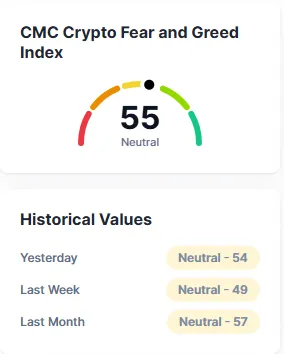

In the past 24 hours, the crypto market saw a total trading volume of $94.7 billion, worth ₹7.9 lakh crore in Indian Rupees (INR). & with a 63.1% Btc dominance, Bitcoin continues to dominate the crypto market, while, on the other hand, Ethereum dominance near 9%.

From new crypto rules in the U.S. and ETF achievements to a huge old Btc account moving funds again. As per today’s headlines, the cryptocurrency market is as active as ever. Here is a key bulletin that remains in today's headlines.

Source: X

The news that is making headlines today is Trump's Big Beautiful Bill. Yes, Donald Trump’s so-called Big Beautiful Bill has passed Congress. Aiming to boost American industries with little regulations. Crypto watchers worry doubtfully that it could complicate the innovation and digital assets are handled.

In a response to Trump’s Big Beautiful Bill, Elon Musk raised the question whether he might challenge the bill if it interferes with crypto’s open innovation.

Now all eyes are sticking on this drama that could shape the future of cryptocurency policy in the U.S.

Elon Musk has teased that he might challenge the bill if it interferes with crypto’s open innovation. This drama could shape the future of cryptocurrency policy in the U.S.

Source- X

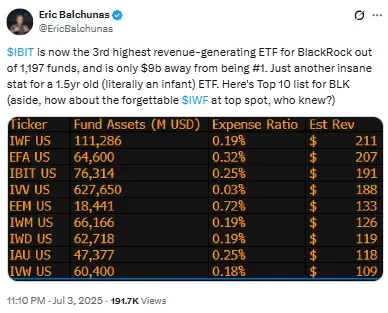

Eric Balchunas, Senior ETF Analyst at Bloomberg Intelligence, shared on X that BlackRock’s Bitcoin ETF, called $IBIT, launched in January 2024, and has now become one of the company’s most successful funds ever. It is the third-highest earning ETF among BlackRock’s 1,197 funds. This is the biggest achievement for a fund that’s only 18 months old.

IBIT holds about 696,874 Bitcoin and manages around $76 billion in assets, making around $191 million per year.

This shows that big institutional investors have strong confidence in Bitcoin, which is positive for the overall crypto market.

As Trump’s Tariff is so close to its deadline, one more break now Trending His 10% tariff policy deadline is making global traders sweat. These new tariffs could spark more trade-war tensions and could hit broader market confidence and that could spill over into cryptocurrency, making liquidity tighter in the short run.

According to US Treasury Secretary Bessen, about 100 countries will get a minimum 10% reciprocal tariff.

Usually, people see Bitcoin as a safe option during global uncertainty. But if panic spreads everywhere, even Digital Currency prices can be affected.

On July 14, the U.S. House will vote on several big bills that will cover stablecoins, DeFi, and investor protection.

Now the situation is very difficult. No one knows what will happen next and how it will affect the market.

If these bills pass, they could set the tone for how digital currency gets regulated over the next few years. Traders and companies alike will be watching closely for clear signals of compliance and innovation rules.

Source: X

One of the most jaw-dropping crypto stories today comes from on-chain analysts. A dormant Bitcoin wallet which originally held just $7,800 worth of BTC has come back to life, now worth a staggering $1.09 billion.

This whale had been quiet since the early Bitcoin days, showing just how powerful patient holding strategies can be - but also raising questions about market moves if old whales start shifting their funds.

So this is what happened in crypto today?

Trump’s political moves changed policy talks, BlackRock’s Bitcoin fund saw big gains, tariff news made markets nervous; the U.S.

Digital Currency Market is one of the fastest-changing industries where every new step can have a big impact on Investors. For now, all eyes are on Trump’s Tariff. Let's see what will happen next. Maybe Trump knows..!

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.