If you are wondering what happened in crypto today, the answer lies in a mix of big institutional trades, ETF outflows, and new listings. The market mood was shaky, but the major crypto market updates gave investors plenty to talk about.

From SharpLink Ethereum purchase to BlackRock’s surprise sale, here’s the full news and crash reasons you need to know today.

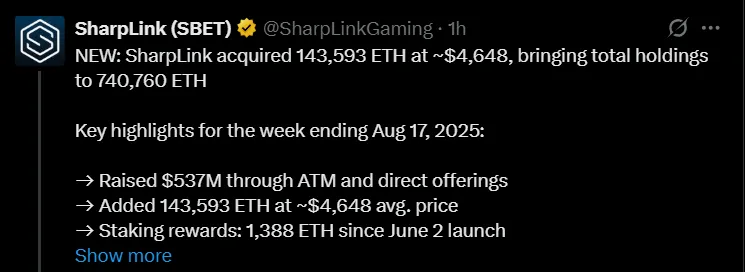

SharpLink SBET shared on its official X account that it purchased 143,593 ETH at an average of $4,648, raising its total holdings to 740,760 tokens. The firm also reported:

$537M raised through offerings.

1,388 Ethereum staking rewards since June.

ETH concentration ratio climbing 94% since launch.

Over $84M cash left to deploy.

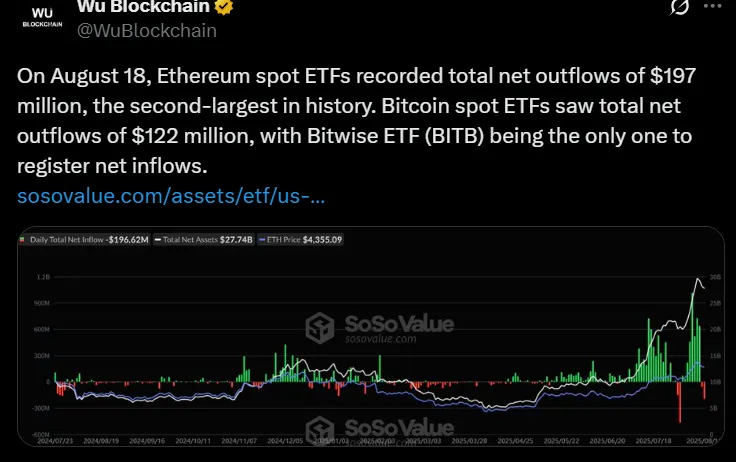

According to SoSoValue data, Ethereum ETFs recorded $197M net outflows, the second largest since launch, which may be considered one of the reasons behind crypto market crash today.

The products still manage $27.74B in assets, equal to 5.34% of Ethereum’s market cap. Bitcoin ETFs also lost steam, posting $121.84M outflows.

This shows that institutional demand is cautious, even though total inflows remain historically strong.

As reported by Wu Blockchain on X, BlackRock sold bitcoin worth $68.7 Million and 19,504 ETH valued at $82.7 Million on August 18. The move came only days after the firm invested over $1B into ETFs, raising questions about strategy.

Some big cryptocurrency analysts see this as profit-taking during volatility, while others view it as mixed signals on institutional trust.

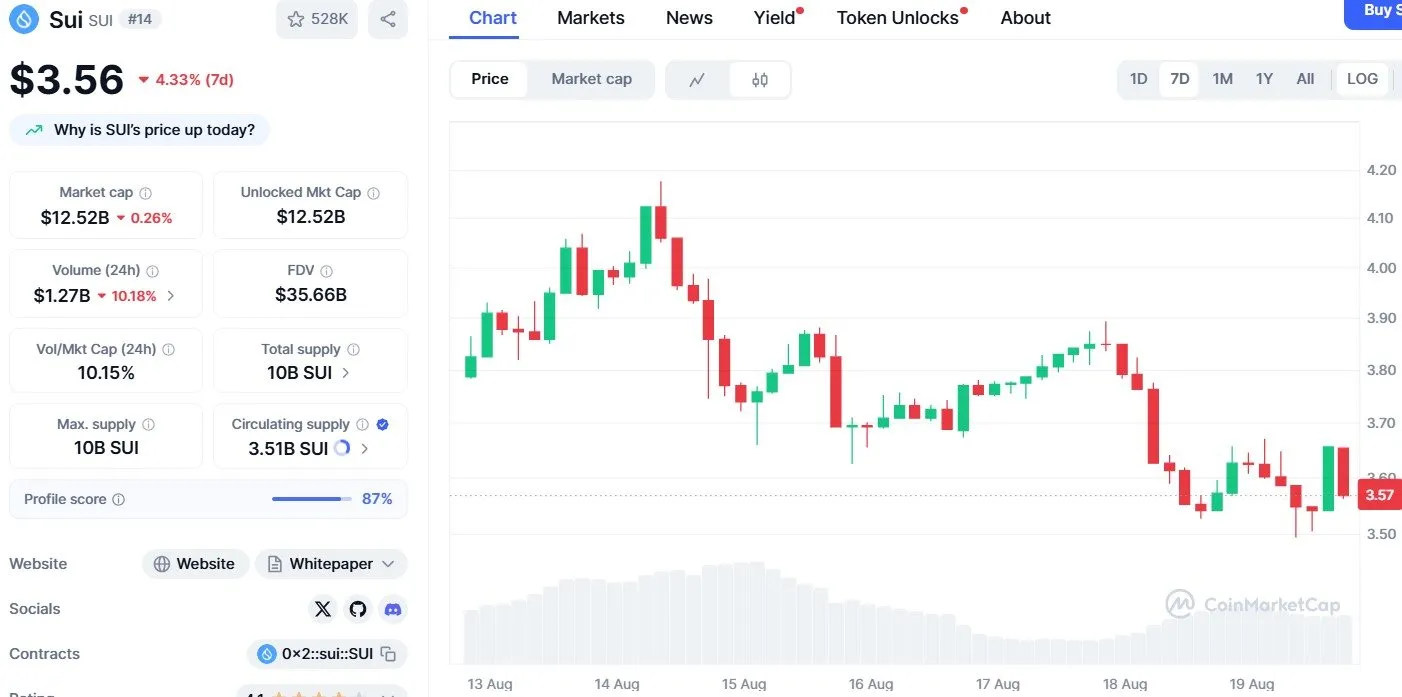

Retail giant Robinhood officially listed SUI spot trading. The token, built by Mysten Labs on its Layer-1 blockchain, is now more accessible to U.S. traders.

As per the CoinMarketCap data, At present time, SUI trades around $3.56, down about 5% in the past week, with $1.27B daily trading volume, a 10% decline. But now the big question comes: will Robinhood launch trigger the price rally or more risk ahead?

As per my analysis being a cryptocurrency observer, this kind of listings often help tokens gain broader retail traction, so SUI coin might see a breakout soon.

“SPAC King” Chamath Palihapitiya is returning with a new venture, American Exceptionalism Acquisition Corp. According to an SEC filing, the company aims to raise $250M by selling shares at $10 each.

The SPAC will list on the New York Stock Exchange and has 24 months to find a target firm to take public.

So, what happened in crypto today? Overall, today’s market reflects a tug-of-war between institutional buying and profit-taking. SharpLink’s ETH accumulation signals long-term bullishness, while ETF outflows and BlackRock’s sale point to short-term caution. Retail markets saw mixed signals, with Robinhood boosting accessibility for SUI even as trading volume dipped.

The market showed both bullish conviction and cautious exits, leaving investors to weigh: Will crypto rise again from the crash or face more short-term pain.

For now, all eyes remain on whether Ethereum and Bitcoin can hold support, because if not then the crypto crash can go deeper .

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.