The global crypto market crash has hit the traders once again, falling almost 4% in the last 24 hours. The total market cap has slipped to $2.92 trillion, and the entire industry is filled with fear.

Bitcoin price dropped back to $85k, Ethereum crashed toward $2,936, Solana crashed 5%, and almost all altcoins and memecoins like Dogecoin, Shiba Inu, and others are dropping fast.

As fear spreads around the marketplace, investors everywhere are asking the same question: why did the crypto crash today, and is more pain coming?

This article breaks down every major reason behind today’s crypto bloodbath, combining sentiment data, liquidation flows, and macro.

One big reason for today’s crypto market crash is the sudden change in who may become the next US Federal Reserve Chair.

According to the latest update shared by The Kobeissi Letter, Kevin Warsh is now the top favorite with a 48% chance, seen in the Polymarket market. This happened just hours after reports said that Hassett’s Fed Chair chances were blocked by people close to Trump.

This political shift has made investors worried, which is one of the strongest reasons behind why the crypto market is falling today.

The U.S. Financial Stability Oversight Council (FSOC) released its 2025 annual report and surprisingly reduced its warning on cryptocurrency assets and stablecoins.

FSOC said cryptocurrency is no longer an immediate systemic risk, and the GENIUS Act, which started in July, now gives a clear rulebook for stablecoins.

But ironically, this shift came during a major crypto market crash, making many investors feel unprotected. This feeling has added more fear during the ongoing Bitcoin, Ethereum, and Solana crash.

Now, let’s look at the numbers behind the bitcoin price drop and the ethereum crash:

BTC at the time of writing is standing at $85,813.10.

Last 24 hours: Down 4%

24H Volume: $44.12B, down 5.58%

Recent high: Nearly $89k on 15 December

The famous trader Merlijn reacted by saying: “BITCOIN DUMPED INTO EXTREME FEAR.”

ETH at the time of writing is starting at $2,931.83.

Last 24 hours: Down ~6%

24H Volume: $27.58B, up 49.22%

Even though ETH price is falling, the huge jump in trading volume may have a positive effect later. It shows traders are very active during this Crypto Market Crash.

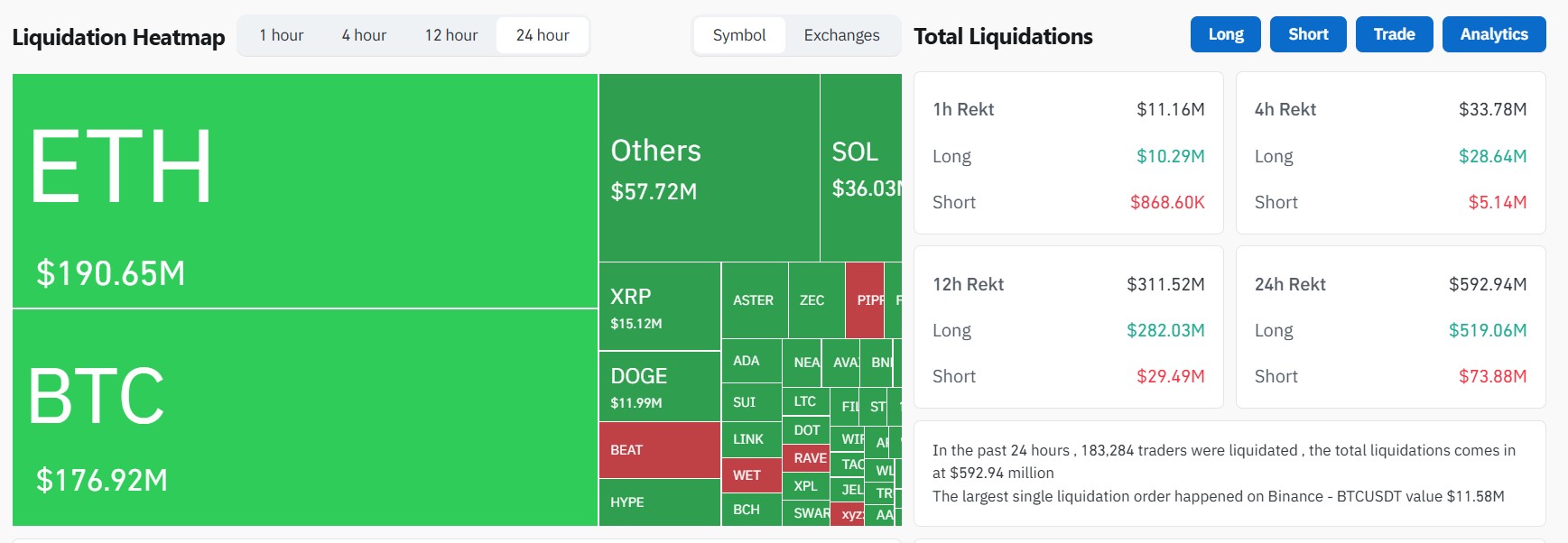

The latest bloodbath news shows that more than $592 million worth of positions were liquidated in just 24 hours. This heavy flush is one of the biggest reasons behind the crypto liquidation news today.

Most traders were expecting the market to rise, so they opened long positions. But when the industry suddenly fell, these positions were force-closed. This caused more selling pressure, which pushed prices down even faster.

Right now, the industry is struggling with very low liquidity, and almost no support from industry makers. Traders keep opening longs, trying to catch the bottom, but this only creates new liquidity levels at lower prices. So the price keeps dropping again and again.

This is why the crypto fear index has fallen to Extreme Fear at 11. Order books are empty, so even small price drops become big falls.

This entire setup is exactly why the crash looks so strong today.

Right now, analysts, influencers, and market experts are all surrounded by uncertainty. There are no clear signs of a trend reversal on the charts yet. Bitcoin is weak, liquidity is low, and big investors are not stepping in.

Being a cryptocurrency expert for a long time, when the industry hits maximum fear, it often creates strong bottoms. With the Santa Rally and Christmas season coming, the final days of December may decide everything.

If stability returns, the marketplace may recover. If fear increases, there may be more downside.

Disclaimer: This article is only for information, not financial advice. The cryptocurrency industry is highly risky. Please do your own research and take experts' help before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.

1 month ago

As the world of cryptocurrency continues to evolve, instances of scams and lost funds have become increasingly common. Many individuals have fallen victim to these nefarious activities, resulting in significant financial losses. I recently found myself in a similar predicament, having lost a substantial amount of Ethereum, valued at $34,000. The experience was not only financially devastating but also emotionally draining. In a desperate attempt to recover my lost funds, I sought the assistance of various organizations and individuals, but to no avail. It wasn't until I stumbled upon GRAYWARE TECH SERVICE that my luck began to change. This reputable company specializes in recovering lost or stolen cryptocurrency, and their expertise in the field is unparalleled. Upon reaching out to GRAYWARE TECH SERVICE, I was greeted by a team of highly skilled and professional individuals who were not only empathetic to my situation but also confident in their ability to assist me. They walked me through the recovery process, explaining each step in a clear and concise manner, and ensuring that I was informed every step of the way. Thanks to the tireless efforts of GRAYWARE TECH SERVICE, I was able to recover my lost Ethereum, and I couldn't be more thrilled. The experience was a testament to the company's exceptional skills and dedication to helping victims of cryptocurrency scams. If you, like me, have fallen victim to such activities, I highly recommend reaching out to GRAYWARE TECH SERVICE. Their expertise and commitment to recovering lost funds are unmatched, and I have no doubt that they will be able to assist you in your time of need. You can reach them on whatsapp+18582759508 web at ( https://graywaretechservice.com/ ) also on Mail: (contact@graywaretechservice.com