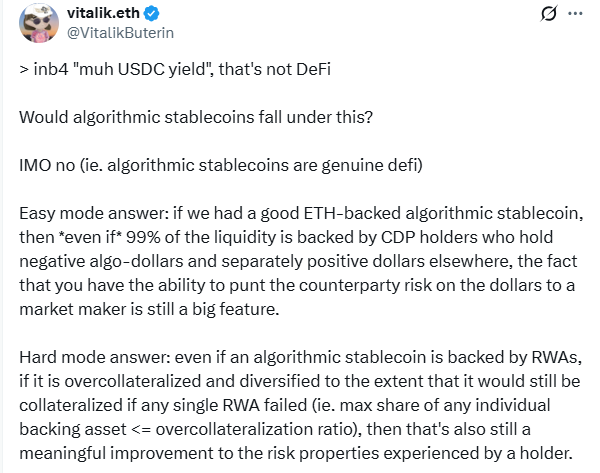

The world of decentralized finance changed on Sunday, February 8, 2026. Ethereum co-founder Vitalik Buterin sparked a new debate about "real" DeFi. He shared his views on X (formerly Twitter). He said that Vitalik Buterin Algorithmic Stablecoins are the best choice for a free financial system. He also spoke against "USDC yield" plans. He called them "cargo cults." This means they look like DeFi but still rely on old banks. He believes we must move toward systems that do not need central power.

Source: X(formerly Twitter)

According to the new framework, the true value of Vitalik Buterin Algorithmic Stablecoins is how they handle risk. Buterin says high-quality coins backed by ETH are a "big feature." Even if most of the money comes from CDP holders, the system still works. The main goal is to shift USD risk away from users. Instead, this risk goes to professional market makers. This makes the system safer for everyone else.

This idea challenges the way many people use DeFi today. Many current apps just put USDC into lending pools like Aave. Buterin says this is not true DeFi. These apps rely on a central company that can freeze your coins at any time. By using ETH-backed designs, we can build a system that no one can shut down. It is a more honest way to handle digital money.

Buterin also talked about "Hard Mode" for stablecoins. This involves using Real-World Assets (RWAs) like bonds or property. He says these can work in DeFi, but they must be very safe. The coins must be over-collateralized and highly diversified. This means if one asset fails, the coin stays stable. This "anti-fragile" style keeps the system running even during a crisis. It protects the holder from a single point of failure.

Feature | Centralized Models (USDC/USDT) | Algorithmic (Vitalik’s Vision) |

Primary Backing | Cash in Banks | ETH or Mixed Assets |

Trust Model | Trust in Companies | Trust in Code |

Risk Focus | Borne by the User | Shifted to Market Makers |

Unit of Value | US Dollar Peg | Global Asset Index |

As we move through 2026, the goal is to stop relying on the US Dollar. Buterin wants the industry to move toward a "diverse index." This would track a basket of different goods. This change would protect people from inflation in any one country. It would create a global money system that is fair for everyone.

This announcement comes at a key time for crypto. In early 2026, central banks are trying to control digital assets more than ever. Buterin’s push for algorithmic stability is a stand for freedom. He is telling developers to build tools that are truly independent. We are seeing a new wave of "Sovereign Web" apps that focus on self-custody.

In the next few months, expect to see new projects follow this path. These tools will favor safety and math over fast yields. While many people still like the ease of USDC, the heart of DeFi is moving toward ETH-native coins. If we can solve the problem of oracle data and staking competition, we might see a new king of stablecoins. This would be a coin that no bank can stop and no government can freeze.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.