquidations amounting to $60.5 million, primarily from long positions, and the funding rate rising by 102%.

At the same time, Ethereum spot ETFs recorded $118.6 million in weekly outflows, while Bitcoin ETFs lost $137 million, reflecting reduced institutional risk appetite.

Today’s jobless report is unlikely to be the final driver of volatility. Markets are also eyeing year’s last jobless claims report on Dec 31, CPI January 2026 report, the Federal Reserve meeting on Jan 28, 2026, and a pending MSCI ruling that could trigger $2.8–$8.8 billion in passive outflows tied to crypto-linked equities.

Until clearer macro signals emerge, labor data like today’s report is likely to remain a key short-term volatility driver across both traditional and digital markets.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.