Why is the Cardano $ADA price surging today when the market is still recovering from recent volatility? Two back-to-back announcements have placed the altcoin at the center of institutional conversations, helping the token rebound sharply after a difficult week.

Two major events that investors should watch:

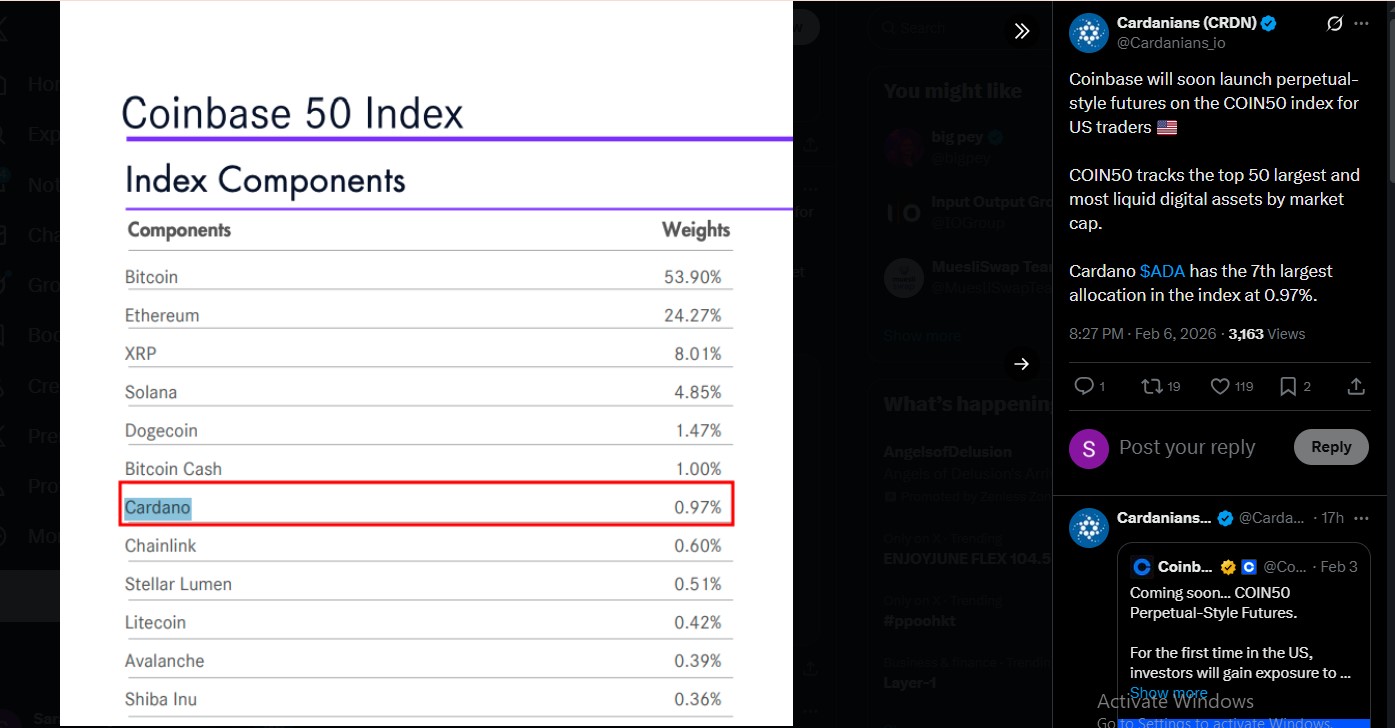

1. $ADA ranks 7th in the Coinbase Coin50 Index List.

2. CME to launch regulated $ADA futures on February 9

The question now is whether this is the beginning of a stronger recovery or just a temporary bounce.

Coinbase is set to launch perpetual-style futures on the COIN50 index for US traders, giving investors exposure to the top 50 digital assets through a single contract.

Source: Cardanians CRDN X Account

The interesting factor to note is that the current asset holds the seventh-largest allocation at 0.97%, placing it among the most influential assets in the basket.

Why does this matter? Easier access and higher visibility are key factors behind ADA going up, as they can attract broader investor participation.

On the other hand, the Cardano futures launch on CME Group is set for February 9, 2026.

Source: CME Group X Account

The asset will launch with two contract sizes:

Standard futures: 100,000 coins per contract

Micro futures (MCA): 10,000 coins per contract

Why does this matter? This regulated setup signals strong institutional confidence. Over time, such infrastructure can improve liquidity and reduce extreme volatility—both critical for long-term price stability.

As seen in the TradingView chart, the price surged around 8% in the last 24 hours to $0.269 after recovering from a sharp decline toward the $0.23–$0.24 zone. Trading volume, however, has dropped nearly 25% to $1.48B, while market capitalization stands at $9.7B.

The move comes after a weekly crash of about 14%, suggesting the latest Cardano $ADA price rally could help recover recent losses if momentum continues.

The broader crypto market also rose roughly 8% during the same period, with Bitcoin, Ethereum, and XRP gaining about 7%–12%, supporting the recovery trend.

The RSI sits around 45, reflecting neutral momentum. Meanwhile, MACD recently showed a bullish crossover but is now flattening, indicating that upward momentum is slowing.

Key Levels to Watch:

Support: $0.25, then $0.23

Resistance: $0.28–$0.30

On February 4, crypto analyst Tezzos shared an update suggesting that recent analysis hinted that the Cardano price surge prediction could hit $100 before March 1. Such a projection would require a multi-trillion-dollar market cap, making it extremely unrealistic in the short term.

Realistic Scenario

Given the current chart structure, the price could trade between $0.30 and $0.38 if sentiment remains stable and institutional access improves.

Very Bullish Scenario

As per today’s Cardano crypto news, if it strongly clears $0.30 with strong volume, the price could quickly target the $0.55–$0.70 range. In an extreme bull cycle with heavy inflows, it may even reach the $0.90–$2.20 range. However, it would require consistent buying and positive market sentiment.

Bearish Scenario

The 25% drop in trading volume signals weakening participation. If it fails to hold $0.25, sellers could push it back to the $0.23-$0.20 range.

Cardano $ADA price is rebounding as Coinbase Coin50 Index exposure and CME Group futures listing highlight growing institutional interest.

These two upcoming events could act as a short-term catalyst, but the real test will be whether trading activity increases afterward. If volume returns alongside institutional flows, it may shift from recovery into a clearer uptrend.

YMYL Disclaimer: This content is strictly for informational purposes only and should not be considered financial advice. Cryptocurrency investments are risky, so it's always better to do your own research before making investment decisions.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.