Could the USD.AI airdrop and upcoming $CHIP ICO become one of the most watched stablecoin events of early 2026? With over $7.7 billion in trading volume and real revenue from GPU-backed lending, foundation is stepping into its next phase through a CoinList sale and token distribution event.

It is a stablecoin protocol built for GPU-backed lending. It has raised $17.4 million from YZi Labs, Dragonfly, Framework Ventures, Coinbase, and others. The project already reports a $1.5B+ pipeline, with the first $100M GPU loans planned for Q1 2026.

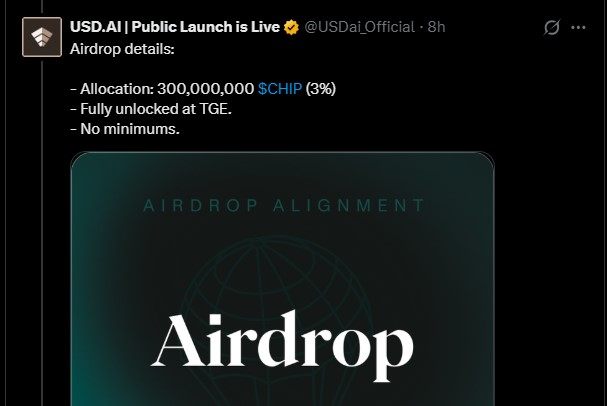

The USD.AI airdrop allocation stands at 300,000,000 $CHIP (3% of total supply), fully unlocked at TGE. There is no minimum requirement. Tokens will be sent automatically to eligible wallets. No separate claim process exists. However, alignment remains mandatory.

Source: Official CHIP X Account

Key conditions include:

Participation in Season 1 of the Allo Game

Alignment in at least one strategy marked “ ICO” or “crypto Airdrop”

Wallet setup on the official platform

Unaligned points burn after February 18.

Many observers view the expected March 2, 2026 TGE as the likely USD AI airdrop listing date, though no exchange confirmation has been issued yet.

The USDai token sale date will run on CoinList exchange from February 22 at 11:00 PM UTC to February 27 at 11:00 PM UTC. Only users who joined the Allo Game can participate, receiving guaranteed allocations based on earned points.

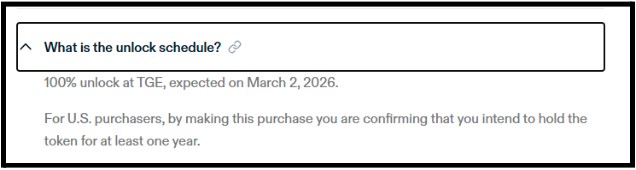

Source: CoinList Website

Traders should note: “Oversubscription is allowed, and if tokens remain unsold, they will be distributed on a pro-rata basis, increasing allocation for higher contributors.”

Current sale details show project’s strength:

Sale price: $0.03

FDV: $300,000,000

Allocated supply: 700,000,000 $CHIP (7%)

Total supply: 10,000,000,000

Minimum purchase: $100

Distribution: Direct to whitelisted wallet

KYC/AML is mandatory for all participants between February 9 and February 27.

Coingabbar’s crypto experts observe that this structure favors active participation rather than passive farming. It may reduce speculative pressure at launch.

The unlock schedule confirms 100% unlock at TGE, expected March 2, 2026. Many consider this the potential listing date. However, no formal exchange listing confirmation has been announced.

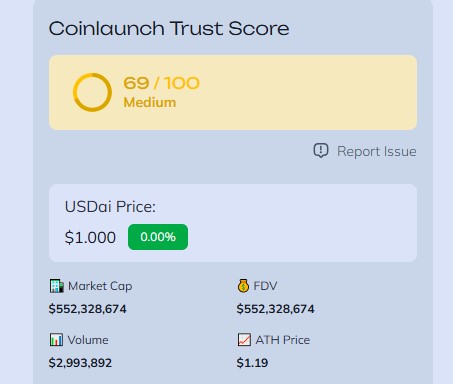

The price remains $1.000 with zero daily change. Other metrics include:

Market cap: $552,328,674

FDV: $552,328,674

Volume: $2,993,892

ATH: $1.19

Current APR is 6.58%, while expected APR is 10.48%. Coinlaunch trust score rates the protocol at 69/100. These figures show operational traction before the chip token ico event.

The USD.AI airdrop listing and CoinList sale mark a key milestone before the $CHIP TGE date Q1 March 2026. With strict alignment rules, full unlock mechanics, and GPU-backed revenue, the rollout appears structured and transparent. Still, participants must review eligibility, compliance rules, and token risks carefully before joining.

YMYL Disclaimer: This article is strictly for information only, and not financial advice. Cryptocurrency involves high risk, so it's always better to do your own research before investing in any token sale.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.