Everyone’s asking: why is Fed not cutting interest rates—especially after today's unexpected market rally and despite pressure from Wall Street and Donald Trump?

Instead of rolling out a policy shift, Federal Reserve Chair Jerome rolled out something unexpected: a meme. A calm meerkat in a flat cap, looking smug with a toothpick in its mouth—representing his unshaken stance as Trump lashes out.

Source: Not Jerome Parody Account on X

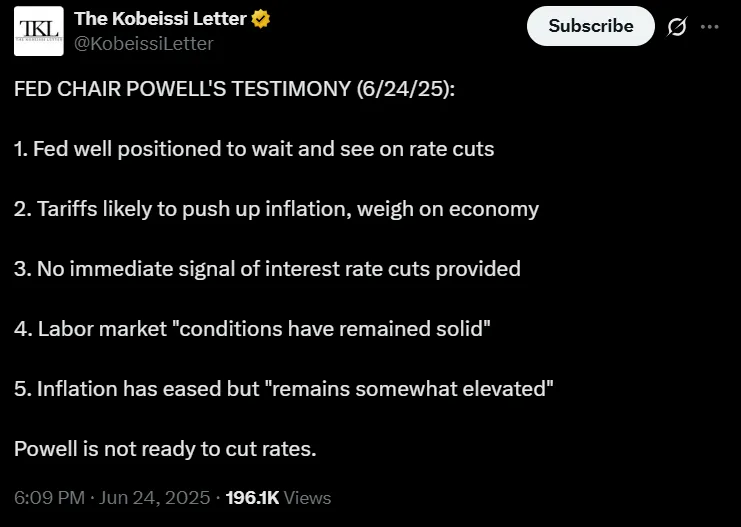

On June 24, 2025, he testified before Congress with clarity: no rate cuts right now. According to insights shared by The Kobeissi Letter, he said the Federal reserve is “well-positioned to wait and see,” especially as:

Inflation remains “somewhat elevated”

Tariffs could push prices higher

The labor market is still strong

This latest Jerome Powell news today revealed the reserve's strategy: stay patient, monitor data, and avoid premature moves.

As someone who's tracked Fed behavior for years, I can say Jerome's calm isn’t detachment—it's carefully planned.

He didn’t hold back. In a post on X, he slammed the chairman earlier, writing:

“Europe has cut rates 10 times while we’ve done nothing. Rates should be 2–3% lower.”

He estimated that lower borrowing costs would save the U.S. $800 billion annually, and accused the chairman of being “dumb” and “hardheaded.” Trump even urged Congress to act and implied Powell’s leadership should end—a line that fueled the Trump Powell termination rumour.

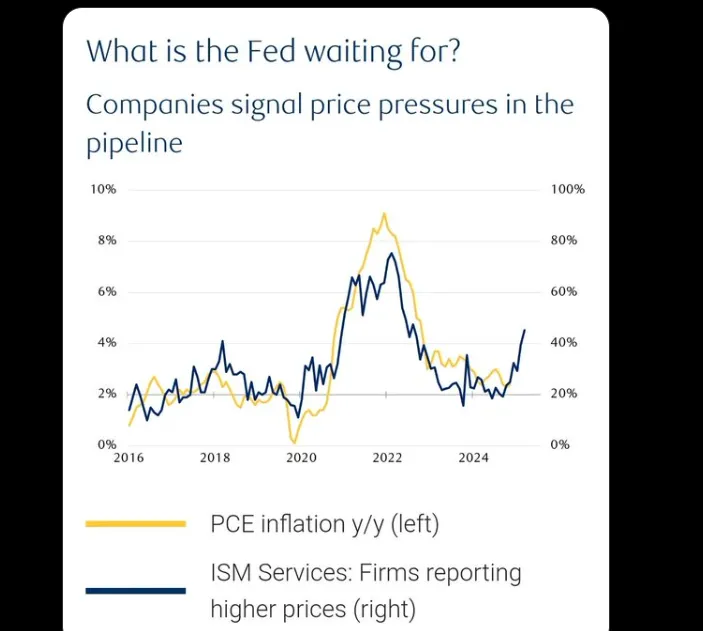

Yellow Line = PCE inflation (Fed’s preferred gauge), which has cooled

Blue Line = ISM Services Pricing (company pricing intent), which is surging

This PCE inflation chart shows what the top U.S. economist sees: Monetary expansion looks better now, but businesses are signaling higher prices ahead.

Cutting rates now could be a disaster fueling inflation again just as it’s calming. Powell, remembering the 1970s missteps that led to high inflation because the FED rate cut interest too early, which resulted in runaway prices, and weak growth. He ultimately doesn’t want to repeat history.

The Fed’s interest rate decision is made by a 19-member committee—and they’re split:

7 members foresee no cuts in 2025

2 members see just one cut

10 members expect at least two

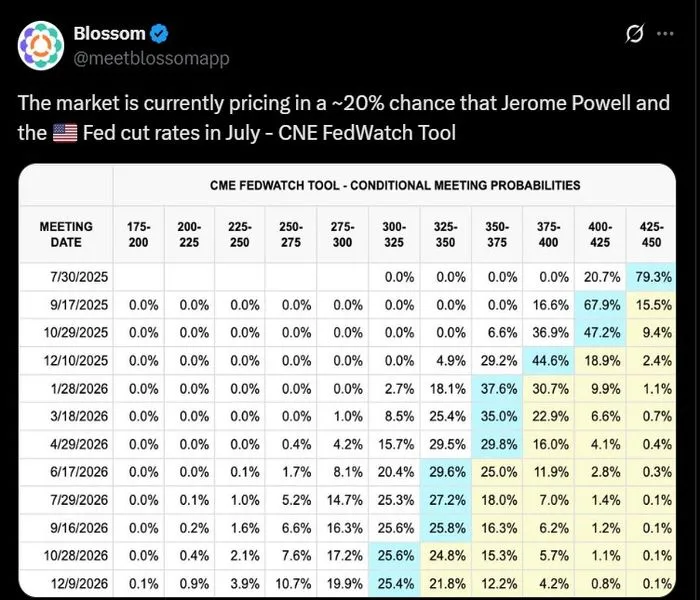

According to Blossom , a investing social network, data from the CNE FedWatch Tool currently shows just a ~20% chance of a July cut—supporting the theory that the powell july rate cut probability is low.

So, why is Fed not cutting interest rates? Because the chairman knows one mistake can unravel years of work. He’s staying locked on forward-looking inflation data, not backward political mistakes.

However, A rate cut typically drives new capital into risk assets like BTC, ETH, and meme coins. But this refusal to blink means markets are now reacting to clarity, not cuts.

Today’s 4% market surge shows that even crypto investors aren’t waiting for the decision—they’re front-running the future, betting that once inflation cools decisively, the floodgates will open.

And until the numbers prove inflation is under control—not just for one month, but consistently—the Fed will not cut. Trump can shout, markets can speculate, but Powell is only listening to the math.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.