Crypto News Today: Market Holds Strong Amid CoinDCX Hack, Fed Split, and Global Deals

The global market saw strong activity today as new events shaped investor behavior across the board. The market capitalization of the market stands at $3.97 trillion, marking a 3.3% decrease over the past 24 hours. The trading volume increased, reaching $153 billion.

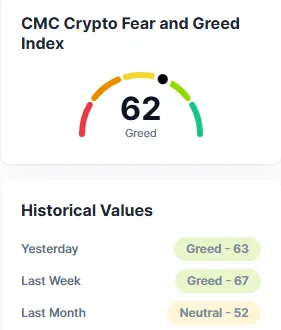

Bitcoin remains on top, with 59.4% market share, increasing 0.1%, Ethereum increased more strongly, picking up 1.5% dominance to 11.7%. Investor sentiment fell slightly, as the Fear and Greed Index fell one point to 62 (Greed).

Source: CoinMarketCap

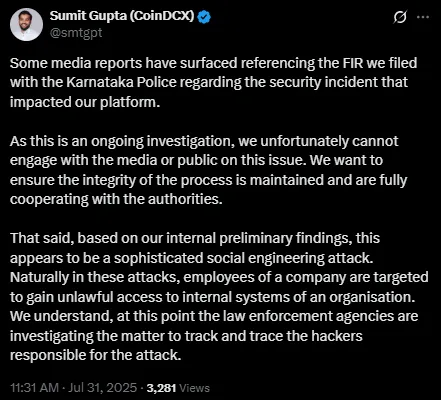

India’s top exchange CoinDCX was hit by a major cyberattack, losing almost $44 million (₹384 crore). Early reports link the theft to North Korea’s Lazarus Group, one of the most infamous hacker groups worldwide.

In a dramatic Crypto , CoinDCX employee Rahul Agarwal was arrested. Authorities believe hackers accessed the exchange’s internal systems through his work laptop, using a fake part-time job offer to trick him.

While some say Agarwal is just a victim, others suspect he played a bigger role. CoinDCX claimed it was a social engineering attack, not a systems failure. They also assured users that customer funds remain safe.

CEO Sumit Gupta also denied any rumors that Coinbase might buy CoinDCX. He warned users to be careful of phishing scams and fake links.

Source: X

The United States and South Korea have agreed on a $350 billion trade deal just before the tariff deadline of August 1. The deal reduces import tariffs on most goods, including automobiles-from 25% to 15%.

As a quid pro quo, South Korea will invest in U.S. industries such as clean energy, biotechnology, and semiconductors. The nation also promised investments in $100 billion worth of American energy products.

According to analysts, the agreement would indirectly benefit blockchain and Web3 industries, particularly with infrastructure and technology support from both nations.

Source: X

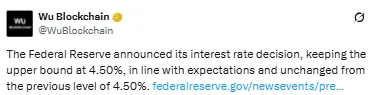

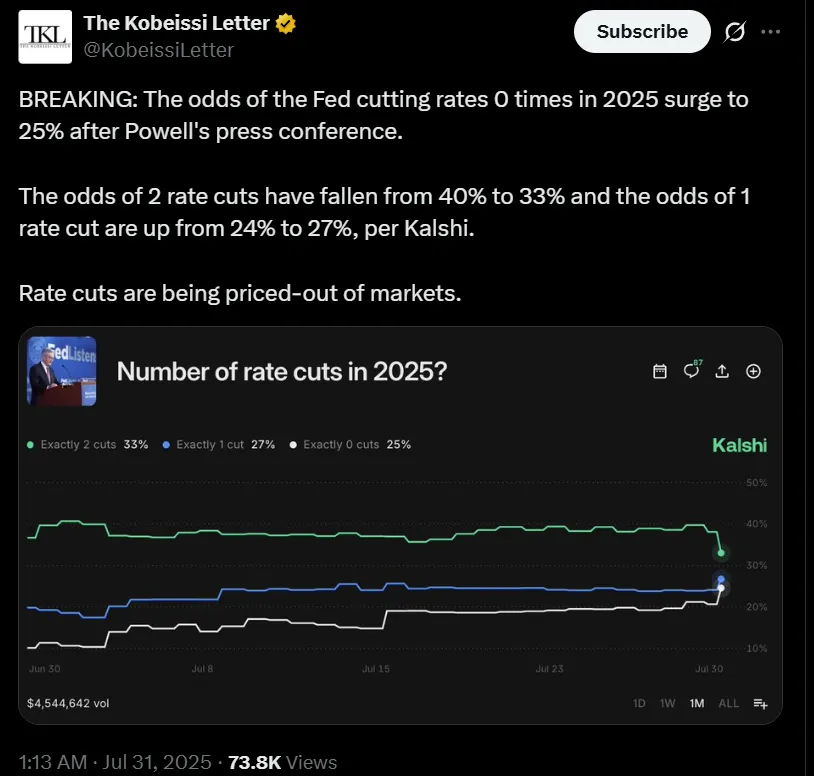

The Federal Reserve held interest rates at 4.50%, the fifth straight time, in line with market expectations. But the real surprise came from the vote count: 9-2, showing rising tension inside the Fed. market reacted cautiously, with Bitcoin hovering near $118K and Ethereum showing slight gains, as traders now expect fewer rate cuts in 2025.

Two members wanted a 0.25% rate cut, pointing to signs of slowing growth. However, Fed Chair Jerome Powell stood firm, saying inflation is still above target and it’s too early to ease.

After the meeting, market expectations for a September rate cut fell to 43.2%. The internal divide-deepest since 1993-has made investors nervous about what lies ahead in digital space.

Source: Wu Blockchain

One of the major Crypto News, A day after the Fed meeting, President Donald Trump expressed his discontent. Reports have him contemplating sacking Powell over the central bank's reluctance to cut rates.

Trump has publicly stated that Powell’s tight money policy is slowing the economy. He blames the Fed for dragging down growth while inflation cools. Sources in Washington say Trump is exploring legal options to replace Powell before the election cycle intensifies.

The tension is also creating uncertainty in the markets, especially for Crypto News, which often reacts to interest rate movements and political instability.

Source: X

One of the mojor Crypto News is The White House published the 2025 Trump Digital Asset Report, which details initiatives to establish the U.S. as a global leader in digital assets.

Key recommendations are to mandate IRS reporting of overseas crypto accounts, establishing a new Crypto-Asset Reporting Framework (CARF), and supporting crypto-welcoming abanks. The report does not support a U.S. CBDC because of privacy concerns but champions legal stablecoin innovation and peer-to-peer self-custody rights.

It calls for more modern AML rules, regulatory clarity between CFTC and SEC, and streamlined digital bank licensing. DeFi is exempted from new regulation though, and the policy sets out a pro-innovation path for America's digital asset future.

Source: X

Today'as Crypto News reminds us how fast things can change here-hacks and political soap opera one day, huge global deals the next. These events may push prices for a day or two, but wise investors pay attention to the larger story. That involves monitoring legislation, new tech, and international alliances that forge the crypto future.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.