Crypto Market Sees a Sharply Drawn-Back Market

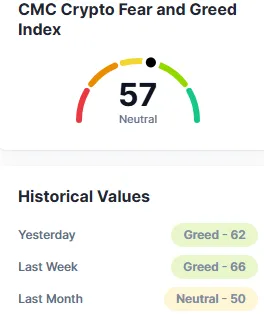

The Crypto Market took a hit today. The total cap went down by 7.9% to $3.81 trillion. The 24h trading volume was $180 billion. Bitcoin is still the market leader with a 60.1% market share, followed closely by Ethereum at 11.5%. The Fear and Greed Index dropped to 57 from a 62 yesterday, showing less investor confidence today.

US President Donald Trump placed new tariffs on 11 countries, which will become effective on August 1, 2025. Canada was hit the hardest with a 35% tariff now—an unprecedented 10-point hike.

Although the announcement was released, Crypto Market were not too moved, suggesting global investors may now be used to Trump's tariff strategies. Nonetheless, long-term effects could still ripple through supply chains and trade deals and potentially impact the Crypto Market should cross-border investment decelerate.

The list of affected countries under the new regime is wide-ranging:

Canada: Raised from 25% to 35%

Switzerland: 39%

South Africa: 30%

Taiwan: 20%

Vietnam: 20%

Cambodia: 19%

Thailand: 19%

Malaysia: 19%

Indonesia: 19%

Turkey: 15%

Venezuela: 15%

Source: X

SEC Chairman Paul Atkins launched Project Crypto, a dynamic new effort to establish the U.S. as a digital asset leader in the world. Rather than simply shutting down, the SEC now aims to enable innovation.

The project suggests one license to encompass trading, lending, staking, and even tokenized equities—streamlining things for developers and companies. If approved, America might be the place to go for Web3 builders.

The proposal also aims to bring back developers who left as a result of past enforcement actions, including the Tornado Cash and GitHub ones.

Tokenization Gains Ground Around the Globe

Tokenizing assets is a fast-evolving trend.

Switzerland's SIX exchangetokenized stocks.

Singapore's DBS offers tokenized treasury bonds.

Hong Kong tested green bonds on blockchain.

While this is happening, in the U.S., similar companies like BlackRock, Fidelity, and KKR are testing out tokenized funds as well. If Project gets regulatory certainty, perhaps this is the moment that Crypto Market instruments go mainstream in traditional finance.

Source: X

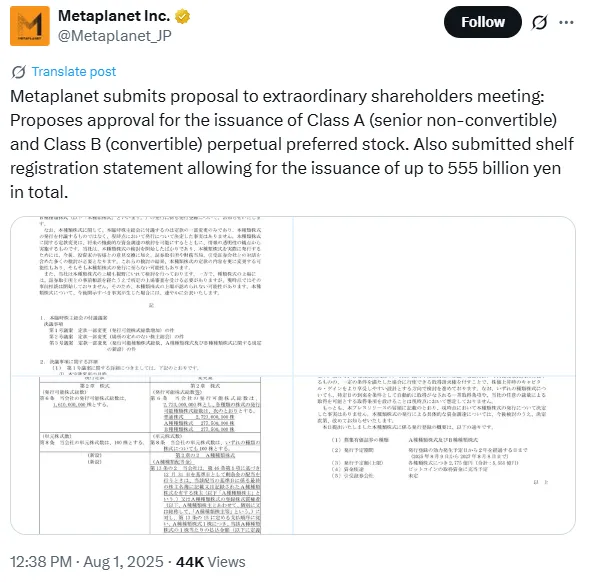

Japanese firm Metaplanet is about to make a giant jump. It will raise up to $3.5 billion through a dual-share format. There will be two types of shares:Class A: Long-term capital, senior and non-convertible. Class B: Convertible with space to accommodate future equity adjustments

There is an Extraordinary General Meeting on September 1, 2025, when the plan is to be approved. If authorized, the capital may provide money for Metaplanet's digital coin and technology ventures.

Source: X

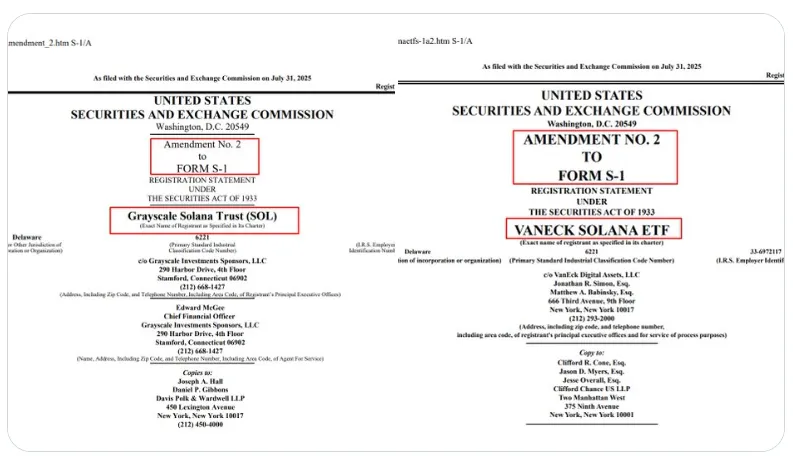

The competition to list Solana-based ETFs in the U.S. is getting intense. Major players like Grayscale, VanEck, Fidelity, and Franklin Templeton filed new S-1 forms with the SEC.

Grayscale's ETF targets a 2.5% fee, payable in SOL tokens. VanEck retorted with a staking product, VSOL, at a reduced 1.5% fee. These moves indicate growing optimism for Solana as a long-term position and bring institutional demand back into the Crypto Market.

Source: Official Website

Stablecoin giant Tether announced that it generated $5.7 billion in the first six months of 2025. Of that, $2.6 billion came from investments in Bitcoin and gold—demonstrating the firm's business strategy in the Crypto Market is yielding.

Tether also generated a further $3.1 billion from its core activity of reserves and USDT printing. The firm has over $127 billion in U.S. Treasuries, making it one of the world's biggest government bond holders.

Its balance sheet remains strong, with total assets of $162.5B and shareholder capital of $5.47B. CEO Paolo Ardoino said, “We’re not just keeping up—we’re shaping the future.”

USDT in High Demand: In Q2 2025 alone, Tether minted $13.4B in new USDT, increasing its total supply to more than $157 billion.

Tether's confidence is very high, as the stablecoin remains firmly pegged to the U.S. dollar. Tether is now investing its profits in the future, funding local projects and tools like the Rumble Wallet.

Source: Website

Final Thoughts

Today's headlines unveil a quickly changing Digital landscape. From SEC reforms and ETF filings to big profits and new funding initiatives, the field of digital finance is beginning to open up. America may finally be turning towards cryptocurrency friendship, while Asia and Europe lead the way with tokenized assets.

Investors and developers need to stay alert. This could be the beginning of the next phase of global digital coin adoption.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.