Cardano is once again gaining attention across the crypto market. After a long period of decline, ADA is showing signs of life just as two major catalysts approach — the CME Group futures listing and Coinbase COIN50 index futures. Traders are now closely watching whether institutional participation could change the direction of its price trend.

Right now, Cardano is trading near $0.2703, which is roughly 80% below its December 2024 peak and about 91% below its all-time high of $3. Such deep corrections historically happen before large crypto recoveries, and that is exactly why analysts believe a potential big move may be forming.

One of the biggest upcoming events is the CME Group Cardano futures listing scheduled for February 9. This is important because CME is one of the largest regulated derivatives exchanges in the world. When an asset gets listed there, it becomes accessible to institutions, hedge funds, and professional traders.

Historically, similar events have boosted crypto prices. Solana (SOL) and Ripple (XRP) both experienced strong price rallies after futures trading began. Increased liquidity, hedging ability, and institutional exposure usually strengthen market confidence.

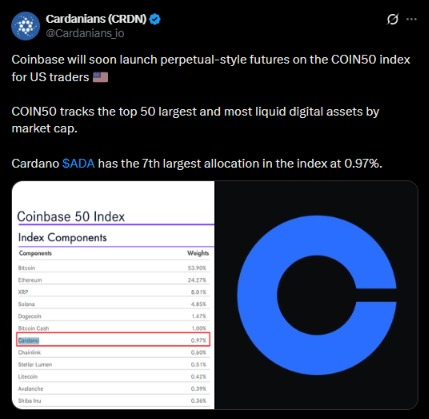

At the same time, Coinbase is preparing COIN50 index futures, tracking the top 50 cryptocurrencies by market cap. Cardano holds the 7th-largest allocation (about 0.97%), meaning it still remains a major large-cap crypto asset. More trading volume from this index could gradually increase ADA demand.

Together, these two developments act as a psychological catalyst — not just technical — because they signal growing institutional acceptance.

Technically, the token recently experienced a 93% correction from the $3.10 macro high. Instead of breaking down further, the price entered a long-term accumulation zone.

The key accumulation area sits between:

Primary support: $0.18 – $0.13

Strong multi-year support: around $0.24

This zone matters because long-term investors typically buy during deep corrections, not during hype rallies. The current price behavior suggests accumulation rather than panic selling.

The bullish outlook remains valid as long as the token stays above $0.13 on the weekly timeframe. A breakdown below this level would invalidate the bull scenario.

Cardano is currently trading inside a high-timeframe (HTF) bullish order block after a sharp 93% correction from its local macro high of $3.10.

The price has entered a critical accumulation zone between $0.18–$0.13, which also aligns with strong multi-year support above $0.24. This zone may represent the last major buying opportunity before the next parabolic phase.

If this support holds, ADA could follow a full-cycle bull market trajectory, with potential targets at $1.20, $3, $5, and even $10+, implying a 4,500%+ expansion from current levels.

The trend remains bullish as long as ADA closes above $0.13 on a weekly timeframe, while a close below this level would invalidate the bullish outlook. For high-risk traders, a strict stop-loss at $0.0755 is recommended.

Overall, ADA is positioned for a potential massive multi-year bull run, provided the accumulation zone holds and trend confirmation is achieved above $0.4374.

The bullish outlook would be invalidated if ADA records a weekly close below $0.13, as this would indicate a breakdown of the long-term support structure.

For high-risk traders, a protective stop-loss can be considered near $0.0755 to limit potential losses if the market moves against the bullish scenario.

Because Midnight operates within the Cardano ecosystem, NIGHT demand is closely tied to ADA’s performance. If the altcoin moves into a bull phase and network activity increases, participation in the Midnight network is likely to grow as well.

Since users will need NIGHT tokens to access the chain and claim mainnet assets, improving ecosystem activity could naturally support the token’s demand.

On the 4-hour chart, NIGHT/USDT is attempting a recovery from the bottom. The price has recently bounced from the $0.045 support zone and moved up toward the descending trendline, now hovering near $0.052–$0.055 resistance.

Momentum indicators are improving — RSI is rising toward the neutral area and MACD is turning slightly positive — suggesting buyers are slowly gaining strength.

If NIGHT manages a clear breakout and a confirmed close above the trendline, the pair could start a short-term bullish move toward $0.065 and later $0.075.

However, failure to break resistance would likely bring selling pressure back, pushing the price toward $0.048 support and possibly a deeper retest near $0.042.

YMYL Disclaimer: This article is strictly for informational purposes only and does not provide any financial advice. Cryptocurrency investments carry high risk, so it's always better to verify the information with official sources and do your own research before investing.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.