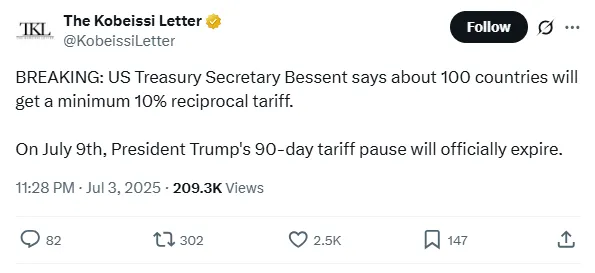

As per The Kobeissi Letter, U.S treasury secretary Bessent confirmed that around 100 countries will soon face a minimum 10% reciprocal tax.

Source: X

The announcement will just come ahead 9th of July when President Trump’s 90-day tax pause officially expires. This strong move has not only generated global concern but has also powered- a new wave of trade tariff news that’s keeping markets on edge.

As the deadline nears, experts believe many deals will remain unfinished, setting the stage for unpredictable decisions and intense over the coming days.

Trump’s proposed 10% tax on nearly 100 nations is not just another piece of import duties but also it has deep implications for crypto markets too.

The geopolitical tensions and trade tariff news has created economic uncertainty which pushes the investors towards alternatives like Bitcoin(BTC) or stablecoins. Experts suggest that if tax disrupt traditional markets, crypto could emerge as a hedge against weakened fiat currencies.

However, crypto may also face headwinds, in response to Trump’s aggressive stance, some governments may secure financial regulations, especially on cross-border digital asset flows. This could result in slower posing for crypto firms.

Blockchain firms dependent on global hardware or international talent could see rising costs. Any disruption from the trade tariff news could delay the infrastructure developments. So, if the crypto could benefit in the short term on the other hand it remains strongly tied to how this import duties evolves in the coming weeks.

As per Coin Gabbar analyst, only-limited progress will be made before the deadline. Their report suggests that some quick deals might help avoid embarrassment for the United States but won’t reduce the overall rigidity rising through ongoing news.

The most likely outcome seems to be some combination at very limited agreements, they noted- “This would allow the U.S to grant further extensions without losing face”. But with Trump’s uncertain nature, new trade tariff news could break at any moment, reshaping the global market landscape.

The European Union is showing no signs of backing down. As a major dealing player, representing 25% of U.S exports the EU is refusing to be influenced by tight deadlines. Their stance has only added more weight to recent tax headlines.

EU leaders are centering on long-term policy, rather than short-term political tactics. Their firm approach throws back a broader shift in global dealing dynamics, where countries are maintaining their own power instead of reacting to the latest trade tariff news. This resistance from Europeans may influence other nations to hold firm as well. Slowing down any rapid resolution to the current dealing standoff.

In addition, Trump announces deal with US-Vietnam Sets Tariffs from 20%-40% on any goods that are shipped through other countries before reaching the U.S

Source: X

In May, the U.S court of International Trade ruled that most of Trump's tax were illicit. While a federal appeals court has temporarily restored them, the case has stirred up more trade tariff news and legal complications. These legal conflicts have added new layers of uncertainty to an already tense environment .

Businesses are unsure whether to prepare themselves for new tax or hope for a ruling that reverses recent policy which is making trade tariff news a daily concern for global markets.

From importers to exporters, firms all over the world are now holding plans due to not yet settled trade tariff news. Rising costs, delayed shipments and unpredictable duties are forcing businesses to rethink strategies.

Crypto firms are also waiting closely. From mining equipment to software terms working remotely, any disruption from this could impact operations, fundraising and global expansion plans. Firms in developing markets are especially vulnerable, lacking the resources to adapt fast. This makes the global business climate more fragile as tax related decisions loom.

With the July 9th deadline approaching and the 10% tax threat confirmed, global markets remain on edge. The latest trade tariff news is reshaping how countries, businesses and even crypto users prepare for what’s next. Clearly, this is just the initial phase in global deal.

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.