The XPIN price is under heavy pressure today, even as Binance Alpha announced the second wave of XPIN Network airdrop rewards. Normally, rewards news creates excitement. But this time, the market reacted with fear.

The asset's price crashed around 15% in just 24 hours because traders see rising supply, extreme reward schemes, and weak confidence coming together at the same time.

In this article, we will look at the reasons behind the price crash, technical analysis, Binance airdrop, and experts price prediction for 2026.

According to Binance Wallet official X account, users with at least 233 Binance Alpha Points can claim 14,600 $XPIN airdrop tokens on a first-come, first-served basis. Claiming the rewards consumes 15 Alpha Points. If rewards are not fully claimed, the score limit drops by 5 points every 5 minutes. Users must confirm within 24 hours, or the reward is lost.

This structure increases fast distribution. In simple terms, it adds more free tokens into the market. History shows that airdrop events usually increase sell pressure because many users dump rewards immediately.

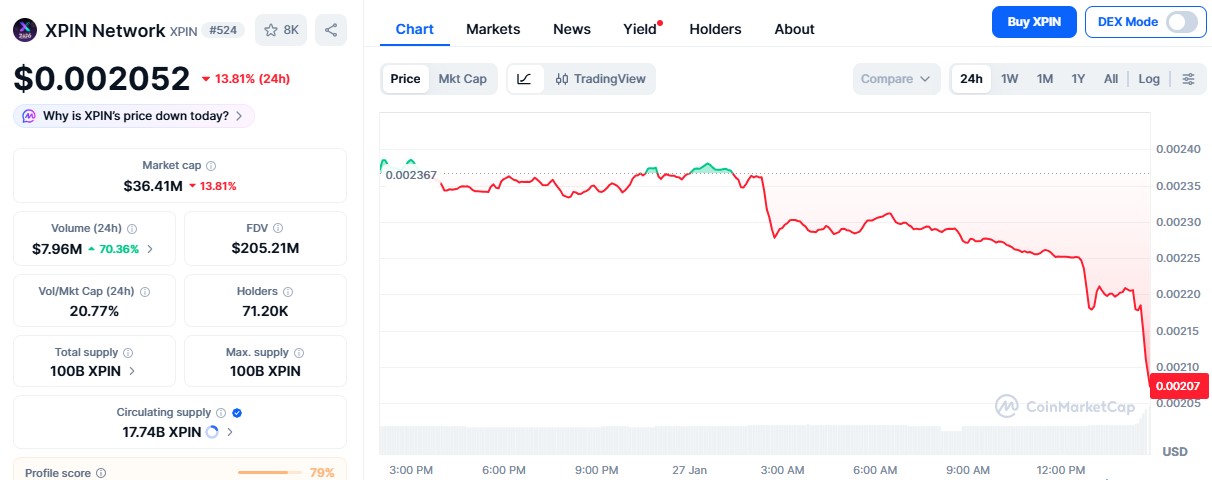

CoinMarketCap data shows the asset’s price dropped to $0.002052, down around 15% in 24 hours. Market cap fell to $36.41M, proving real value loss, not just small moves. Trading volume jumped to $7.96M, up 70.36%.

Rising volume with falling price means distribution, not buying. Big holders are selling while smaller traders absorb losses. The chart shows a slow bleed first and then a vertical dump, which signals panic selling or a liquidity shock.

What traders should watch now:

XPIN price crash broke the key support at $0.00220. Once that level failed, buyers disappeared. Now the $0.00200-$0.00190 level is the last psychological support.

Resistance: $0.00220–$0.00225

The project also launched its 2026 Freedata Plan. It offers 245% APR, plus 41% extra compounding, and free global eSIM rewards. Deposit tiers include:

20,000 coins → 1GB data ($12)

200,000 tokens → 10GB data ($95)

1,000,000 → 50GB data ($300)

5,000,000 → 100GB data ($533)

The event runs from January 19 to January 31, 2026. Such extreme rewards often signal emergency liquidity needs. Instead of building trust, they raise doubts. That is one major reason behind the today's crash.

In the short-term, the XPIN price crash shows weak momentum. As per TradingView chart on-chain price structure and data, RSI is around 14, which shows panic selling. MACD is deeply negative, proving strong downside momentum. If $0.00200 breaks, $0.00190 is possible. Any bounce is likely temporary unless $0.00220 is reclaimed.

Long-term, recovery depends on supply control and trust rebuilding. If inflation slows and real usage grows, it could move back toward $0.00250–$0.00300. The only strong positive XPIN news today is its partnership with zkPass, which will strengthen its privacy, identity, and trust among investors.

If it fails to recover $0.00220 support, the trend stays bearish. Binance airdrop supply can push it lower if demand does not rise fast.

The price is falling because trust is breaking faster than rewards can support it. Binance airdrops and extreme APR schemes add pressure, not stability. Only supply control, and real adoption can repair investors' confidence. Until then, it remains in a damage phase, not recovery.

YMYL Disclaimer: This article is strictly for informational purposes only. It does not offer financial advice. Cryptocurrency markets are highly volatile, so it's always better to do your own research before making any investment decisions.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.