Robinhood has officially launched the Public Testnet along with a strategic partnership with Chainlink as the oracle provider, opening the doors for developers to start building on its new Ethereum Layer 2 blockchain.

Source: Press Release

Built on Arbitrum, the Robinhood Public Testnet is designed to support real-world asset tokenization, including stocks and digital assets, while maintaining reliability, security, and regulatory awareness.

Developers can now access:

Network entry points to the Public Testnet

Full documentation at docs.robinhood.com/chain

Compatibility with standard Ethereum tools using Arbitrum technology

Early infrastructure support from Alchemy, Allium, Chainlink, LayerZero, and TRM

Developed as a financial-grade Ethereum Layer-2 on Arbitrum, the testnet is now live for developers to begin building and testing decentralized applications. With the testnet being live now, Robinhood mainnet launch date also seems to approach faster in 2026.

Chainlink’s role (oracle layer):

Provides trusted price and market data for tokenized assets

Enables cross-chain interoperability between blockchains

Supports compliance-focused data standards for financial use cases

Arbitrum’s role (Layer 2 scaling):

Powers the blockchain infrastructure for the native chain

Offers faster transactions and lower costs than Ethereum mainnet

Maintains compatibility with Ethereum and DeFi liquidity

This collaboration of Chainlink and Arbitrum supports the Robinhood Public Testnet as its backbone.

The public launch was widely viewed as a long-term strategic move rather than a short-term catalyst.

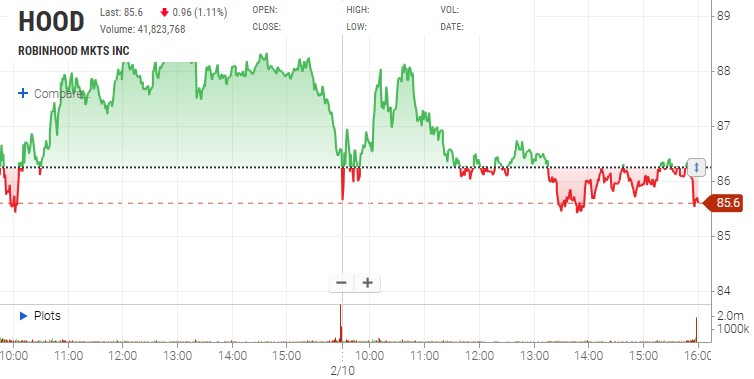

Robinhood Stock ($HOOD)

The announcement came at the time when its recently released Q4 2025 earnings performed weaker than expected. While total revenue rose 27% on yearly-basis to $1.28 billion, it still missed Wall Street expectation of $1.34 billion. As a result, $HOOD share prices facing downtrend despite the blockchain news.

$HOOD closed at $86.56 on Tuesday, currently at $85, remained volatile but supported by strong trading volume of 41.8 million shares–above the average.

Source: Nasdaq Official

Crypto prices (ETH, Arbitrum ecosystem)

No major or sustained price rally followed the news. Broader crypto market weakness (-3.17%), including Bitcoin’s 3% decline to $67,700, outweighed any short-term optimism.

Source: CoinMarketCap

Ethereum ($ETH): $1,971, -4.7% in around the clock trading

Chainlink ($LINK): $8.39, -3.57 in the last 24-hours trading

Arbitrum ($ARB): $0.1086, -2.19% in 24-hours

Overall, the market reaction was neutral to slightly negative in the short term.

With the public testnet now live and developers can already begin building and testing on the network, communities are highly expecting for a mainnet launch in upcoming months. While the platform has not shared a fixed date, official statements and ecosystem timelines suggest the mainnet launch is expected in mid-2026.

For now, users can gain testnet-only stock tokens, direct integration with Robinhood Wallet, and expanded infrastructure support and stability upgrades.

In short: the testnet marks the starting point. The original attention gatherer is mainnet, which will bring broad adoption, product-ready infrastructures, and strong market access that seems closer from here.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.